The first quarter was pretty busy for Integra Resources (ITR.V, ITRG) on the financing front. The company has been indicating that for the better part of the second semester of 2023, it would have to raise money in the first part of 2024 to ensure all of its activities can be funded without interrupting the momentum.

In a two-step process, Integra raised a total of almost C$28M and approximately C$27M after fees by selling a 1.5% Net Smelter Royalty on the DeLamar project to Wheaton Precious Metals (WPM, WPM.TO) and completing a bought deal financing priced at C$0.90. That bought deal financing contained half a warrant with an exercise price of C$1.20 and those warrants are now tradeable on the TSX Venture Exchange.

Initially, we weren’t thrilled with the sales price of the royalty, but after running the numbers (and we will explain our thought process in this report), it looks like Integra got a fair price. Whereas the company is currently trading at 0.07 times the combined after-tax NPV5% of DeLamar & Wildcat / Mountain view, it was able to sell the royalty at approximately 0.45 times the pre-tax NPV6% (according to our calculations). As the royalty buyer will have to wait multiple years before seeing its first dollar in royalty revenue, that is a more than acceptable multiple it receives for the royalty sale. And it’s only in a very optimistic scenario that Wheaton Precious will be the winner of the royalty deal as it appears to be a win-win situation right now. The price of the royalty sale looked a bit light at first sight but it sure beats the second option, which was diluting the share count by in excess of 20%.

The company is now fully funded to complete a feasibility study at DeLamar while the permitting process remains ongoing. The financing will also allow for an exploration program at Wildcat, a deposit that has not seen significant exploration. The current treasury will carry Integra into next year.

The recent capital raises

Integra Resources obviously has to raise enough cash to bankroll its activities as a non-revenue company. The easiest solution would be to issue new shares, but at a share price of around one Canadian Dollar, that hardly is the best idea. Although new shareholders would get a pretty good deal out of it and existing shareholders could average down, raising money at 1/10th of the share price it was trading at just three years ago likely wouldn’t make the company any friends.

