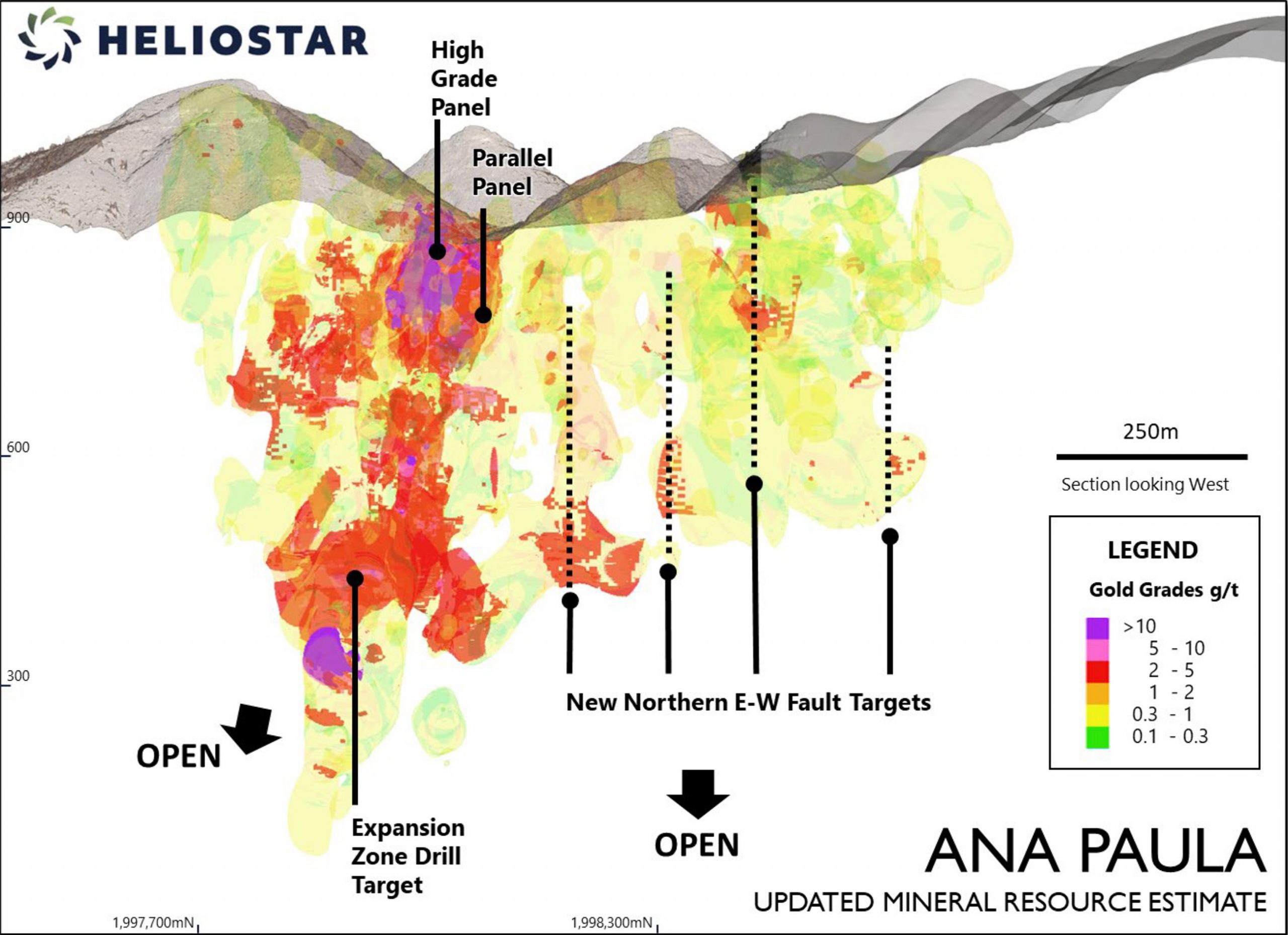

Last month, Heliostar Metals (HSTR.V) announced it had signed a Letter of Intent with a syndicate of lenders to obtain a US$20M senior secured debt facility. The company had been considering advancing the Ana Paula project, and completing the underground decline to reach the high-grade panel was a logical step to consider.

The recent elections in Mexico have put pressure on the companies that are active in Mexico but it is important to realize Ana Paula will be developed as an underground mine, and it should not be affected by any potential open pit mine permitting ban.

