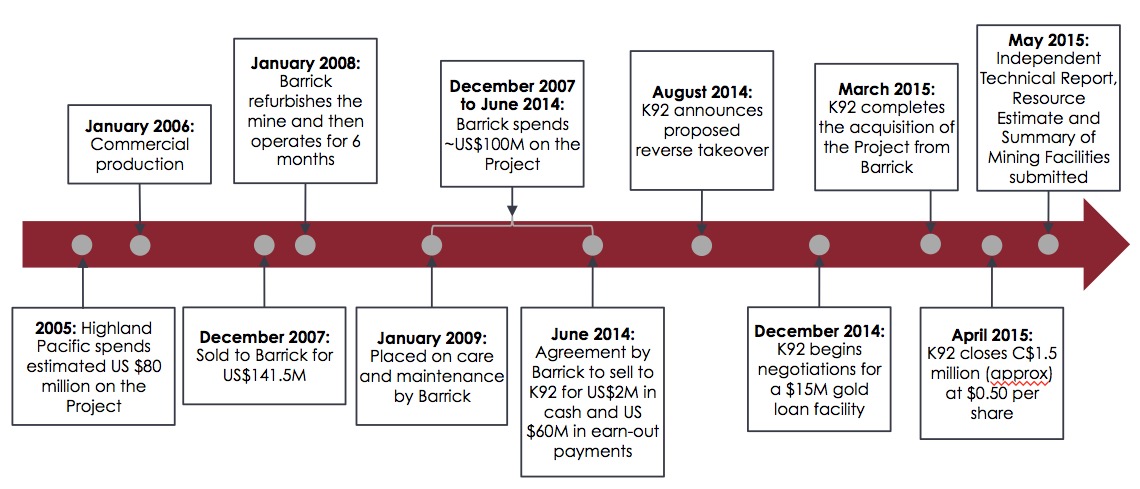

Approximately two years ago, Barrick Gold (ABX.TO, ABX) went into ‘survival mode’ and started to selling off assets at whatever price they could get for it. Several Australian assets went on the chopping block, but the market seemed to have missed a small private outfit (actually, a special purpose vehicle) acquired the Kainantu mine from Barrick for an initial payment of just $2M.