A. The royalty deal

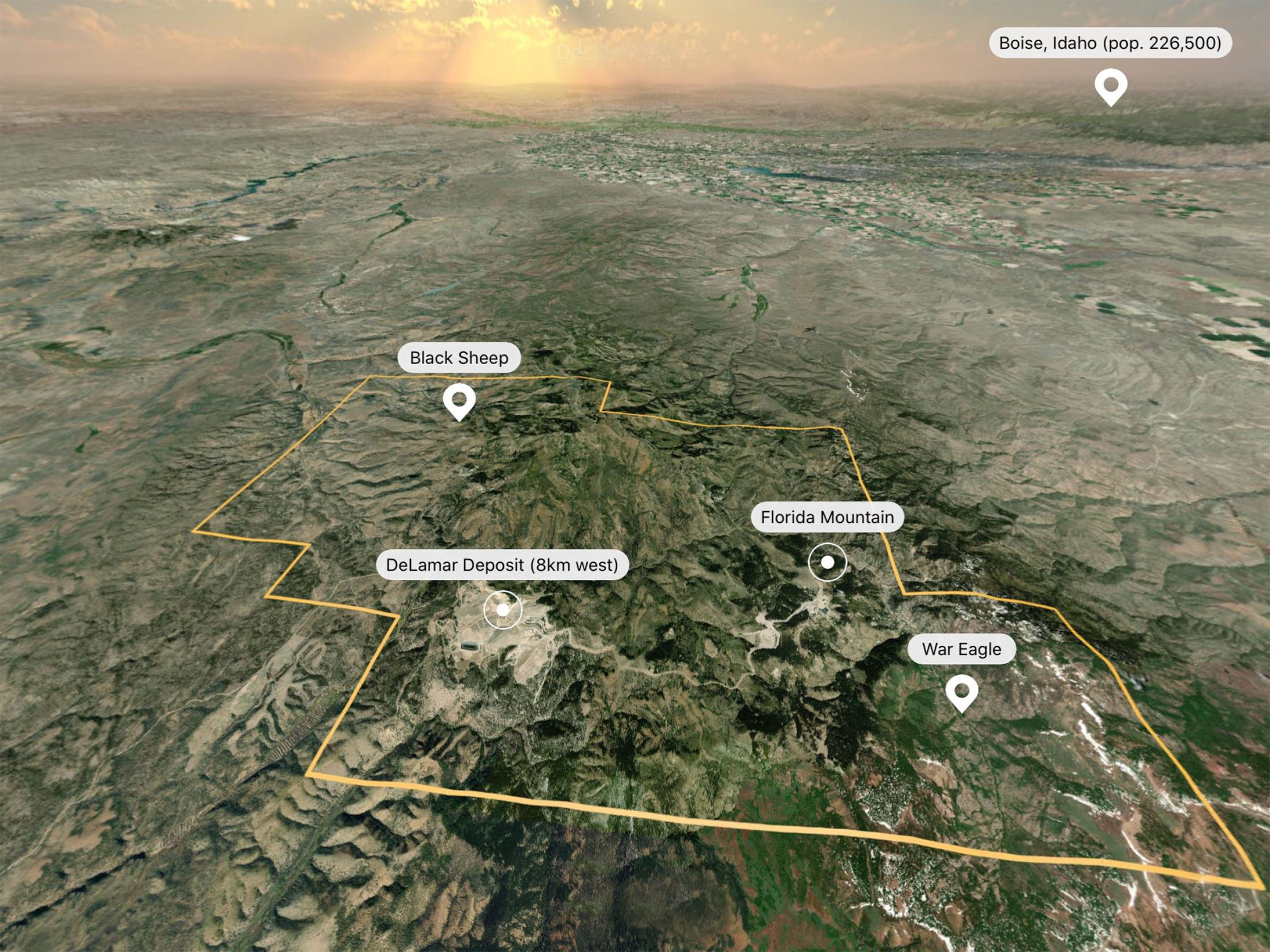

In February, before the BMO and PDAC conferences, Integra Resources announced it had signed an agreement with Wheaton Precious Metals whereby the latter is acquiring a 1.5% net smelter royalty on the metal production at DeLamar and Florida Mountain. Wheaton will pay US$9.75M in cash upfront, payable in two equal tranches. The first installment of just under US$4.9M was already received by Integra while the second installment will be payable in July (four months after receiving the first installment).

We would have been allergic if Integra Resources had claimed this was a ‘non-dilutive’ financing, as so many other companies pretend royalty financing is. While it is not dilutive to the share count, a royalty financing is obviously dilutive on the project level.

There are two perspectives on the royalty deal. First, from Integra Resources’ perspective, it is a very fair deal. The company needed about C$20-25M to get DeLamar through the permitting process and the feasibility study. The market knew this, and there was no way around it.

The US$9.75M received price for the royalty represents approximately C$13M. If Integra had to raise C$13M at the same terms of the bought deal (see below), it would have had to issue almost 15 million new shares, resulting in a share dilution of over 20%. So, from Integra’s point of view, it was a choice between two evils. And in an era where money is still scarce – despite the gold price comfortably trading above $2,000/oz – selling a royalty is a justifiable way of raising money – as long as you get a good valuation.

Looking at it from the other side, Wheaton Precious is also getting a good deal. As per the October 2023 technical report with an effective date of August 2023, the heap leach phase of the operations at DeLamar would see a total gold production of 843,800 ounces, while the cumulative silver production is estimated at just under 19.2 million ounces.

A 1.5% NSR across the board would result in a total of 12,657 ounces of gold and 287,500 ounces of silver being delivered to Wheaton Precious. At a gold price of $2,000/oz and a silver price of $25/oz, Wheaton Precious would be entitled to US$22M in gold sales and $6M in silver proceeds for a total of approximately US$28M based on the amount of gold and silver that would ultimately be payable.