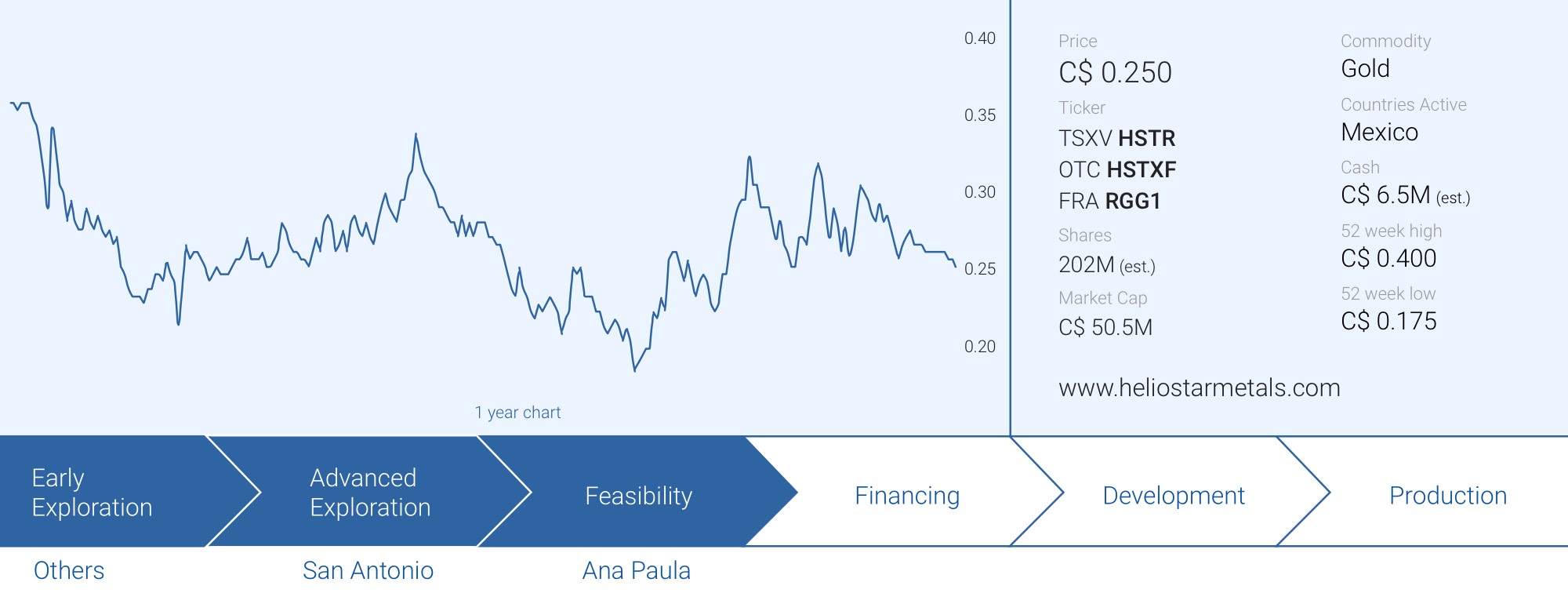

Cash is tight for non-revenue companies. In Heliostar’s case, with a market capitalization of around US$40M, raising money to complete the decline would not be feasible without completely blowing up the capital structure. Rather than sitting on its hands and going through the traditional procedure of completing the economic studies and securing funding, the company retained its focus on pursuing the test mining scenario, which also directed the company towards finding funding to complete the decline.

That funding has now been secured (assuming the LOI will be converted into a binding commitment) and although the cost of funding is quite steep with an anticipated cost of debt in the mid-20% range (which appears to be the cost of doing business these days as for instance West Red Lake’s (WRLG.V) gold-linked loan has similar characteristics), Heliostar appears to be very confident it can make it work. Investors are voting with their feet though, and the stock is down about 20% since announcing the loan agreement. It will be up to CEO Charles Funk and his team to deliver a flawless execution of the current plan.

To have additional breathing room, the company is also conducting a C$5M no-warrant financing, making the financial situation more comfortable.

The loan agreement and the implications

The loan agreement is relatively straightforward: The company pays an interest rate, gives away the upside on about 11,000 ounces of gold, and issues a few dozen million warrants.

The secured debt facility will have an initial term of 30 months and will carry an interest rate of 10% on a semi-annual basis. That’s all very straightforward.