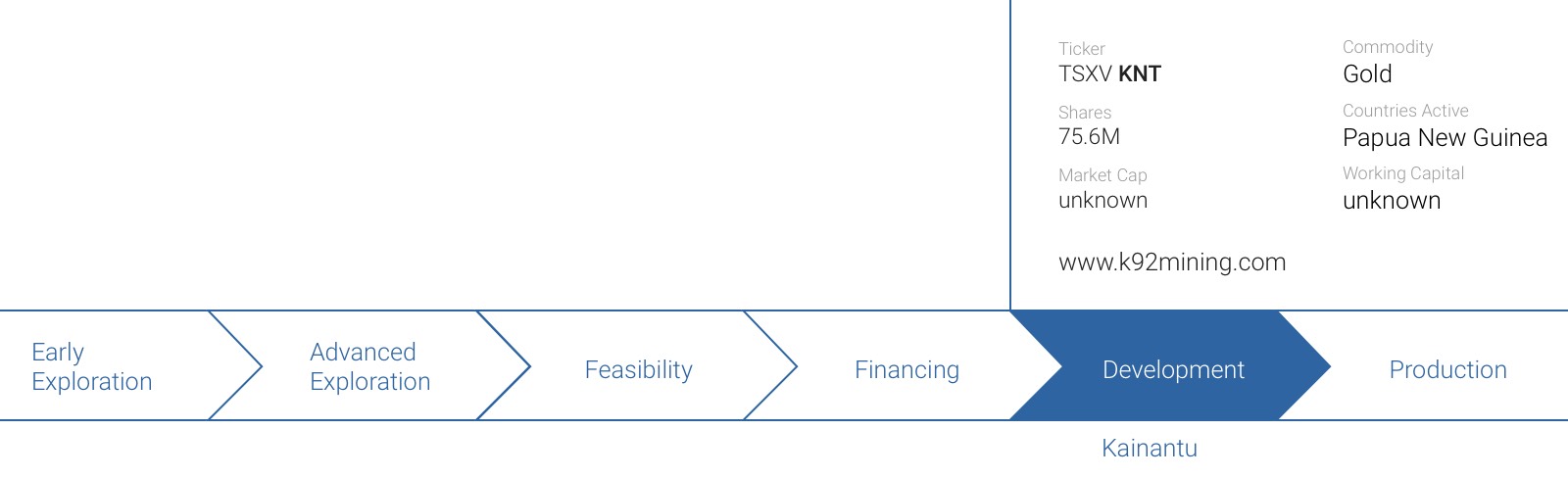

That was quite a big deal, considering both Barrick and the previous owner have invested in excess of $200M on the property and thus sold it for just a fraction of the money that has been invested in the property, which comes with a 500 tpd mill. Fast forward to today, and K92 Holdings (the SPV) has now completed its reverse take-over of Otterburn Ventures and has started trading on the TSX Venture Exchange as K92 Mining (KNT.V).

The background of the project

As the initial price tag of the acquisition of the Kainantu mine was just $2M (see later), you might think this is just another junior company picking up another sub-par property hoping to find something of value.

Wrong.

This is perhaps one of the strongest acquisitions we have seen in the past few years as not only does the K92 mine come with an existing resource estimate (containing 1.4 million ounces of gold, 5.2 million ounces of silver and 222 million pounds of copper), there still is a working mill on site (with a capacity of approximately 500 tonnes per day). And the nicest part of all of this; the property comes with a valid mining license which only expires halfway the next decade.

