You may remember Redstar Gold and its Unga project as we kept an eye on the company’s high-grade gold project in Alaska several years ago. While the Unga asset is definitely still interesting, it has proven to be difficult (and expensive) to reach a critical mass there in order to even start considering the development of the asset.

Heliostar Metals (HSTR.V) shifted gears and (relatively) new CEO Charles Funk and his team identified the Ana Paula gold project gathering dust on the shelves at Argonaut Gold (AR.TO) which has been scrambling to secure funding for all the cost overruns on its new Magino gold mine in Canada. Heliostar was able to strike a deal with Argonaut whereby it agreed to acquire full ownership of Ana Paula and an option to acquire the troubled San Antonio gold project. A very interesting project as well, but community relations are the main issue there.

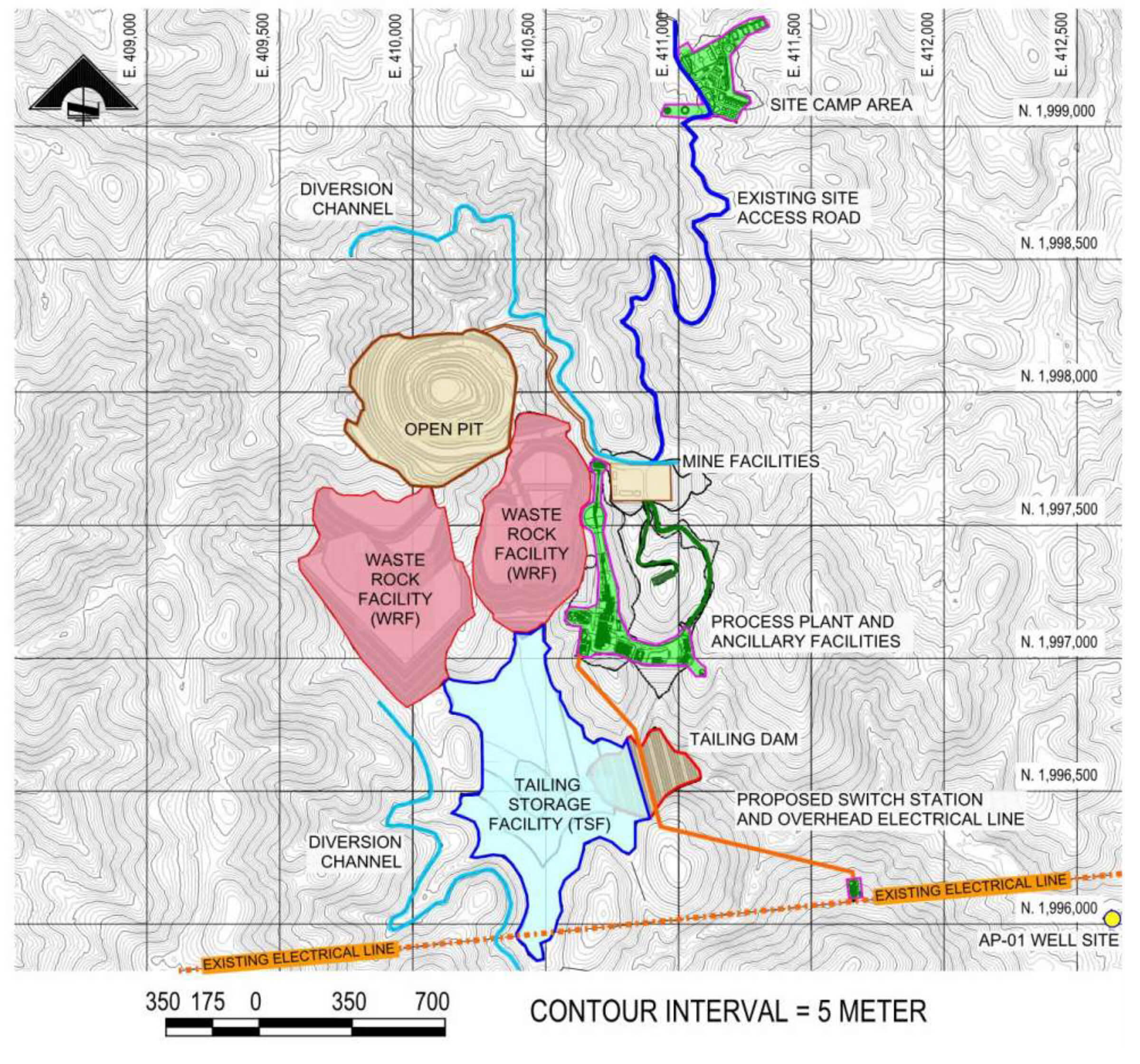

This means all attention will go to the Ana Paula project, which is fully permitted for an open pit mining scenario. But that’s not the direction Heliostar Metals wants to go in and the company is fully focusing on an underground mining scenario. That would reduce the footprint of the mining activities and likely still provide strong economics (that’s based on our interpretation, the company still has to publish an updated pre-feasibility study using an underground-only scenario). The proof of the pudding will be in the eating, but we have the impression CEO Funk is on a mission to get Ana Paula in production sooner rather than later.

The game-changing acquisition of Ana Paula (and San Antonio)

Heliostar Metals was just chugging along slowly at the Unga high-grade gold project in Alaska when they announced a company-making acquisition in December of last year. It acquired the Ana Paula gold project from Argonaut Gold while it also attached an option to acquire San Antonio from the same seller.