The company can repay the principal amount at any given time without any penalty, but as part of the agreement, it ‘has’ to start repaying the principal when the first gold from the test mining phase is produced. Heliostar must make repayments equal to the number of ounces of gold sold multiplied by $1850/oz after deducting the operating expenses.

That sounds difficult but is relatively straightforward. Let’s assume 5,000 ounces of gold are produced in a quarter (readers are warned this is just a theoretical explanation and does not represent an official production or cost guidance provided by Heliostar) and the company needs US$4M for operating expenses and interest accrual. This means it would need to sell approximately 1,750 ounces at a price of $2,300/oz to cover its expenses. This means that Heliostar would have 3,250 ounces (5,000 – 1,750) available for repayment purposes in this theoretical scenario.

The catch is that although these ounces would have a market value of 3,250 * $2300 = $7.5M. But as per the loan agreement, the gold price is capped at $1850/oz which means the ‘repayment value’ of the ounces is 3,250 * $1850 = $6M. The $1.5M difference between market value and the repayment value is the ‘bonus’ for the lender. The fixed price for the gold works both ways; should the gold price drop below $1850/oz, Heliostar would still be allowed to use the reference price of $1850/oz to calculate the loan repayments.

The lenders will also receive 8.62 million warrants with an exercise price of C$0.40 per share and 8.62 million warrants with an exercise price of C$0.55/share. Both series of warrants will mature 30 months after the issue date. Should all warrants be exercised (and with an exercise price that’s 50% and more than 100% above the current share price, we obviously hope they will get exercised!), Heliostar Metals will receive just over C$8.1M in cash proceeds.

The implications of the agreement

We don’t have all the details yet to determine how interesting and ‘safe’ the loan agreement is, as this completely depends on how many ounces could ultimately be recovered and sold during the test mining phase. The company is still working out all the potential scenarios and hasn’t even decided whether toll milling or building a small’ish facility on its own lands could make sense. Both would have different implications on the capex and opex front (an owned facility would require a higher capex but would have a substantially lower opex while a toll milling scenario would represent the exact opposite).

As the first and sole priority should be to get rid of the loan as fast as possible we would lean towards using the least capital intensive approach, mainly to also avoid any teething problems the start-up phase of an owned plant could present. Once the proof of concept has been established and Heliostar shows it has been able to successfully recover gold from its underground mine in a profitable way, it could start looking into using the cash flow from a subsequent phase 2 test mining / toll milling program to fund its own facility.

Considering we don’t anticipate any production within the next 12 months and as we would assume the company needs another 6 months to produce enough gold to fulfill its loan repayment obligations, we expect Heliostar will have to repay approximately US$23-24M, including interest.

