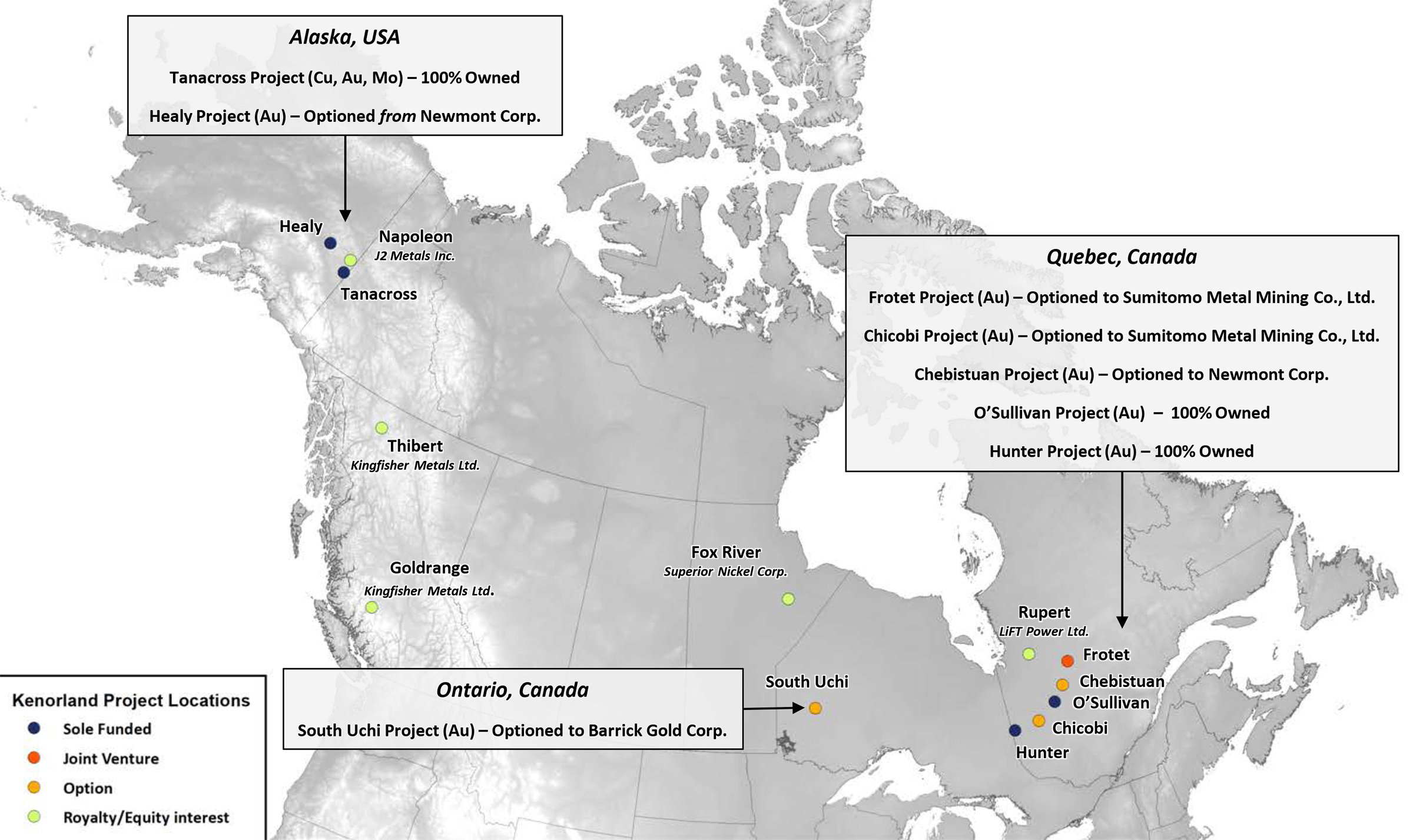

We were originally attracted by Kenorland Minerals (KLD.V) because the company had assembled massive land packages in the right greenstone belts. In our initial report we highlighted the projects that appeared the most interesting to us and Kenorland has been able to advance the assets on all fronts.