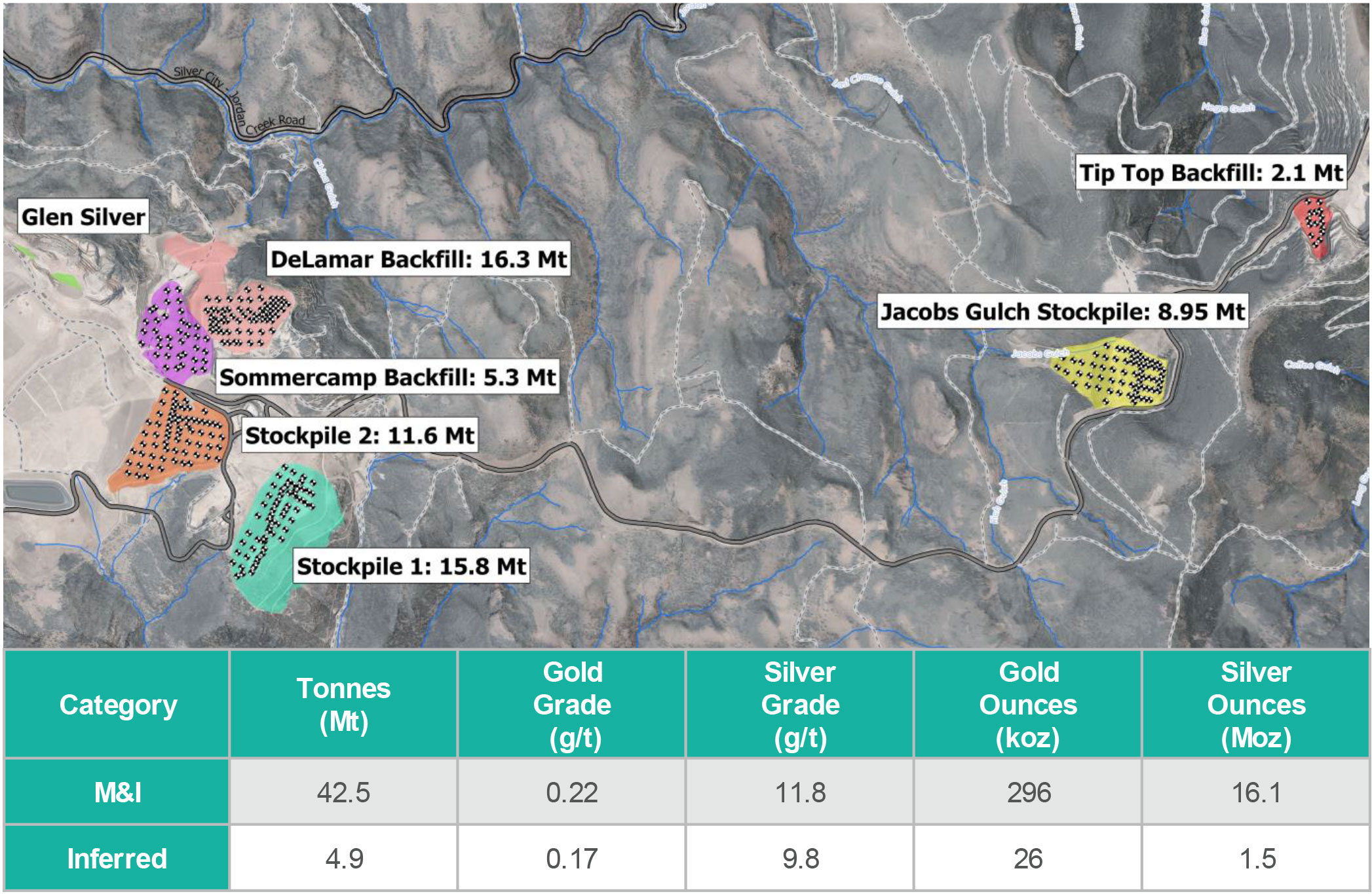

This excludes the potential to add the stockpile and backfill areas to the mine plan. The same 2023 technical report disclosed a total of 42.5 million tonnes containing 0.22 g/t gold and 11.8 g/t silver in the measured and indicated categories for a contained 296,000 ounces of gold and 16.1 million ounces of silver. Applying a 70% recovery for gold and 40% for silver (these recovery rates will have to be confirmed in the upcoming feasibility study, so you should consider them to be a back-of-the-envelope assumption for the time being) would indicate about 210,000 ounces of recoverable gold and 6.5 million ounces recoverable silver. This would add about 3,000 ounces of gold and about 100,000 ounces of silver to Wheaton Precious’ entitlement, resulting in an additional pro forma revenue of US$8.5M, assuming the measured and indicated resources are integrally adopted in the feasibility study.