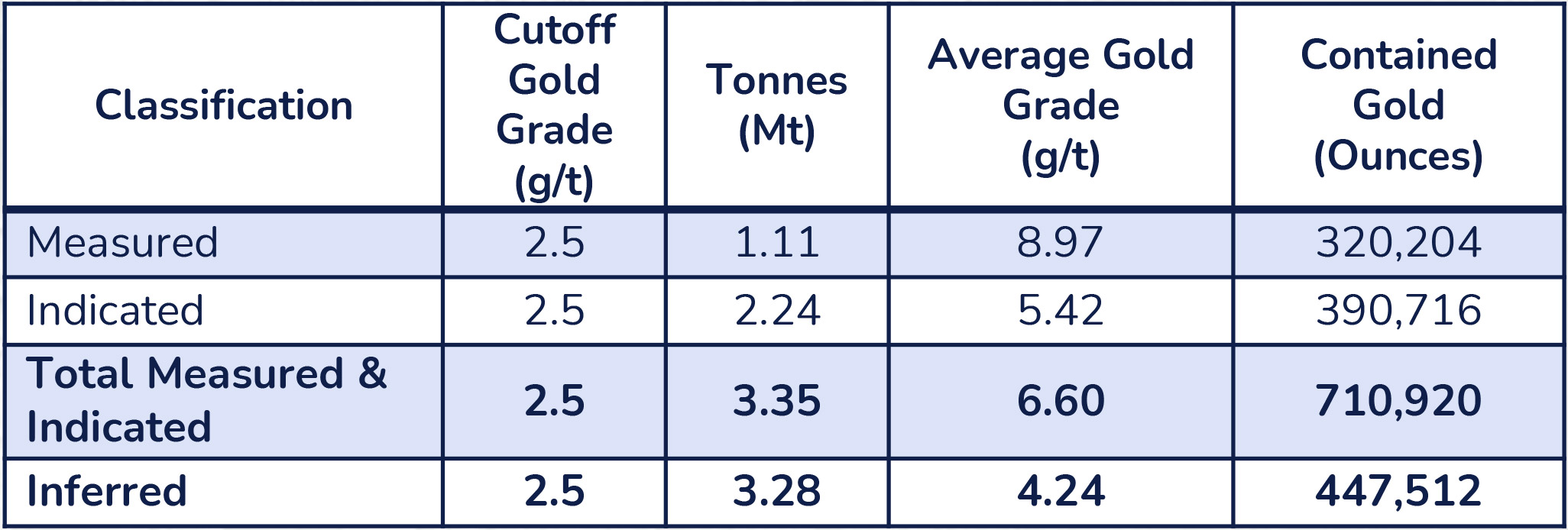

The 10% coupon on the debt facility is easy enough to determine the first part of the cost of debt. Delivering ounces at a discount to market requires a different approach. In order to repay US$20M of debt at $1850/oz, Heliostar needs to be able to deliver approximately 10,800 ounces of gold. Depending on the total operating costs and the interest payments, we estimate (again, this is our own estimate and not an official guidance by the company) Heliostar needs to recover 20,000-22,000 ounces of gold to have a fully cash neutral business plan.

At $2350 gold, the lender will make an additional margin of $500/oz. Multiplied by 10,800 ounces, the ‘gold price bonus’ equals US$5.4M at the current gold price. This means that the lender, assuming the entire case can be wrapped up within 1.5 years, will receive a total of US$29M for its $20M investment, representing a total IRR of around 27-28% which could also be seen as Heliostar’s total cost of debt.

However, should Heliostar need more time, the total cost of the facility decreases. If the lender makes about US$31M over the 2.5 year period (including one additional year of interest payments while the ‘gold price bonus’ remains unchanged but needs to be amortized over 2.5 years), the cost of the financing gets reduced to just under 20%. That being said, it would be in Heliostar’s best interest to become debt-free as soon as possible, as loan agreements to fund a test mining scenario are generally not well perceived by the market.

Please note: all scenarios and assumptions mentioned above are our own. Heliostar is still working on the definitive details of its test mining scenario and will undoubtedly publish some scenarios that will help to finetune our calculations and determine the total economic impact.

Filling the treasury with a no-warrant financing

Our main issue with the debt funding is that the company has to be darn sure it can generate enough cash flow and produce enough gold to cover all repayment requirements.

Fortunately, the company understands this risk as well, and it is raising approximately C$5M in equity in a placement priced at C$0.265 per share. No warrants are attached to these new shares, which is a testament to the strong support Heliostar enjoys from some of its cornerstone investors. A first tranche of C$4.45M has already closed and the second tranche for an additional C$0.5M in proceeds should close in the next few days.

Conclusion

The company has clearly been focusing hard on advancing Ana Paula towards production, and if all goes well, completing the decline will indeed allow Heliostar to jumpstart the project toward full production (subject to a positive feasibility study).

The key words are ‘if all goes well’. Heliostar’s management team is very confident in the positive outcome of this venture, but let’s not forget that the entire Ana Paula asset is collateral for a default on the loan agreement. This means it will really be up to Charles Funk and his team to deliver ounces, on time, and on (preferably under) budget. A partial ‘miss’ wouldn’t mean the end of Heliostar as a company as the company could tap the equity markets in a worst-case scenario and repay the loan balance. If it fails to do so, the lender may take possession of the Ana Paula project.