Additionally, Kenorland attracted well-respected senior gold producer Barrick Gold (GOLD, ABX.TO) as joint venture partner on the newly staked South Uchi project. South Uchi was staked in the first few months of 2021 and it took Kenorland less than six months to actually find a partner with deep pockets. To earn an initial 70% interest in South Uchi, Barrick Gold will have to spend at least C$6M on exploration activities ànd it will have to outline an initial resource containing at least 1 million ounces of gold (so we like the odds Barrick will ultimately have to spend much more than the previously quoted C$6M to earn an initial 70% stake).

In 2021, Kenorland did what it had promised to do. It advanced the Frotet project in a joint venture with Sumitomo while it completed a drill program at the Healy project in Alaska. While the turnaround time between drilling and actually getting assay results back from the labs was excruciatingly long in 2021, Kenorland is finally in a position to start reporting on the results of its drill programs.

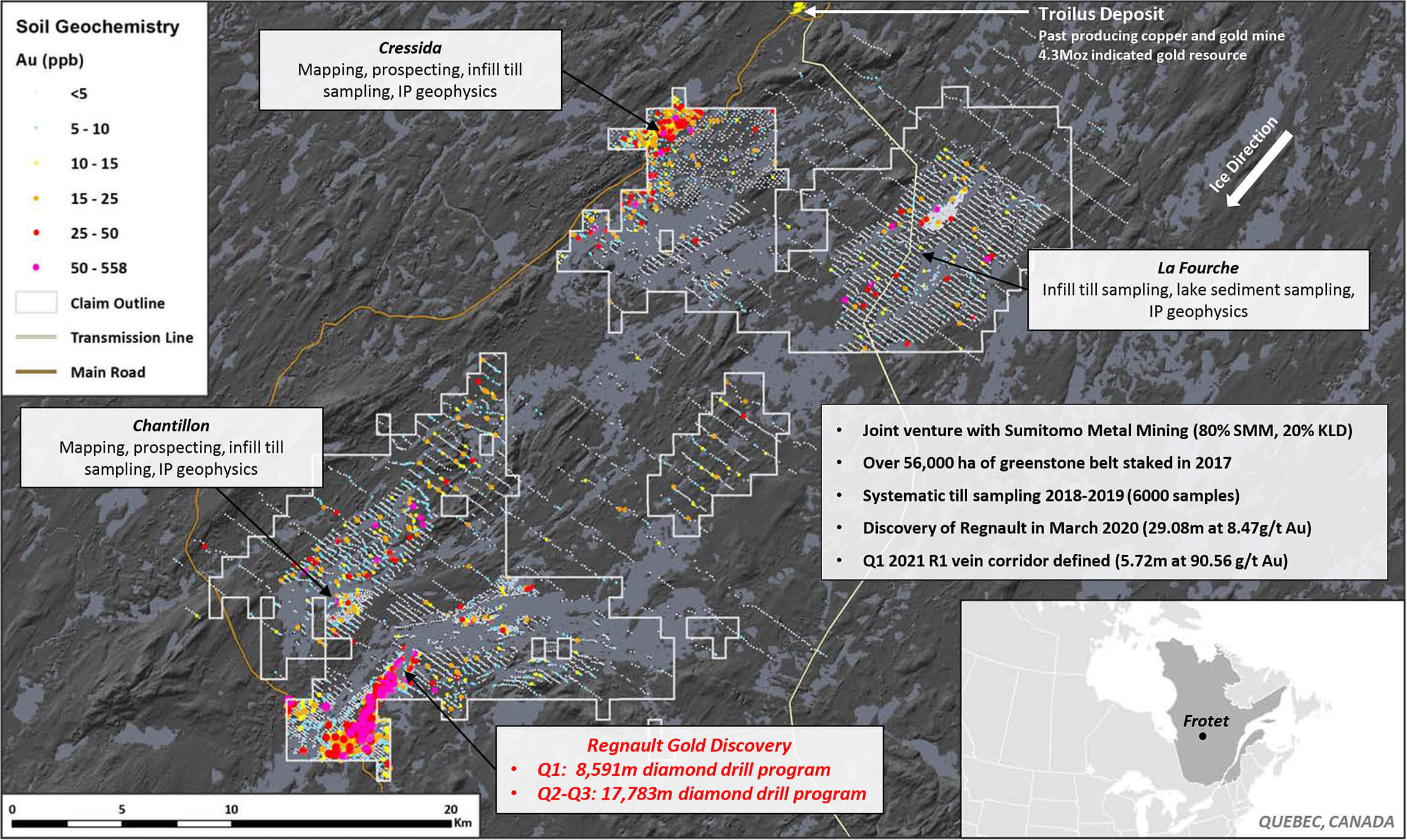

A first batch of assay results from the Regnault zone on the Frotet project has been published, and Kenorland is now anxiously awaiting a second batch of results as well while discussing the 2022 budget and drill program with joint venture partner Sumitomo.