It’s safe to assume Wheaton’s upfront US$9.75M cash payment will likely get them close to US$40M in cash flow in value based on our assumptions. While it sounds nice to get a ‘4x’ on an investment, keep in mind that in a best-case scenario, it will take several more years before Wheaton sees a first dollar from DeLamar hitting its accounts.

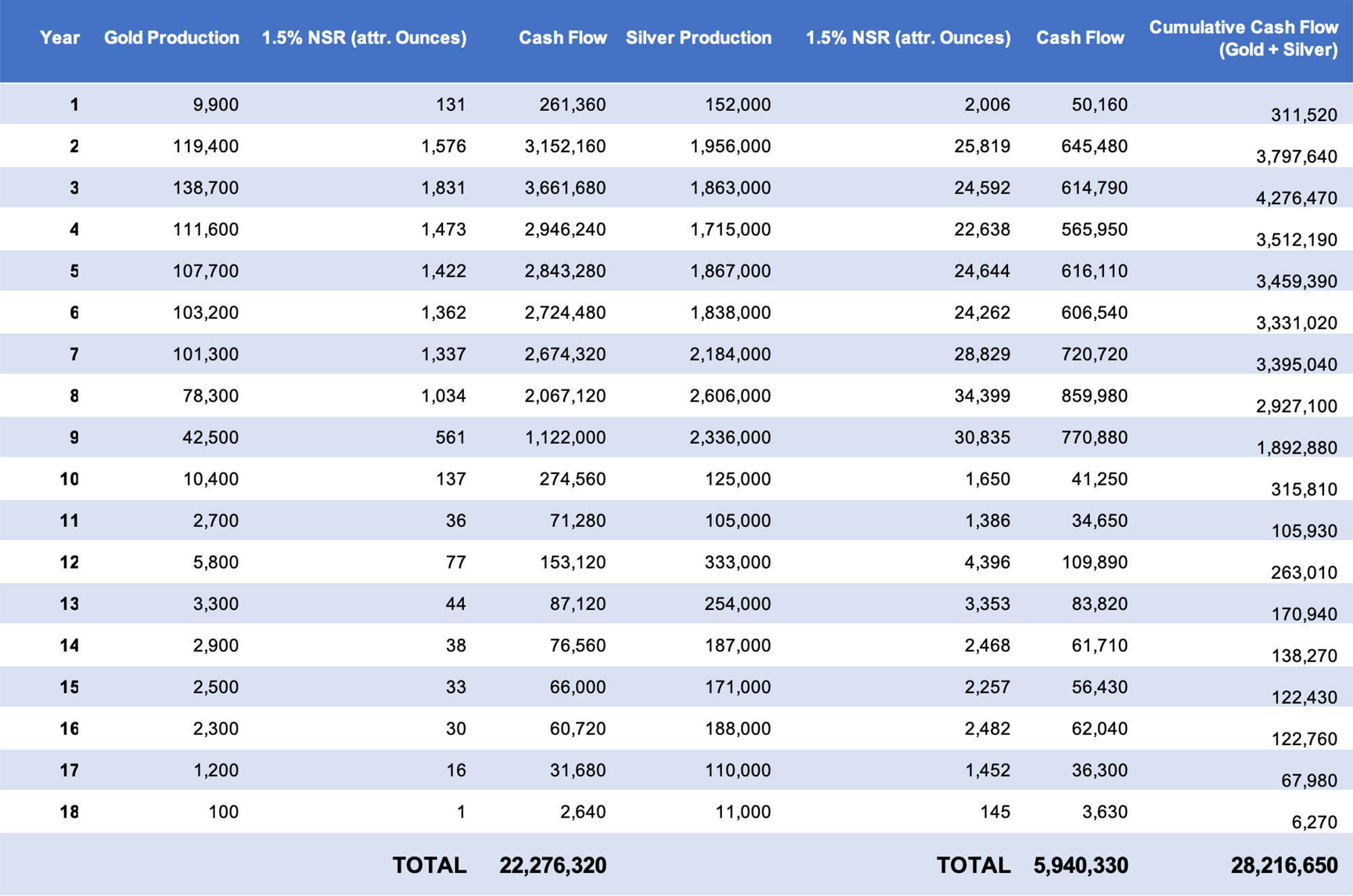

The table below shows the anticipated production attributable to Wheaton Precious Metals. We used the anticipated recoverable gold production from the NI43-101 technical report and the aforementioned precious metals prices of $2000 for gold and $25 for silver. Note: we limited the table to 18 years. In years 19-20, there is no anticipated gold production anymore, while the cumulative silver production of 7,000 ounces (105 ounces attributable to Wheaton Precious) is irrelevant in the bigger picture. The average delta between recovered ounces and payable ounces is approximately 12% as the pre-feasibility study indicated a total of 749,000 ounces of gold would be payable versus the 843,800 ounces of gold that would be recoverable. The table below does not include this delta but we are including it in the NPV calculation in the second table.

Again, the table above excludes the backfill & stockpile zone potential. As you can see, the cumulative cash flow is US$28.2M using $2000 gold and $25 silver (which are rather aggressive prices).