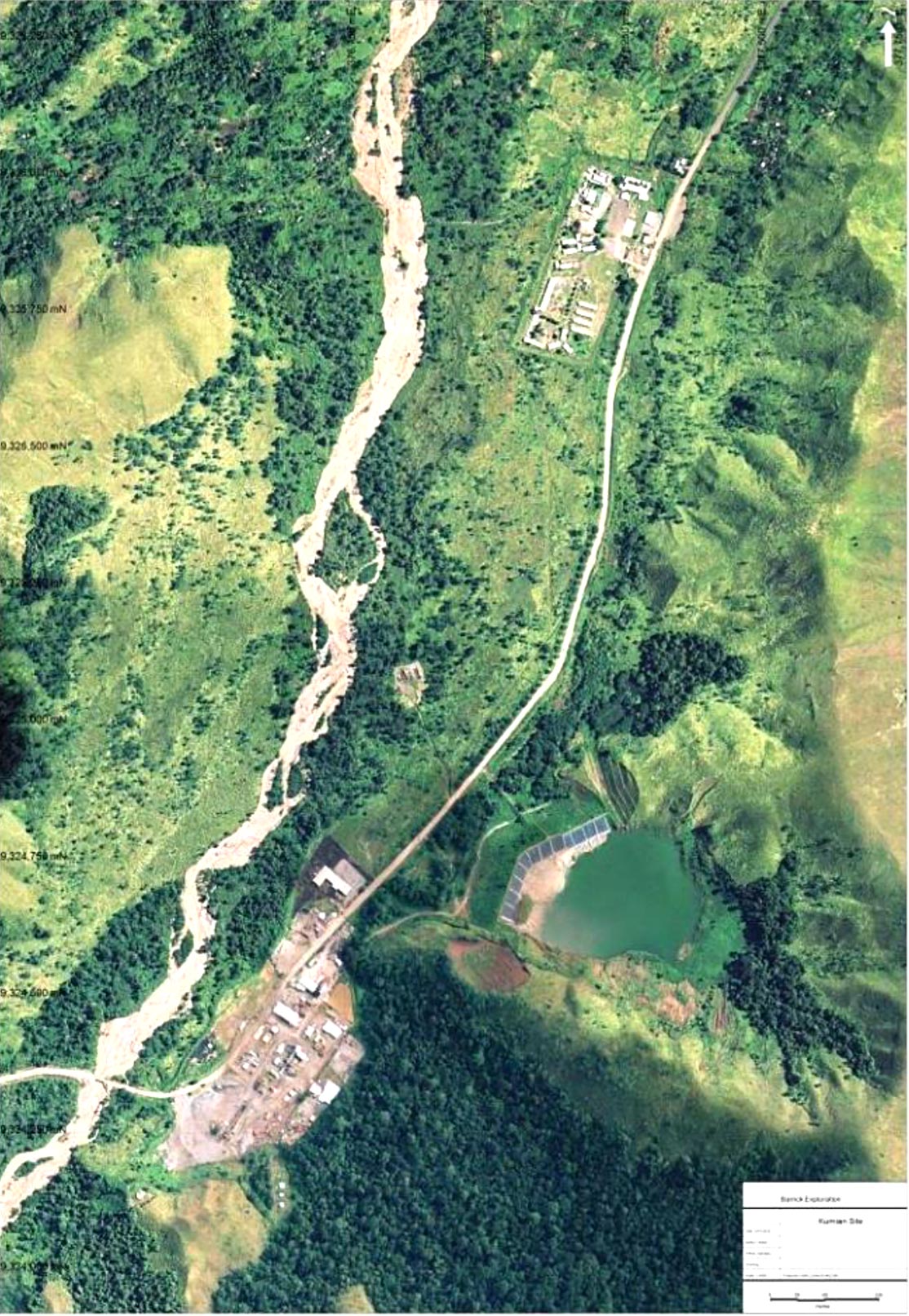

What’s important here is that this mine has already been in production before Barrick Gold placed it on care and maintenance in 2009 due to a land slide within their property boundary that had nothing to do with their operations. But at the same time the financial crisis was going on and management of Barrick changed. With that change came the mandate to sell off non-core assets to reduce the company’s net debt position. The Kainantu Gold Mine actually was the first asset sold as part of this divestment program.

But let’s get back to the basics here. The project contains a total of 5.5 million tonnes of which 90% belongs to the inferred category where the 5 million tonnes have an average grade of 7.5 g/t gold, 32 g/t silver and 2% copper for a technical gold-equivalent grade of 11.6 g/t (and a gold-equivalent grade of 10.24 g/t based on $17 silver, $1250 gold and $2.10 copper). This resource estimate was based on almost 80,000 meters of drilling from almost 800 holes, so it’s needless to say a lot of work has been completed at Kainantu.

Basically everything is ready to go on-site, and K92 has already started to refurbish the mill that has been on care and maintenance (to the tune for $6M/year spent by Barrick), and the company expects to haul the first underground ore to the stockpile in July. That’s right, the mining process should start within the next few months, resulting in an official production restart in July, concentrate being produced in August. This means that K92 will already generate revenue in the next quarter, which is almost unheard of!