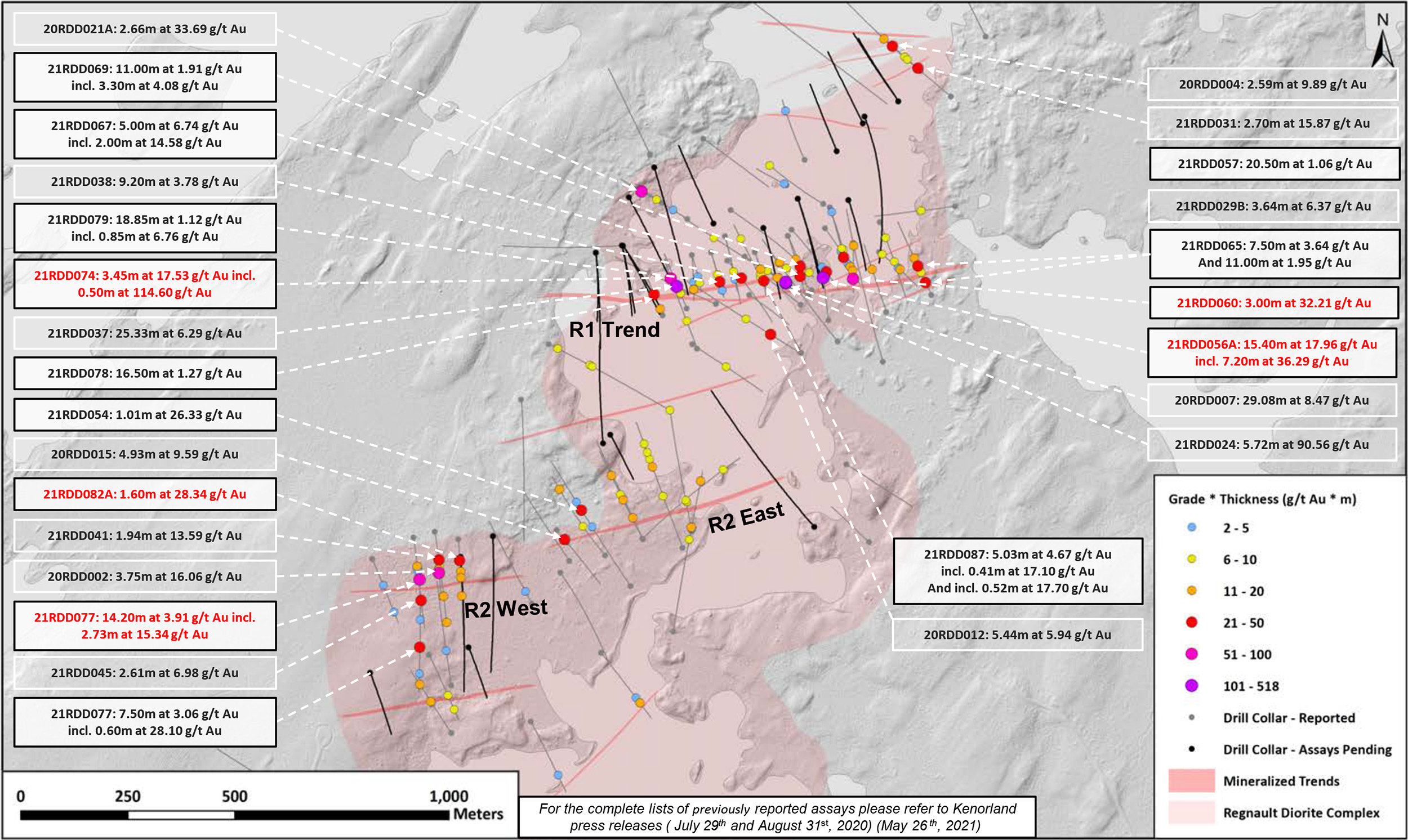

The recent exploration update contained more high-grade assay results at Regnault

Right before Christmas, Kenorland released the assay results from 32 of the 57 holes that have been completed as part of the almost 18,000-meter summer drill program.

The headline result was an interval of just over 15 meters containing in excess of half an ounce of gold per tonne, including a higher grade interval of 7.2 meters containing 36.29 g/t gold. This jaw-dropping result was complemented by other high-grade intervals of for instance 3 meters of 32.2 g/t gold, 3.45 meters containing 17.53 g:t and 2.73 meters containing 15.34 g/t gold.

The reported results are once again excellent as the company confirmed the presence and continuity of the high-grade gold zone while the widths remain pretty consistent at around 1-3 meters. The joint venture partners now seem to have a firm grip on the R1 structure at Regnault and based on the current dimensions of the encountered mineralized zones, the R1 structure by itself already seems to contain about half a million ounces of gold at an average grade of 6-8 g/t (these are our own estimates, the company obviously has not yet published a resource estimate on the Regnault discovery).

It’s easy to guess what the next steps at the R1 trend will be: Kenorland will likely try to confirm the entire 800-meter strike length while it will likely also drill deeper. The mineralization has been consistently encountered up to a depth of 275 meters below surface and this appears to be inviting for the Kenorland/Sumitomo joint venture to drill a few deeper holes to see how the mineralization evolves at depth.

Of course, the R1 zone is just a portion of the Regnault discovery, which is just a small land package on the entire Frotet project. While we would expect the joint venture partners to make good progress at R1, there are plenty of other structures to be drill-tested at Regnault. The R2 target seems to be some low-hanging fruit to continue to work on while there are a bunch of other high-priority drill targets on the greater Frotet project area.