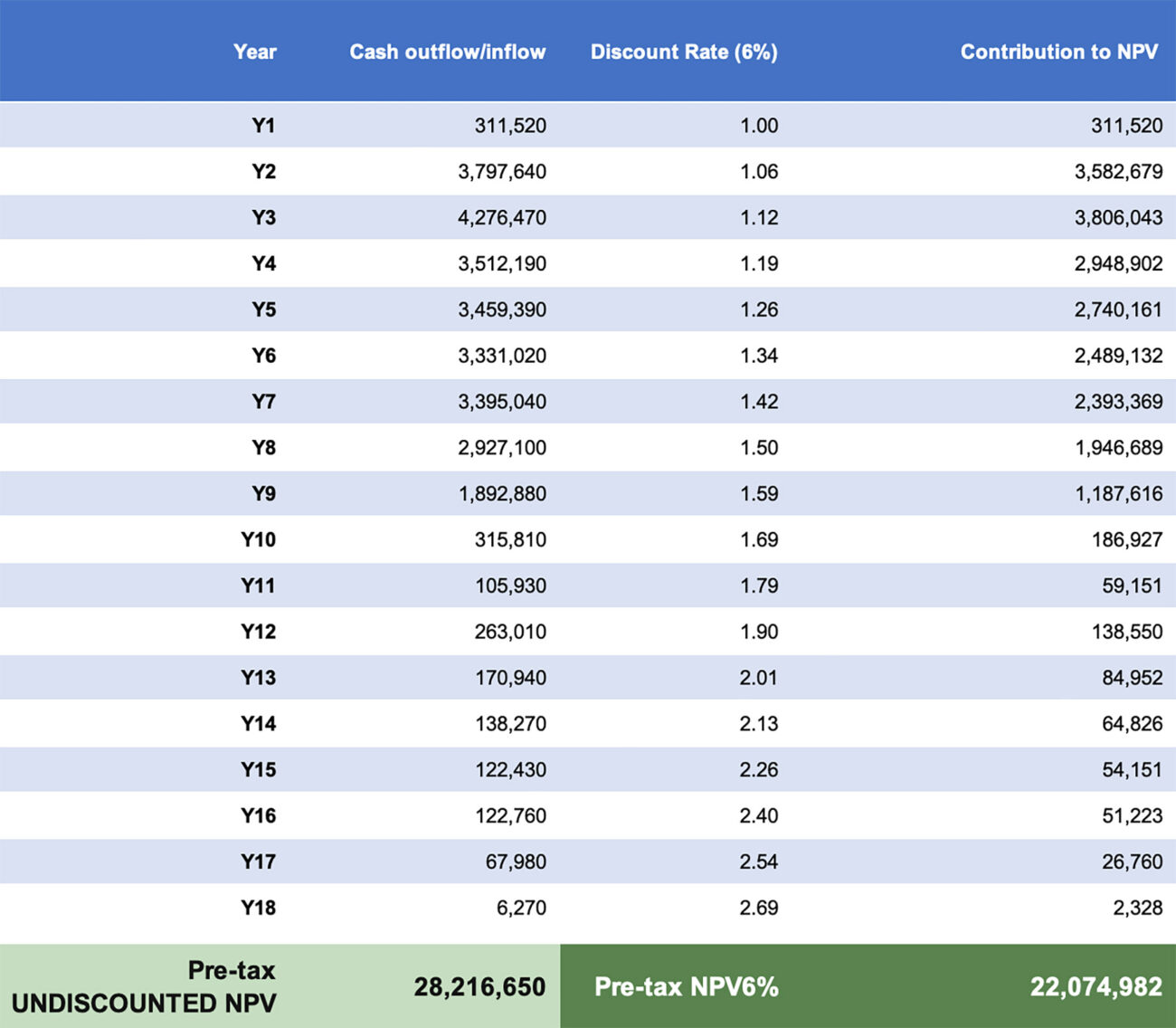

Plugging those annual cash flows into a DCF model using a 6% discount rate (5% is outrageously low when a 30-year US treasury currently yields 4.7% and even a 6% discount rate represents a markup of just 130bp) and disregarding taxes results in the following calculation:

This means Wheaton Precious paid about 45% of the pre-tax NPV6% of the gold and silver.

But there is more. The project is not in production. Heck, it’s not even permitted. Integra expects to receive its Record of Decision in 2026, so production is unlikely to reach cruising speed before the end of 2028. This means we need to discount the pre-tax NPV further to derive the fair value ‘today’. As this is an unpermitted project, a discount rate of 8% for the 2024-2028 era seems warranted. This further reduces the fair economic value of the stream to Wheaton Precious to approximately US$15M.

And taking all these elements into consideration, it appears Integra received a very fair price for selling a 1.5% NSR as a portion of the timing risk and the execution risk has shifted to Wheaton.

B. The Bought Deal

Subsequent to announcing the agreement to sell a royalty to Wheaton Precious Metals, Integra also announce a bought deal financing. Unfortunately this means most retail investors can’t easily participate as the brokers tend to keep the order book close to their chest and the president’s list for this type of financings is traditionally rather small. On the positive side: a bought deal is a fully underwritten financing with zero risk to the company as brokers commit to placing the entire bought deal size and just take the ‘leftovers’ (if any) on their own books. Fortunately for the brokerage firms, the bought deal was quite popular and the initial C$10M bought deal was upsized to C$13M and eventually raised C$14.95M after seeing the over-allotment option being exercised.

A total of 16.6 million units were issue with each unit consisting of one common share and half a warrant with each full warrant allowing the warrant holder to acquire an additional share of Integra Resources at C$1.20 during a three year warrant. Those warrants were subsequently listed on the TSX Venture Exchange and are now freely tradeable with ITR.WT as ticker symbol.The initial warrant price was quite optimistic as the Black Scholes model indicates a fair value in the low to mid 20 cent range while warrants were changing hands at a price level as high as C$0.38 a warrant holder would only start to outperform the common shares when the common shares are north of C$1.90. That being said, as the Integra share price started to move in the past few weeks, the early warrant buyers appear to have made the right decision!

While betting on a C$2+ share price obviously is an acceptable strategy, investors buying warrants above C$0.30 are heavily speculating on a C$2+ share price. We saw there was a very good trading volume on the first day of the listing when approximately 1 million warrants changed hands at prices between C$0.15 and C$0.25 but the volume has completely dried up since. We think this isn’t a coincidence as almost 15% of the total C$1.20 warrant count traded hands on day 1, and the smarter institutional investors likely aren’t buying more warrants at a substantial premium over the theoretical fair value of the warrants. We mainly saw smaller orders in the past few trading days, indicating it appears to be mainly retail-related buying. The warrants are an excellent tool for gold bugs and Integra bugs believing the share price will exceed C$2.50 within the next three years.