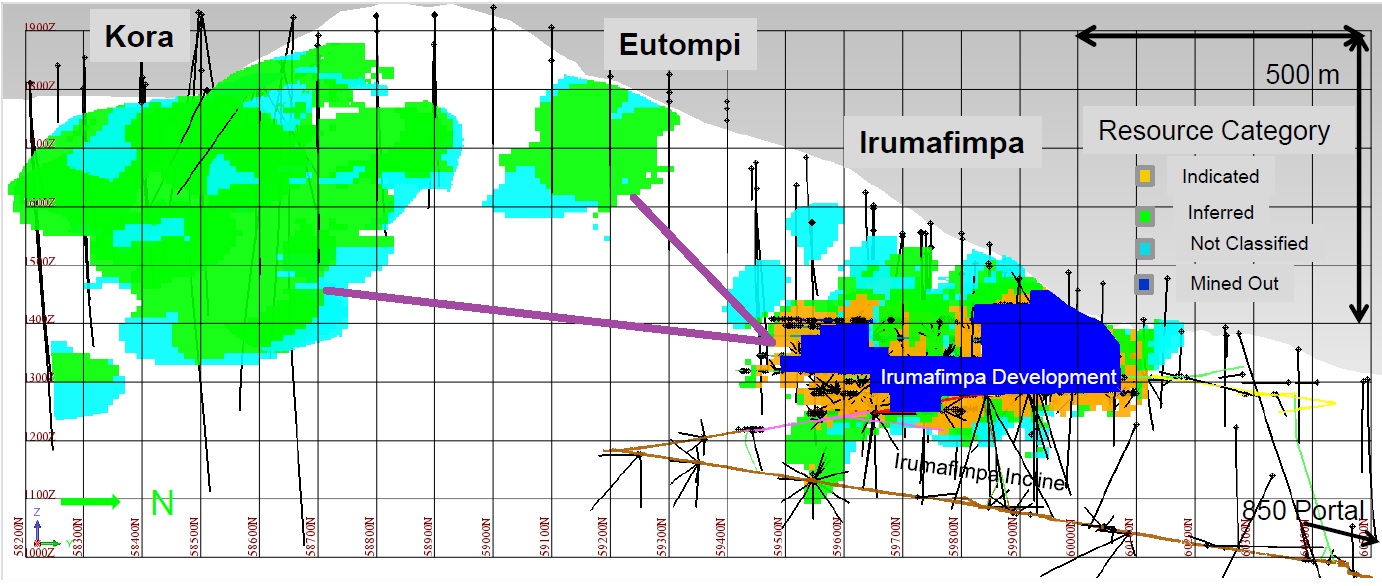

The company will start to mine at the Irumafimpa-zone where Barrick and its predecessor have spent tens of millions on underground development. The Irumafimpa zone does contain the lowest tonnage (just 1.1 million tonnes of rock) but does have the highest gold grade (and lowest copper grade), as the average grade of the deposit is approximately 12 g/t gold. The immediate access to this zone is extremely important as it allows the company to a) start the production process within months and b) use the cash flow from Irumafimpa to develop the other promising parts of the land package.