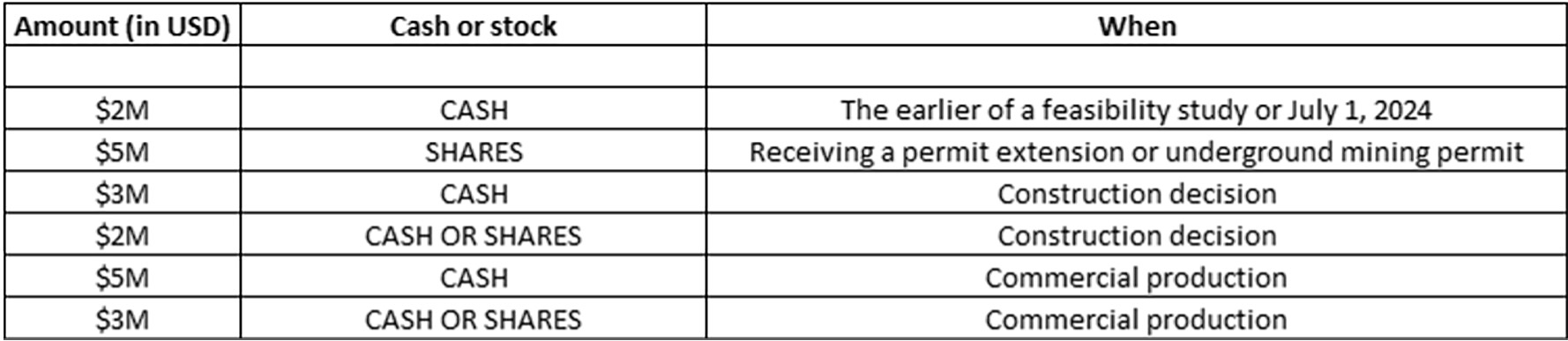

The transaction was pretty straightforward. In order to acquire full ownership of Ana Paula, Heliostar Metals was required to make a cash payment of US$10M to Argonaut Gold (this step has been completed) while there will be a bunch of follow up payments. Heliostar will have to make a US$5M share payment to Argonaut when the open pit receives a permit extension or being granted an underground mining permit. An additional US$2M cash payment will be due on the earlier of the completion of a feasibility study on Ana Paula or July 1, 2024. When Heliostar makes a construction decision on Ana Paula it will have to make an additional US$3M cash payment as well as US$2M in cash or stock and the final payment will occur when Heliostar declares commercial production at Ana Paula. On that date an additional US$5M in cash and US$3M in cash or stock will have to be paid to Argonaut Gold. The table below summarizes it all. A total of US$10M will be payable in cash while an additional US$5M will be payable in cash or shares at Heliostar’s discretion on top of the US$5M in shares payable once the relevant permits have been issued or extended. Also important: the minimum deemed price of the permit-related Heliostar shares will be C$0.24, the others at the price at the time of the milestone.

In the same transaction, Heliostar also negotiated an option to acquire full ownership of the San Antonio project. This option is completely dependent on Heliostar securing an environmental permit from SEMARNAT within the next three years. Once that has been established, Heliostar has the option to acquire 100% of San Antionio by making a final payment which depends on the gold price. If the gold price averages less than $1800/oz during the six months before the option is exercised, Heliostar will be required to make a US$80M payment. If the gold price averages $1800-2000/oz the total payment will increase to US$120M and if the gold price average exceeds $2000/oz in the six months preceding the exercise of the option, the price tag will be US$150M. In all three scenarios Heliostar will be allowed to settle up to half of the purchase price in shares. The company is treating this project as a call option on gold. It believes if it gets the permit, it can complete a feasibility study in the one and half year window between getting the permit and having to make the payment. If the company is large enough it will take the development on itself, and if not it will take a profit on the sale to a major mining company. Additionally, Argonaut Gold will be granted a 2% NSR as well. Note: the exercise of the option to acquire San Antonio is unrelated to Ana Puala, they represent two separate agreements that can be completed or sold in isolation from each other.

While San Antonio, an oxide gold deposit, is a very interesting asset from a technical perspective (1.73 million ounces of gold in the measured and indicated resource categories at an average grade of 0.83 g/t), it is just a theoretical project because as long as the company doesn’t obtain a social license to advance the property, San Antonio will be dead in the water. That also means the project definitely takes a back seat and Ana Paula is without any doubt the flagship project in the portfolio.