The acquisition of additional claims at DeLamar

Integra Resources also disclosed the acquisition of 17 unpatented claims in the Rich Gulch area of DeLamar. These claims are located directly adjacent to the Florida Mountain Deposit. According to CEO Jason Kosec, this is a small but strategic acquisition for the company as it could be very suitable for a Development Rock Storage Facility during the mining operations. The newly acquired claims will be earmarked as such in the upcoming mine plan that will be part of the feasibility study on the project.

The acquisition cost was settled by issuing 2.96 million common shares of Integra Resources and the payment of US$24,000. The 2.96 million shares are escrowed with about 1.48 million shares only being released on July 9th 2024 and on January 3rd 2025.

Looking at the NPVs of the projects, Integra is trading at a very deep discount

While Net Present Value calculations definitely aren’t the holy grail, they do provide useful information and help to somewhat underpin a company’s valuation. While the results of the pre-feasibility study on DeLamar are somewhat outdated by now, we don’t expect to see a substantial deterioration of the investment case between the pre-feasibility study and the feasibility study as the additional ounces from the backfill & stockpile zones should make up for any negative surprises.

The company has also hired Whittle Consulting out of Australia to help unlock additional value at DeLamar by further improving the economics. On Whittle Consulting’s own website, they refer to usually being able to increase the NPV by 5-35%. Even if engaging Whittle only results in a 5% NPV bump, it would still be ‘money well spent’.