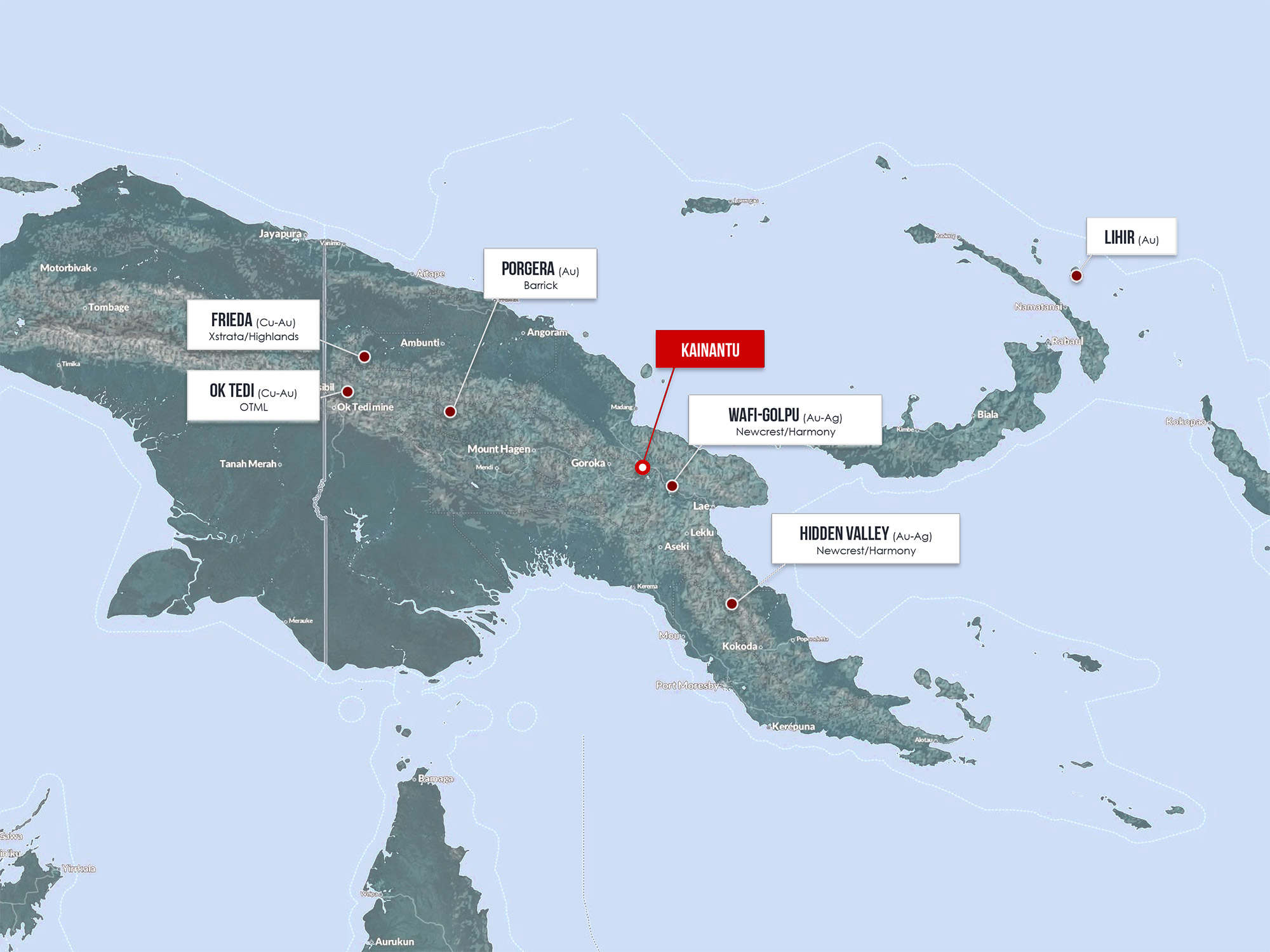

On the other side of the mountain, you can find the Kora zone which is much bigger than Irumafimpa. Whereas Irumafimpa contains just 1.1 million tonnes, Kora/Eutompi’s resource estimate contains an impressive 4.5 million tonnes of rock. Yes, the gold grade is lower (at 7.1-7.2 g/t), but this is being compensated by the copper grade, which is 7 times higher than at Irumafimpa. Based on the location of Kora and Eutompi, it would make sense for K92 Mining to try to reach these zones through the construction of an underground ramp to reach these zones. We would like to emphasize Barrick already started this underground drive and K92 will look to continue this to reach the Kora deposit. Along the way, the company will drill from underground setups, which looks very promising, as the entire area between Irumafimpa and Kora has never been drilled before.

We are currently getting our hands on some production cost related data from the Barrick-period, and will try to build an economic model in a next report but our first indications are pointing in the direction of an all-in sustaining cost of US$750 per ounce, net of by-product credits and based on an annual production rate of 170,000 tonnes for a gold production of 45,000 ounces. Keep in mind this is based on Barrick’s production cost and we would expect K92 Mining to implement more efficient structures and find other ways to save cash. Also note this is an average based on the total resource estimate; at Irumafimpa the gold production will be higher, whilst it will be lower at Kora (where the value of the by-products will be higher).

The acquisition terms

The total price tag of the acquisition is $2M cash + milestone payments, which, technically could be as much as $60M over time but if you have a closer look you can really see how the final terms are definitely working in K92’s advantage. The initial payment was just $2M (and this has already been paid), and the remaining $60M will only be due if K92 has a big discovery, moves ounces from inferred to indicated, or produces 1M ounces over a 10 year period.

According to the purchase agreement, K92 Mining will be required to pay an additional $20M per additional million ounce gold-equivalent that will either have been added to the measured and indicated resource categories, or have been mined. The maximal additional payments are capped at $60M after having found and/or mined 3 million gold-equivalent ounces and have a term of 10 years. So whilst it’s not impossible K92 will find much more gold on the property, the company’s agreement provides it with several options to minimize future payments to Barrick.