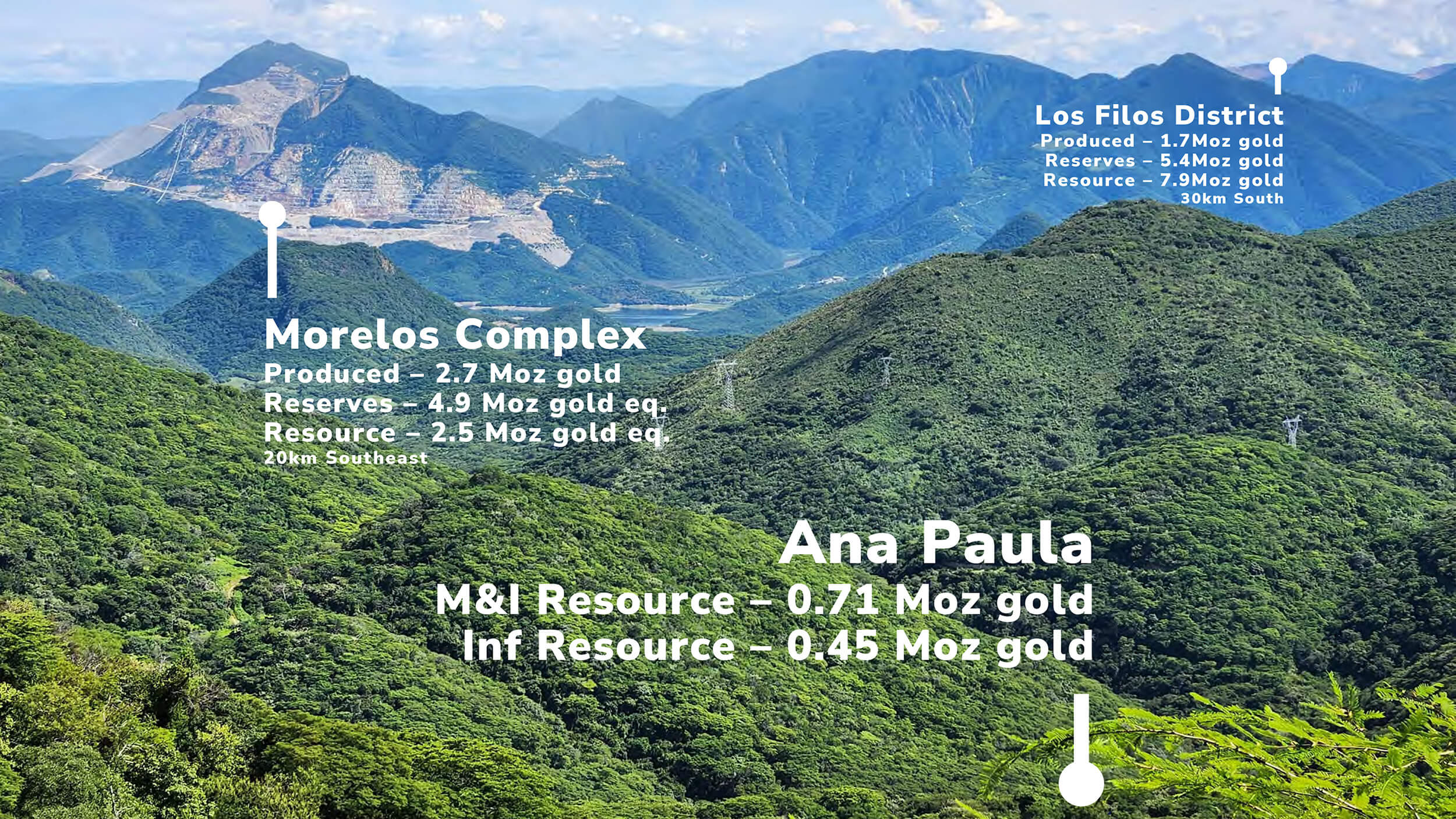

If the test mining scenario turns out to be successful and Heliostar is able to meet all debt repayments without any issue, this approach will undoubtedly be seen as ‘brilliant’. Additionally, it shows that neighbour Torex Gold is prepared to try to advance the Ana Paula project on a standalone basis. We remain convinced that the Ana Paula deposit could be an interesting source of mill feed for Torex, and we hope the neighbors are watching the developments at Heliostar.

Given how the loan agreement is structured, the next 18 months will be pivotal for Heliostar. The main risk is the financing and execution risk to ensure the test mining scenario provides a sufficient amount of ounces to repay the loan as fast as possible. And if all goes well, Heliostar will end up with a fully functional decline into the higher grade zones of the underground Ana Paula resource which could then be used to further develop and mine the high-grade panel while giving up 1-2% of the total resource on the project. A more than acceptable trade-off if all goes well.

Disclosure: The author has a small long position in Heliostar Metals. Heliostar Metals is a sponsor of the website. Please read our disclaimer.

Charles is smart & tenacious. The Company will succeed getting to cash generation.

Test from developer