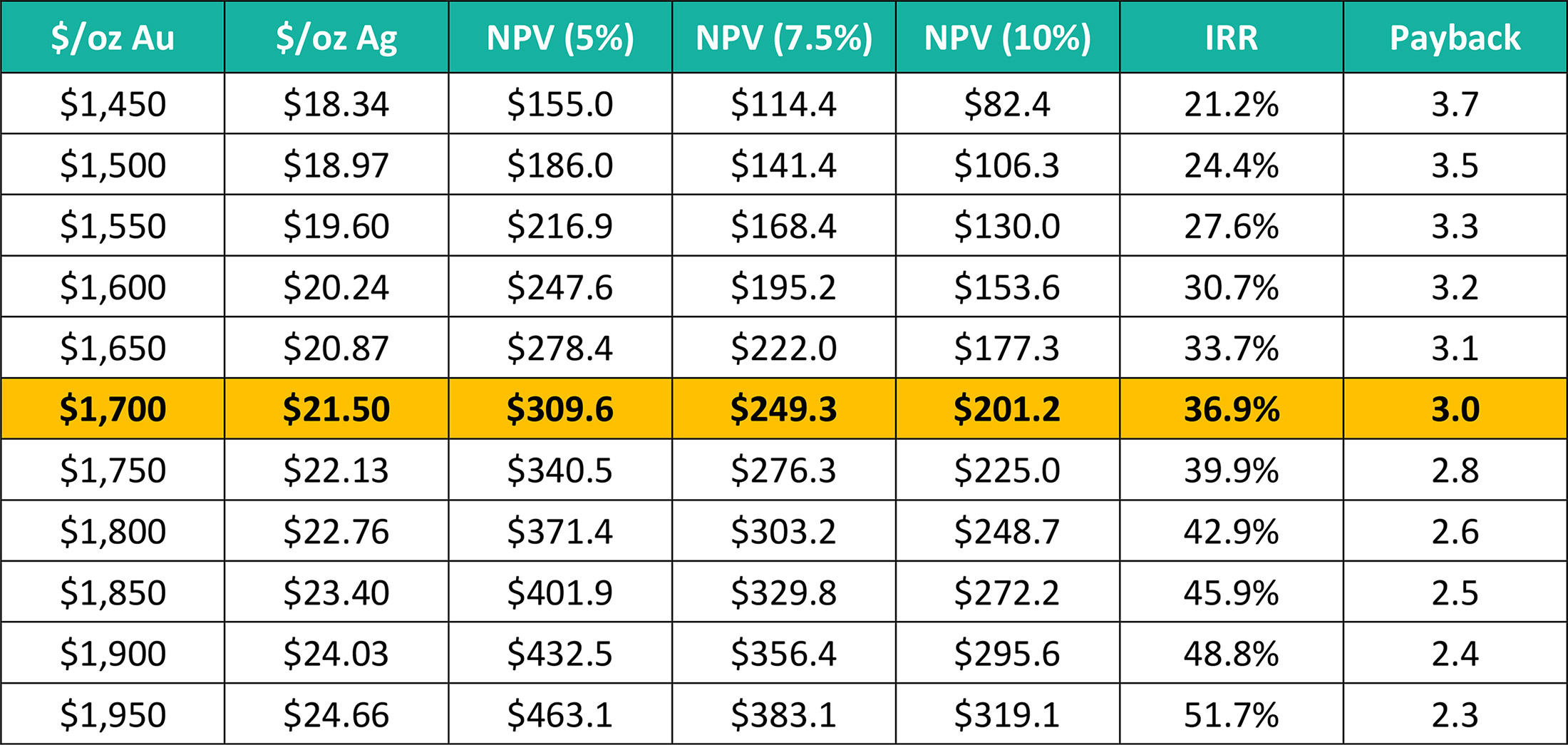

That’s why we are comfortable going back to the DeLamar pre-feasibility study. In an update, disclosed in April 2022, Integra Resources announced an after-tax NPV5% of US$314M at $1700 gold and $21.5 silver while a gold price of $1900/oz and a silver price of $24.03 per ounce resulted in an after-tax NPV5% of US$435M.

Let’s use that as the current base case scenario for Integra Resources (of course subject to the final results of the feasibility study on the project later this year) and also include the 2023 economics on the Mountain View and Wildcat gold projects in Nevada. The sensitivity analysis below is extremely interesting.

As you can see, at $1700 gold and $21.5 silver, the after-tax NPV5% is US$310M. Applying $1900 gold and $24.03/oz silver, the after-tax NPV5% increases to US$432.5M.

This means that at $1900 gold, the combination of the official DeLamar and Mountain View/Wildcat NPVs would be US$870M. And for every $100 increase in the gold price, the combined after-tax NPV5% increases by approximately US$100M. So at $2000 gold, the combined after-tax NPV5% on both assets can be estimated at US$950-980M for a Canadian Dollar equivalent of approximately C$1.25-1.35B. Using C$1.25B and the current share count of just over 88M shares, the combined after-tax NPV5% of the most advanced Idaho and Nevada assets would be C$13.5-14.5 per share. This of course doesn’t mean the stock should be trading at those levels, but it’s not far-fetched to assume a fair value of 0.25 times NPV for a feasibility stage project (it should be even higher as soon as the market gets confident about permitting and financing possibilities) and 0.15 times NPV for a PEA stage project. Using the official numbers at $1900 gold and $24 silver, this would result in a current fair value of US$109M for DeLamar and US$65M for Wildcat/Mountain View. The combination of both would be US$2 or C$2.70 per share. One caveat: the impact of the recent royalty sale is not yet included in this assumption but it would have a negative impact of just a few percent on the consolidated asset base.