There’s no need to prove up 3 million gold-equivalent ounces. Right now, the mill has a capacity of 170,000 tonnes per year (approximately 500 tonnes per day), so if K92 doesn’t increase the capacity of the mill, it would only need to outline 1.7 million tonnes of ore it could process. Some of that ore will indeed be part of the measured and indicated categories, but there’s nothing preventing K92 to aim to produce gold from the inferred categories. It’s not unlikely K92 Mining might be ‘on the hook’ for the first payment of $20M after finding/producing an additional 1 million gold-equivalent ounces, but we are pretty certain the final 2 milestone payments will never have to be paid to Barrick Gold.

What kind of impact will the streaming deal have on the cash flows?

K92 Mining obviously needed some cash to be able to restart the mining and processing activities at the Kainantu mine, and tried to find a non-dilutive way to raise the cash. It completed a gold streaming and equity investment deal with Cartesian (a large private equity fund), whereby Cartesian will invest C$3.5M in equity at C$0.35/share (which is the same price as all other participants in the equity rounds, so they didn’t get a preferred treatment here).

What’s more important is the streaming deal. Cartesian is paying US$4.8M to get a certain percentage of the gold production at Irumafimpa. The exact percentage has not been disclosed, but the total amount of gold delivered to Cartesian will be anywhere in between 18,000 and 20,000 ounces of gold. Sure, this isn’t a ‘cheap’ stream and it looks like Cartesian is on the better end of this deal, but at least this does reduce K92’s need to issue millions of new shares to fund the project. Additionally, it allows K92 to start the refurbishment of the mill and the redevelopment of the underground workings right away, instead of having to wait for months to complete a private placement.

And let’s put things into perspective for a moment. Assuming a head grade of 10.5 g/t gold and a recovery rate of 90%, Irumafimpa will produce 150,000 ounces of gold, assuming a full production rate of 170,000 tonnes per year. So even if the total production will be just 100,000 ounces of gold in the first 2 years, just 20% of the total production will be delivered to Cartesian, leaving a lot of cash on the table for K92 Mining.

Keep in mind K92 Mining has made sure the Kora deposit is not part of the streaming deal, so the company will keep almost its entire exposure to Kora (except for the 0.25% NSR issued to Cartesian, but this NSR is subject to a buyback clause).

How risky is PNG?

When we were talking about this company and project to some people, the question that always came up was ‘but how safe is it to operate in Papua New Guinea?’.

That’s a very valid question, and we agree the previous perception of the country hasn’t been great, but that’s predominantly caused by the fact the western countries don’t really know much of it. We usually use two main tools to determine how ‘safe’ a country is; the first one is obviously the Fraser Institute which ranks the world’s mining jurisdictions.

The Fraser Institute used data from 109 countries to put together a ranking to determine the ‘investment attractiveness index’ (based on a combination of policy perception and mineral potential), and of the 109 surveyed countries, Papua New Guinea came in ranked 43rd. That doesn’t sound extremely impressive, but a 43rd place means PNG is actually more attractive than for instance New Brunswick (45th), Idaho (50th) and New Zealand (44th). Should you just look at the policy perception index, then PNG would indeed come in much worse, but still ahead of countries like Indonesia, the Philippines and South Africa.

A second tool we like to use is the so-called Corruption Perception Index which is published by Transparency International on a yearly basis. In the CPI, Papua New Guinea was ranked 139th which isn’t a great result, but fortunately for K92, all mining permits have been renewed by Barrick and remain valid for 10 years. That’s a bureaucratic hurdle the company won’t have to take which reduces the risk of being exposed to situations of corruption. There also was some noteworthy news last week as Interoil (IOC) is being acquired by OilSearch (ASX:OSH) and Total (EPA:FP) for US$2.2B, a strong vote of confidence for the commodity sector in PNG!

So, yes, PNG obviously isn’t a Québec or Nevada, but it does leave some other countries behind and as the mining sector in the country continues to develop, we would expect the legal framework and policies to improve and the corruption rate to decrease. Also keep in mind the U20 women’s soccer team from the USA is about to go to PNG to play some friendly games, preparing for the U-20 world cup.