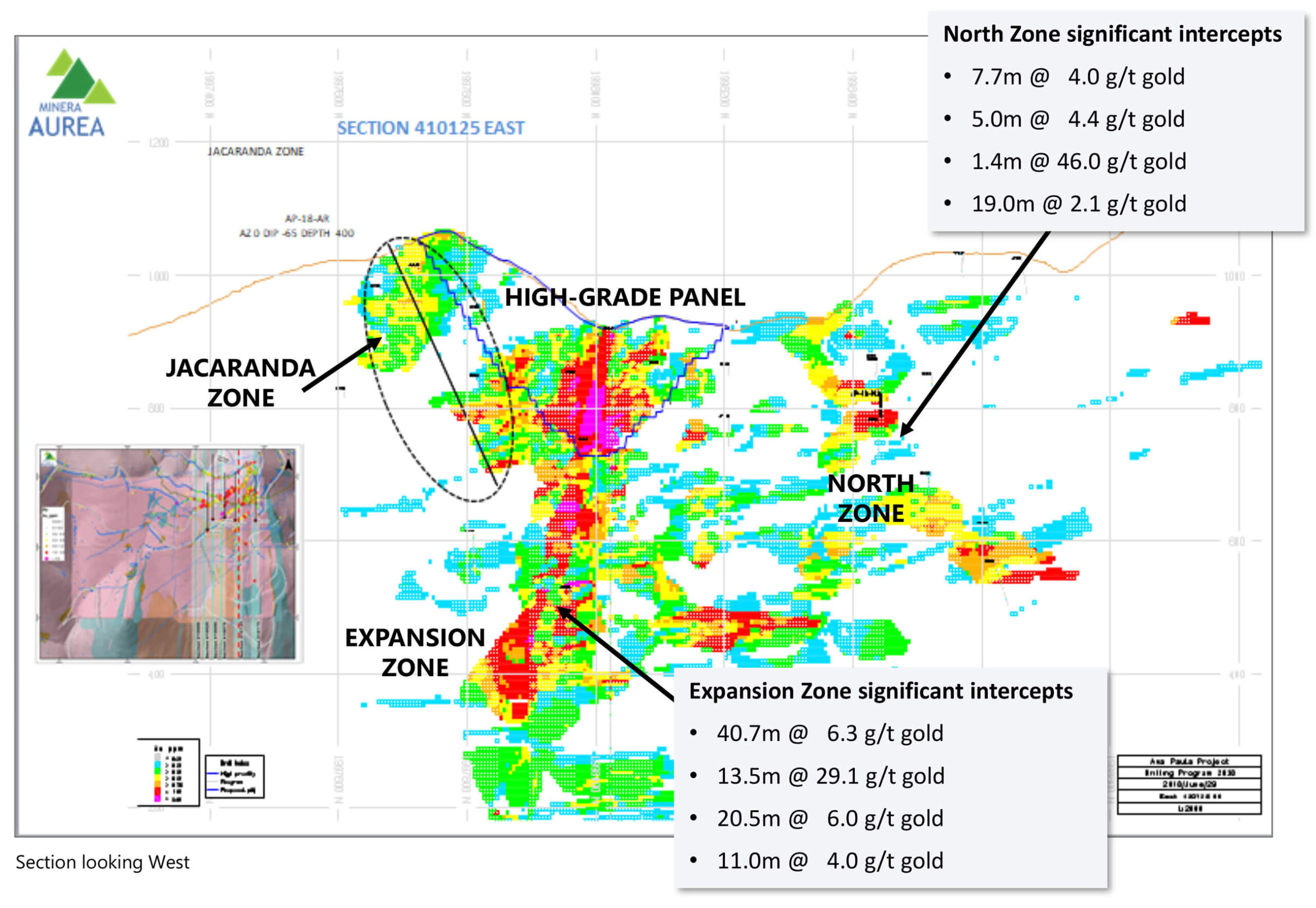

A closer look at Ana Paula

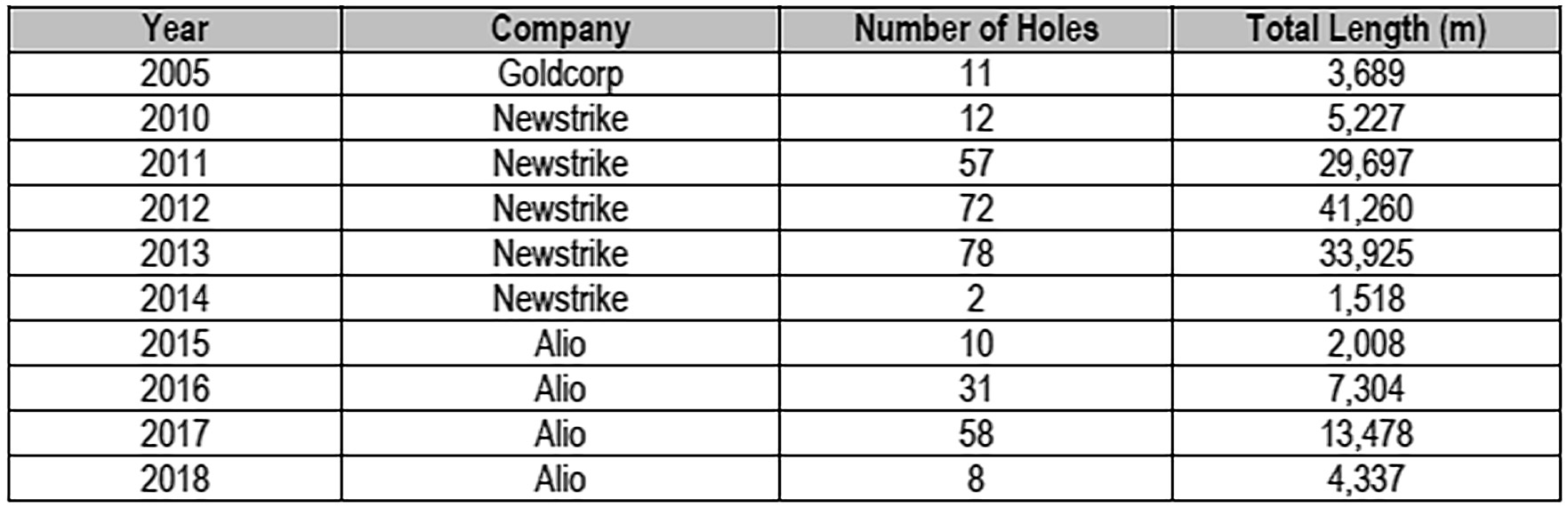

The Ana Paula project may ring a bell as Newstrike Capital used to own this project in the Guerrero Gold Belt. The project currently has a resource of 1.46 million ounces of gold in the measured and indicated resource categories, including about 1.02 million ounces at 2.36 g/t gold in the proven and probable reserves (thanks to the in excess of 140,000 meters of drilling that has been completed on the project). Those grades are exceptional for an open pit project, and that’s exactly what made Heliostar re-think the project: what would happen if the project would be approached as an underground mine, chasing the higher-grade underground mineralization first.