An although the 0.25 and 0.15 multiples appear to be pulled out of thin air, they are actually very reasonable for precious metals projects. A recent research report published by Canaccord Genuity put the average P/NAV of development stage ànd exploration stage companies at approximately 0.25 times NAV (whereas we apply an additional discount to the PEA-stage assets in Nevada). And those valuations are already taking a pretty depressed market into account.

Long story short, you can use any multiple you want. The official studies indicate both DeLamar and Wildcat/Mountain View are worth approximately US$435M each at $1900 gold and $24 silver, using a 5% discount rate. Do you want to use a multiple of 0.1 times NPV? 0.25? 0.50? Be our guest. But considering the company is trading at 0.07 times the NPV at the aforementioned prices, you’d have to use very depressed multiples to justify the current share price.

Conclusion

We initially weren’t very impressed with the terms of the royalty sale to Wheaton Precious Metals, but after running the numbers on the pre-feasibility study and even after considering the resource expansion with the stockpile and backfill material, US$9.75M appears to be very fair given the timing and permitting uncertainty.

The company’s feasibility study will be out by the end of this year. As that study will include the resource calculation for the backfill and stockpile zones, we may expect to see a longer mine life and a higher NPV for the DeLamar project.

Disclosure: The author has a long position in Integra Resources. Integra Resources is a sponsor of the website. Please read the disclaimer.