Also keep in mind the key thing of running a successful business in Papua New Guinea is related to getting along with the local communities. And that’s something Barrick did understand and applied to its PNG operations. Barrick had no less than six people liaising between the company and the communities, and K92 Mining also has 4 people on the CSR-team right now (and this will increase as the operations will re-commence in full force).

The team running the show gives us quite a bit of confidence

If you’re operating in a country in the middle field, you have to make sure your management team knows what it’s doing, and upon reading up on K92’s management bio’s, we’re confident these guys know what they are doing and will pull this off.

STUART (TOOKIE) ANGUS, CHAIRMAN & DIRECTOR

Mr. Angus is an independent business advisor to the mining industry. He was a director of Bema Gold until its takeover by Kinross Gold in 2007. More recently, he was managing director of mergers and acquisitions for Endeavour Financial and a director of Ventana Gold until its takeover by AUX Canada Acquisition in 2015. He is presently chairman of Nevsun Resources (NSU)

IAN STALKER, CEO & DIRECTOR

Mr. Stalker is an international mining executive with 40 years of experience in mine development and operations in Europe, Africa and Australia. Mr. Stalker was the chief executive officer of UraMin Inc., a London-listed and Toronto-listed uranium company, from July, 2005, until its $2.5B acquisition by Areva in August, 2007. Mr. Stalker was a vice-president of Gold Fields Ltd., the world’s fourth-largest gold producer, where he spent considerable time on the ground on its international operations.

BRYAN SLUSARCHUK, PRESIDENT & DIRECTOR

Mr. Slusarchuk has significant international experience structuring, funding and operating companies involved in mineral exploration, development and production. In addition to experience operationally and in the conducting of equity raises, Mr. Slusarchuk has structured complex debt financing transactions in the United States, Canada and Europe with multiple top tier banks. This includes negotiating and securing the first ever funding of a mineral exploration company by the European Bank for Reconstruction and Development (EBRD).

JOHN LEWINS, COO & DIRECTOR

Mr. Lewins is a Mineral Engineer with over 35 years’ experience in the Mining Industry having worked in Africa, Australia, Asia, North America and the Former Soviet Union. He has have extensive management experience from project and operational level. Responsible for the development and operations management of Tom’s Gully Gold Mine (NT), Tick Hill Gold Mine (QLD), Nolan’s Gold Mine (QLD) and the McArthur River Lead – Zinc Mine (NT).

DOUG KIRWIN, ADVISOR

Mr. Kirwin is an independent geologist with 45 years of international exploration experience, including five years in Papua New Guinea. He held senior positions with Anglo American and Amax during the 1970’s and was Managing Director of a successful international geological consulting firm during the 1980’s and early 1990’s. In 1995 he accepted a role as vice president, exploration for Indochina Goldfields and subsequently became the executive vice president for Ivanhoe Mines Limited until 2012 after which Ivanhoe was acquired by Rio Tinto.

Conclusion

You shouldn’t be too fast to dismiss any investment in Papua New Guinea, as we think the risk/reward ratio of K92 Mining is pretty attractive. The majority of the capex to restart the mine was funded with a gold streaming deal and whilst this is dilutive for the cash flows and attributable production rate in the short term, this was the best way to advance the project to production as quickly as possible. Once the gold stream comes to an end after 36 months, Irumafimpa will produce 45,000-50,000 ounces of gold per year at a margin of US$500/oz for a net operating cash flow of C$30M per year which will be used to consider developing Kora.

Of course, the company still has a long way to go, but we do like the risk/reward ratio here as it’s not unlikely this company will generate C$0.40 per share in pre-tax net cash flow per year (based on 75M shares). We also expect the warrants to be in the money pretty soon, which means K92 Mining will receive an additional C$17.5M in proceeds which by itself could fund the underground push-through towards the Kora zone and a mill expansion.

It sure looks like K92 Mining is hitting the ground running, and we are really excited about the potential of this company. We will follow all developments closely and are already looking forward to see the first concentrate leaving the mine site before the end of next quarter.

Disclosure: K92 Mining is a sponsoring company, we hold a long position. Please read the disclaimer