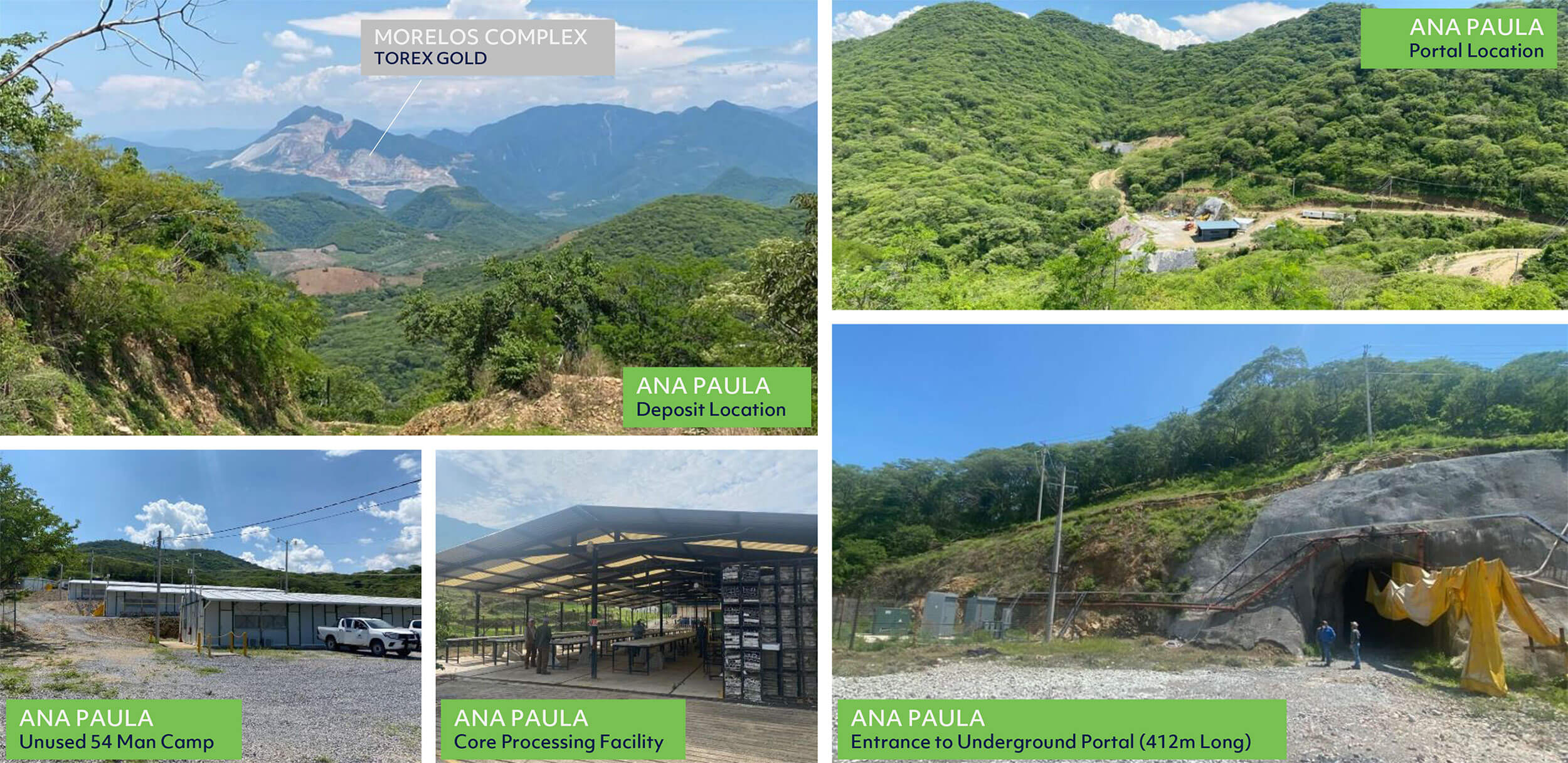

The project is located in Mexico’s Guerrero Gold Belt where the total concession currently stands at approximately 600 square kilometers, and Heliostar has surface access in place to about 22 square kilometers.

Thanks to the very extensive drill programs of the previous owners of Ana Paula (mainly Newstrike), Heliostar has access to the database which contains in excess of 140,000 meters of drilling of in excess of 300 holes. As you can see below, the exploration activities really fell off a cliff when the project ended up in Alio’s hands, and as far as we know, no drilling has taken place since 2018.

The mine plan in the existing pre-feasibility study calls for an open pit mining scenario with a mining rate of 5,000 tonnes per day and the anticipated initial capex was approximately US$234M. The after-tax NPV5% came in at US$279M using $1600 gold and $20 silver. These are 2017 numbers and somewhat dated. But that’s fine as the open pit scenario has now become less relevant given the company’s focus on updating the pre-feasibility study using an underground mine plan.

What will Heliostar do differently from the previous operators?

Let’s face it: Ana Paula is a recycled asset and Heliostar is the fourth company in about a decade trying to make it work (the previous owners were Newstrike Capital, Alio Gold and Argonaut Gold). We were skeptical when we saw the original acquisition announcement in December last year, but after several conversations with CEO Charles Funk, we started to understand the rationale of the acquisition, and more importantly, the game plan. So when Heliostar was able to complete a C$20M financing, the company didn’t just have a game plan but also the financial strength to actually execute on the plan.

The Ana Paula project has always been seen as an open pit mine. That’s how Newstrike Capital designed it, and as Argonaut Gold didn’t do any work on the asset, the open pit perception never went away. And that’s the main change Heliostar is envisioning. Rather than looking at Ana Paula from an open pit perspective, Heliostar plans to go underground. Likely easier to permit than an open pit as the surface disturbance area would be smaller, while the economics will likely remain very strong as well. And just to be clear, the project is fully permitted for an open pit mining plan but the company will have to submit new paperwork to modify that permit for underground mining.

To convert the open pit mine plan to an underground operation and improve the overall economics at Ana Paula, Heliostar Metals will abide by three simple steps.

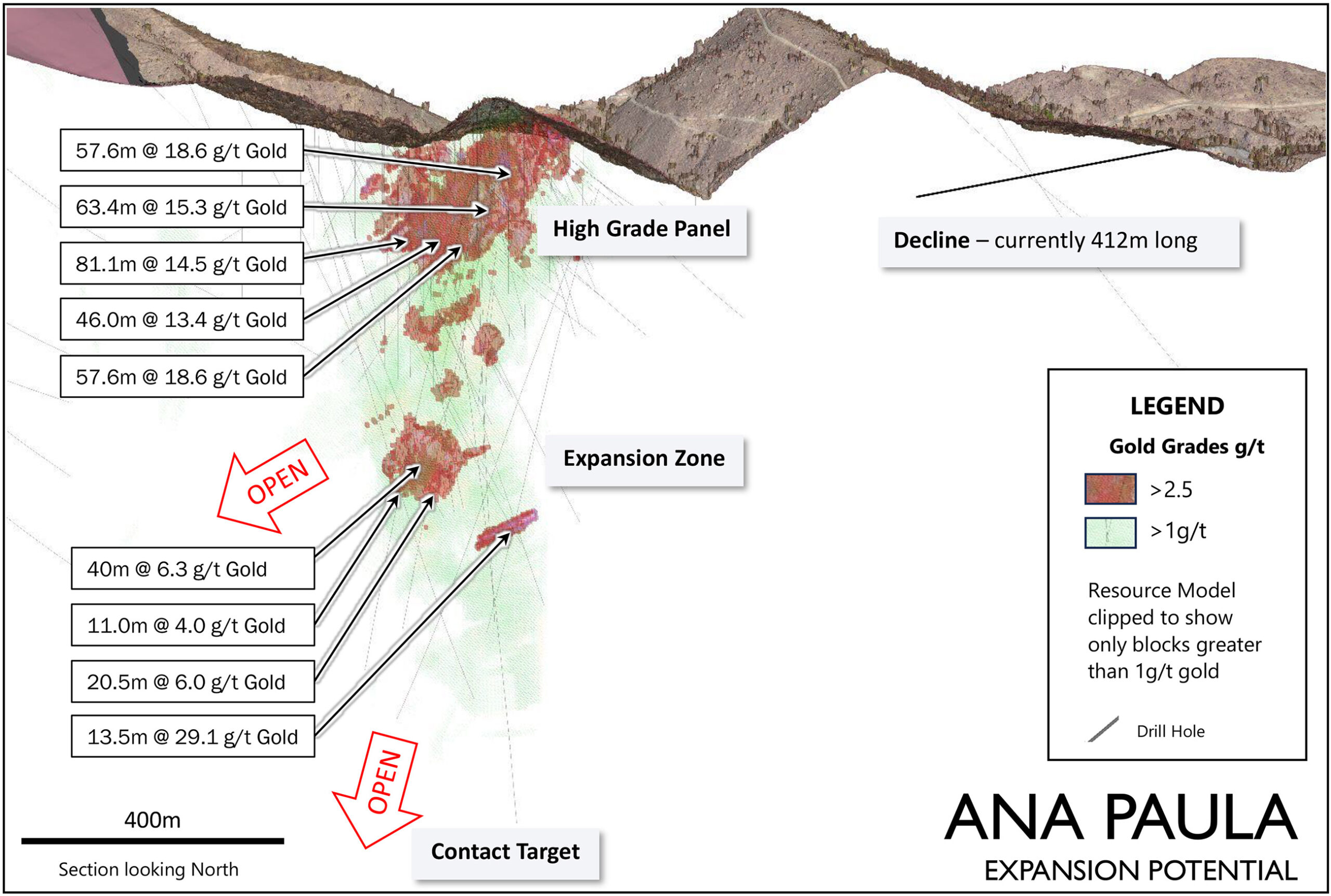

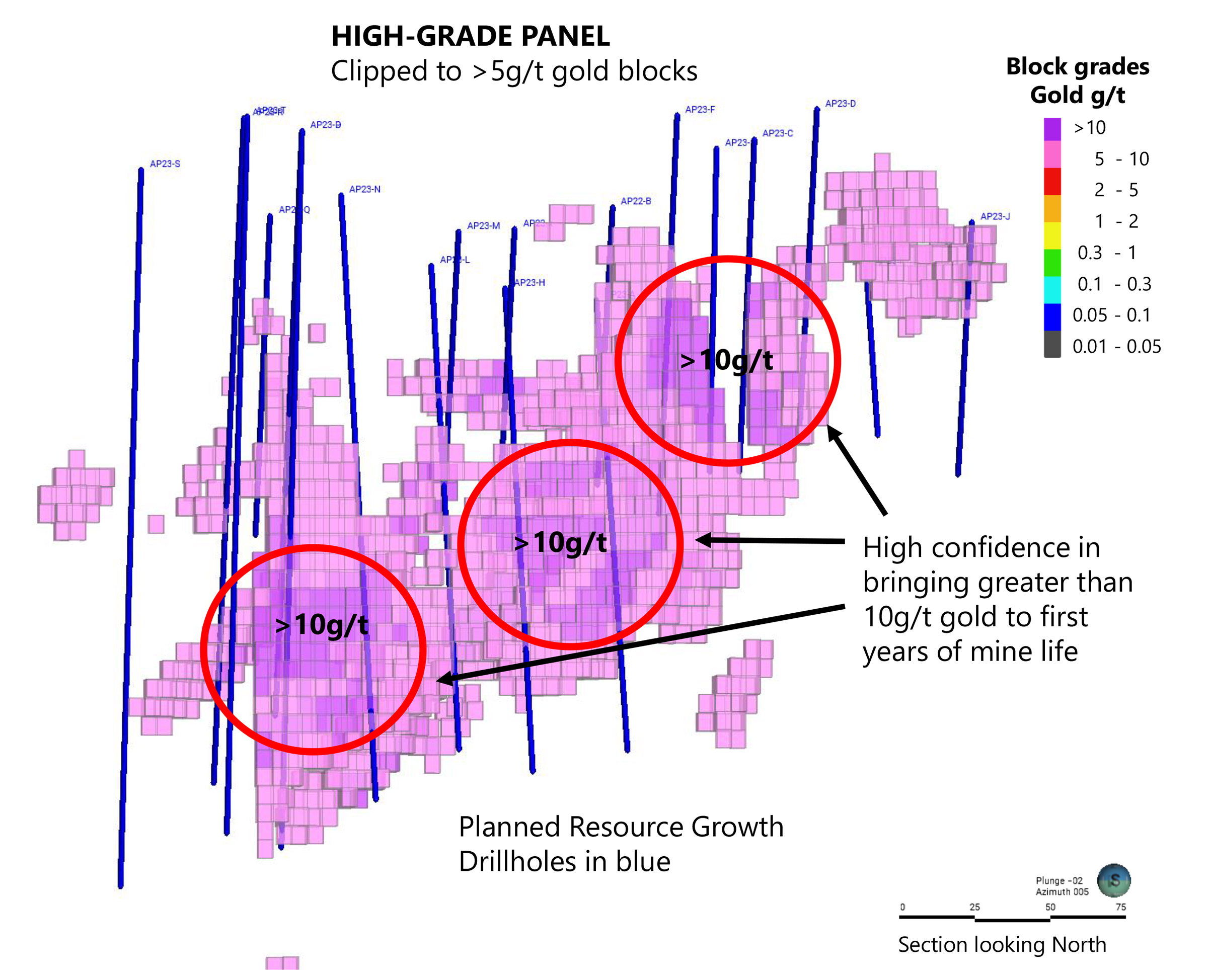

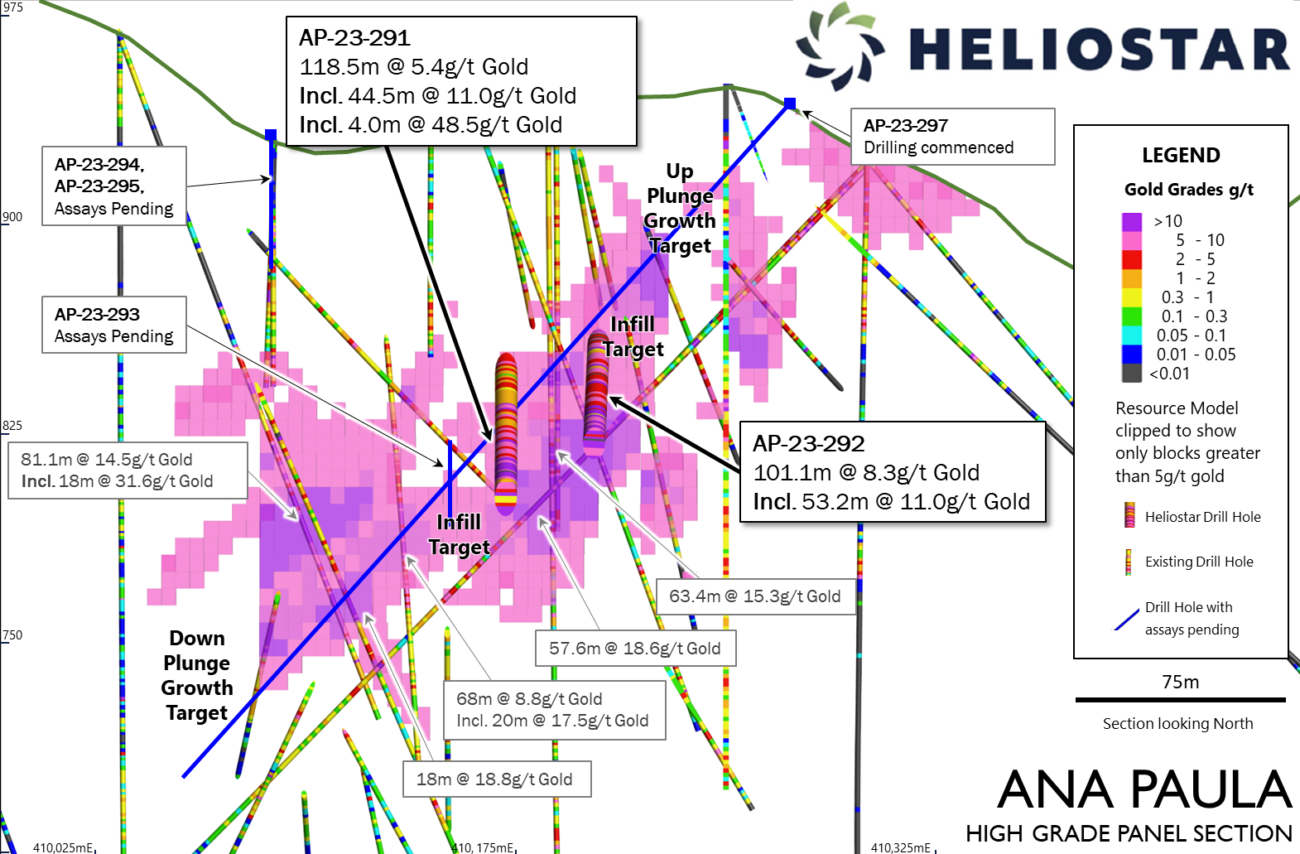

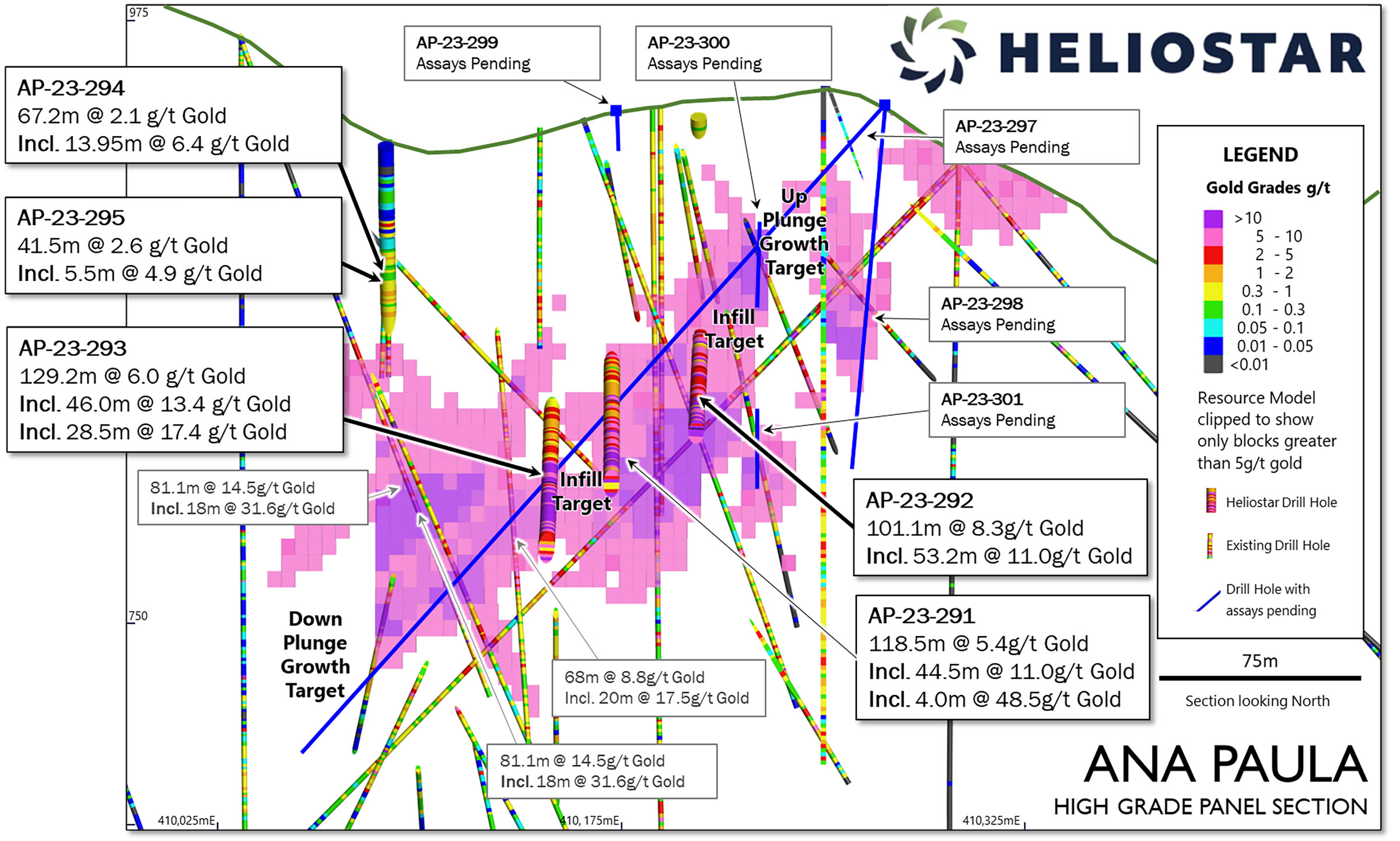

First of all, it wants to drill out the underground resource and increase the confidence level in the higher grade panels. An infill drill program has started in April and the first results have now started to trickle in. This should increase the known resources that are part of the high-grade panel to very close to 1 million ounces of gold. And while it is still early days, the recent assay results from this high-grade underground drill program are exceeding our expectations so far.

Secondly, as the mine plan will be revised to favor an underground mining scenario, this also means the high grade zones would be mined pretty much right away. There is an existing decline that was moving towards the high-grade zone but the construction of the decline was halted after about 400 meters. Redeveloping the mine plan focusing on an expanded underground mining scenario likely has some low-hanging fruit that could pretty easily create quite a bit of additional value.

A third element Heliostar will be focusing on is the metallurgy. The previous operators were finetuning the metallurgy based on an open pit operation, and the approach has not been refined yet to account for the high-grade and very high-grade nature of the underground mining zones. Given the grades encountered so far, Heliostar will complete additional test work focusing on gravity recovery methods and grind size possibilities. The current drill program will help Heliostar to conduct these tests on fresh core samples. Results from the additional metallurgical test work will likely be available in Q4 of this year.

The first phase of creating additional value is going well. The company has already released two batches of assay results from the drill program which was focusing on expanding the high grade underground zones at Ana Paula.

The first two holes drilled on the property by Heliostar were already excellent with for instance 101 meters containing 8.3 g/t gold including 53.2 meters containing 11 g/t gold in hole AP-23-292 and 118.5 meters containing 5.4 g/t gold including higher grade intervals of for instance 44.5 meters of 11 g/t gold and 4 meters containing 48.5 g/t gold. Both holes are excellent ad especially in the case of hole 291 the potential to increase both tonnage and grade of the underground resource on the back of that hole is real.

Of course the mining sector is a very promotional world and you may think Heliostar specifically released these holes first to grab some attention from the market as the company only started trading just before the end of March. It’s good to be skeptical but now the company released the assay results from an additional four holes just last week, it becomes clear those first two holes weren’t a coincidence.

Hole 293 for instance, encountered 129 meters of 6 g/t gold including 28.5 meters of 17.4 g/t gold and 46 meters of 13.4 g/t gold. This is a very important hole not just because of the grade but mainly because of the location of the hole. Hole 293 was an infill hole which has now successfully connected a series of known high-grade holes and it basically confirmed a strike length of 195 meters with assay results exceeding 15 g/t gold.

Given the exceptionally strong results in the first three holes, the almost 14 meters containing 6.4 g/t gold in hole 294 and 41.5 meters containing 2.6 g/t gold including 5.5 meters of 4.9 g/t gold in hole 295 may actually sound a bit disappointing. But of course that isn’t the case. The grade is still excellent and most exploration companies would give an arm and a leg to encounter 0.2 oz/t gold over a 14 meter interval. For Heliostar, it is just the icing on the cake. The gold it encountered in those two holes is actually located above the high-grade panel.

The key word here is now ‘continuity’. All three infill holes in the high-grade underground panel encountered high-grade gold and this should strengthen the company’s confidence in its strategy. And the ‘weaker’ holes are located higher up in the system and aren’t part of the high-grade underground panel. In any case, it’s not something we take into consideration right now (although those tonnes may end up in the mine plan anyway, as those grades would likely exceed the cutoff grade), and it likely won’t even be Heliostar’s problem.

While Heliostar is advancing the project on a standalone basis – as it should – we can’t ignore Torex Gold (TSX: TXG) is operating the Morelos Complex pretty much on the next hill over. You don’t have to be a rocket scientist to see there could be synergies between both projects and we are surprised Heliostar and not Torex ended up with Ana Paula.

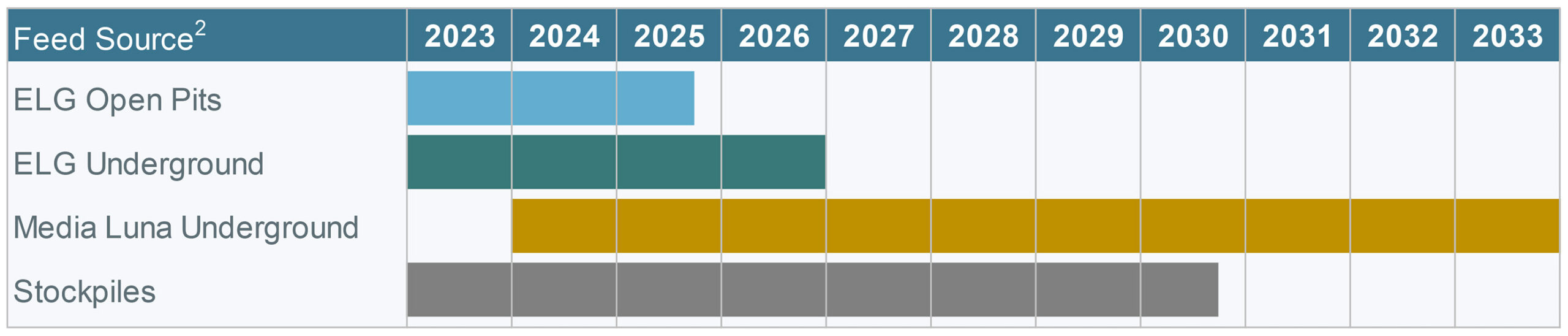

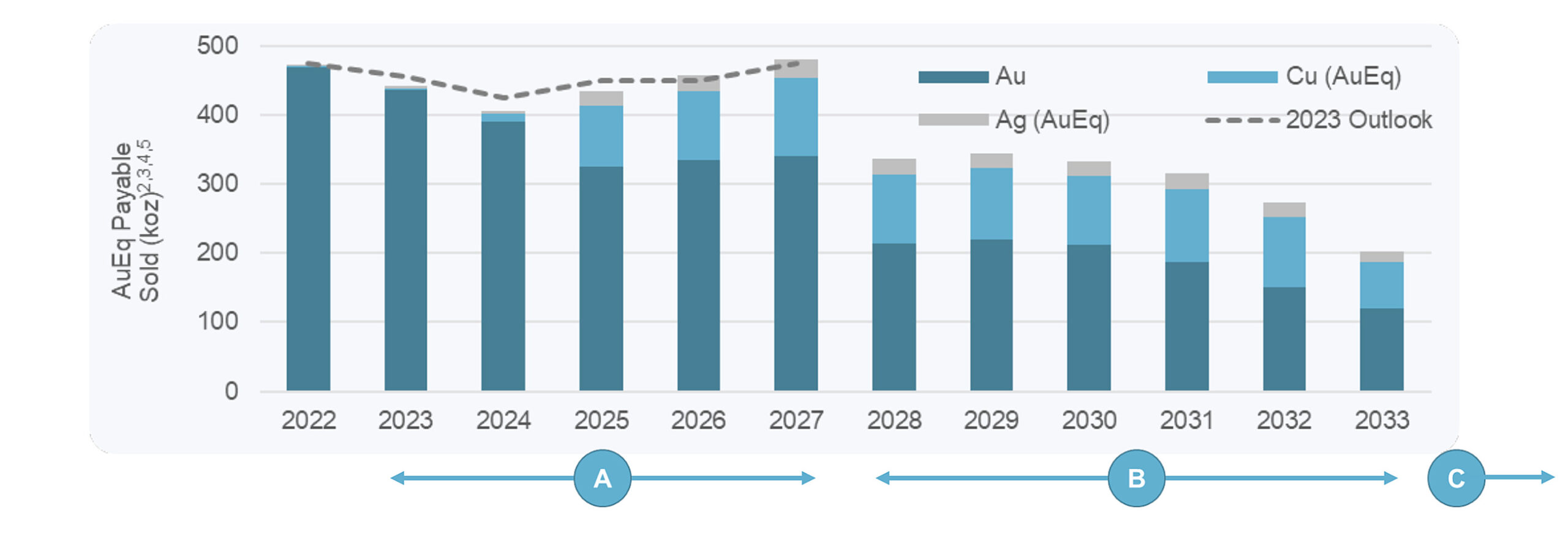

The following image was taken from the Torex Gold presentation. You notice a sharp decrease in the gold production rate from 2027 on, which is when the El Limon deposit will be mined out (see above). And you once again don’t have to be a rocket scientist to understand that hauling a few thousand tonnes per day from Ana Paula to the Morelos mill would benefit Torex as well as it wouldn’t have to downsize its mill capacity. Of course it is very easy to be too ‘armwavy’ but if you have a mill running below capacity with a 1 million ounce high grade deposit just 25 kilometers by road away from that mill, it just makes a lot of sense.

Heliostar has enough cash to complete the drill program

Subsequent to the large capital raise, Heliostar Metals has approximately 148 million shares outstanding, resulting in a current market capitalization of C$59M based on the current share price of $0.4. After making the cash payments to Argonaut, Heliostar has about C$5M left in the bank. This should be sufficient to complete the planned 3,600 meters of drilling but Heliostar may have to tap the markets again right after the summer period and hopefully additional good drill results will generate some market interest.

The company also has 58 million warrants outstanding, of which just over 46 million were issued in the private placement which was completed in March. Those warrants have an exercise price of C$0.30 and could provide additional funding further down the road but the owners of those warrants will obviously have to be willing to exercise them as there is no accelerated expiry clause. We expect a bunch of the warrants to be exercised along the way providing a nice and continuous net cash inflow, but not enough to build plans around.

One important date to circle in your calendar: the 92.7 million new shares will be free tradeable on July 18th, which is four months and one day after the official closing of the financing. While CEO Funk appears confident the vast majority of the shares were placed in strong hands, ‘leakage’ can and should be expected as Heliostar is one of the very few companies in the gold exploration sector whose share price actually went up in the past three months.

Highlighting some members of the management and board

Charles Funk — CEO & Director

Mr. Funk has over 14 years of industry experience for major and junior mining and companies including Newcrest Mining and Evrim Resources. Charles is a geologist specializing in business development for gold, silver and copper projects from early stage to production. Charles has led or supported multiple deposit discoveries in Mexico and Australia and contributed to over $60 million dollars in capital raisings.

Sam Anderson — VP Projects

Samuel Anderson has 19 years of experience in exploration, development, and production geology including a 17 year career with Newmont Gold Corp. where he held successive positions from Exploration Project Manager to Senior Development Geologist to Mine Geology Superintendent to Senior Manager of Exploration Business Development before taking leave to earn a Master of Science Degree in Finance at the University of Arizona’s Eller College. He joined Heliostar Metals in September of 2020. In addition to an MSc in Finance, Sam holds an MSc in Geology and a BSc in Geology from the University of Idaho.

Jacques Vaillancourt — Executive Chairman & Director

Jacques has spent 30 years in finance and during that time has been involved in over $30B of financings for the natural resource sector. He is currently President & CEO of Mount Everest Finance, which finances natural resource companies. Prior, he was at HSBC Bank Plc. where he was Managing Director and Global Head of Metals & Mining From 1992 to 2009 he was at BMO Capital Markets. While at BMO he was Managing Director and Head of the European Equity products business and was part of a team that made BMO one of the leading mining investment banks in the world. In addition he has been a sell-side analyst at RBC . Jacques graduated from McGill University and is a Chartered Financial Analyst.

Conclusion

Heliostar hasn’t wasted any time and just a few weeks after it was reinstated for trading in March the company has already released the assay results from six holes. All three infill holes have now confirmed the very high-grade nature of the underground zone where Heliostar now seems to have a good shot at ending up with 0.9-1 million ounces of high-grade gold in the underground mine plan (that’s our target and we hope to see this target being confirmed in an updated resource calculation later this year).

The rest of the year will be exceptionally busy. Expect Heliostar to continue to release drill results from new holes throughout the summer (the company will drill a total of 16-24 holes so there’s plenty of data yet to be revealed). An updated resource should be released in the final quarter of this year (subject to turnaround times at the lab but that doesn’t seem to be a major issue these days) and that, in combination with the underground mine design and the updated metallurgical test work will pave the way for an updated economic study to be completed using the most up-to-date data available to the company.

Disclosure: The author has no position in Heliostar Metals. Heliostar Metals is a sponsor of the website. Please read our disclaimer.