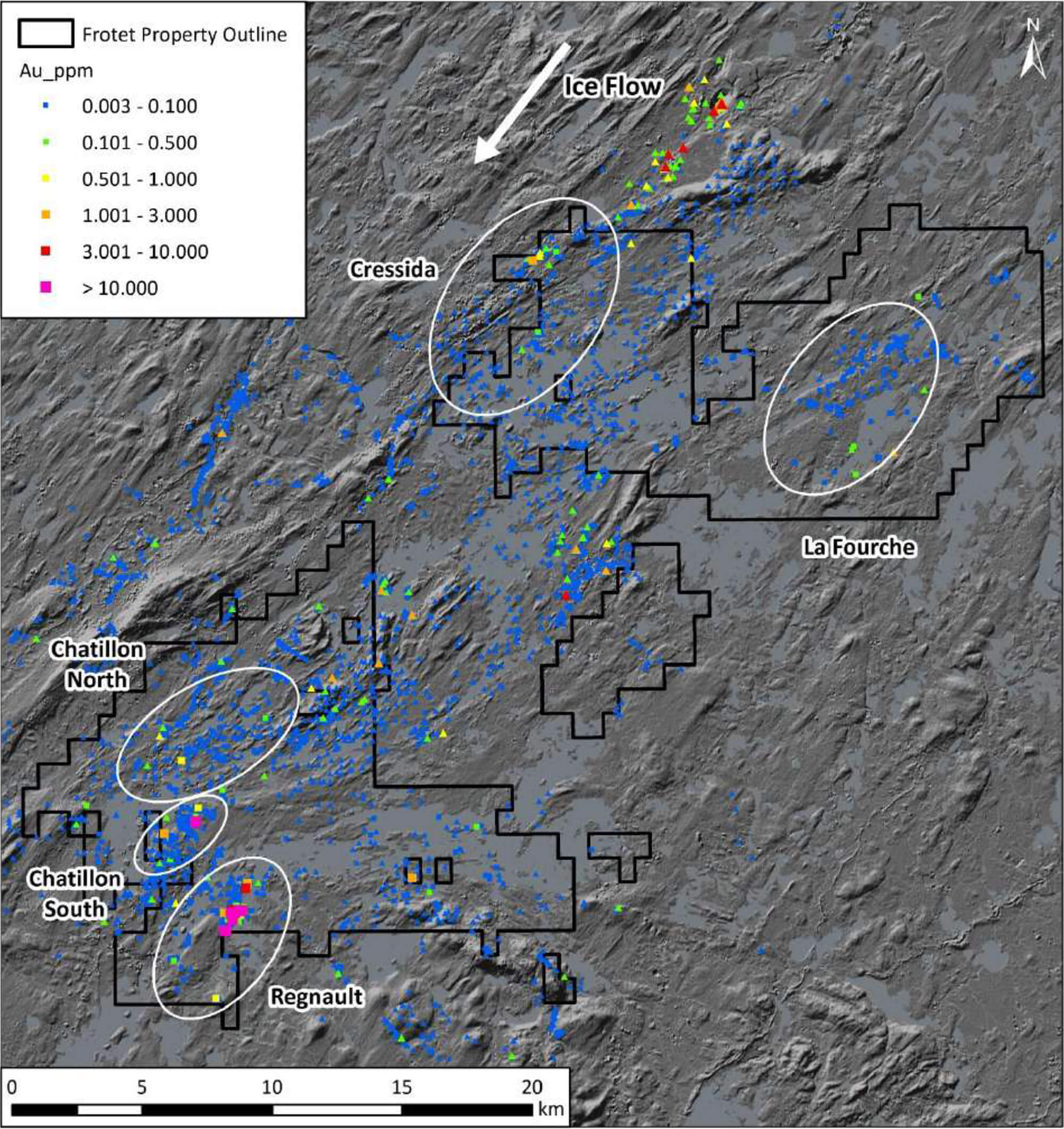

Talking to CEO Zach Flood, it looks like the 2022 drill programs will likely include a budget to drill the Chantillon, Cressida and La Fourche zone. At Chantillon, the company expects to do complete some additional IP surveys in anticipation of drill-testing some of the targets.

Cressida was originally developed from a till anomaly with anomalous values in both copper and gold. That’s interesting as the past-producing Troilus mine (owned by Troilus Gold (TLG.V)) just a few kilometers to the northeast from Cressida has a similar mineralized footprint. The Frotet technical report explicitly warns that it has not been determined yet if the Cressida Mineralization is associated with the Troilus deposit till dispersal train and more work is needed to establish the connection. Considering the ice flow movement has been confirmed in a southwesternly direction, the exploration theory that Cressida and Troilus could have similar characteristics is not so far-fetched.

We expect to see Kenorland punch a few holes into Cressida and if the presence of copper-gold mineralization could be confirmed we would probably have to look at the Troilus district from a new perspective.

Sumitomo has acquired a strategic stake in Kenorland

During the fourth quarter of 2021, the company has closed a C$5.2M capital raise with Sumitomo as its sole subscriber. The financing was priced at C$1.00 which represents a premium of in excess of 40% to the share price before the announcement. The financing does not include any warrants, this clearly is a good deal for Kenorland as it tops up its treasury with a reputable partner while it’s not being held hostage by the market which was likely betting on Kenorland going back to the markets.

The 5.21M shares that have been issued to Sumitomo represent just over 10% of Kenorland’s share capital, and the Japanese company will have participation rights in future financings to keep their position at the 10.1% it currently owns. Additionally, both companies signed an investor rights agreement that prohibits Sumitomo from making a buyout offer or do anything else to undermine the Kenorland management (although Sumitomo would obviously be free to negotiate a friendly deal with Kenorland should that ever come into play.

Waiting for the Healy drill results while getting ready to drill Tanacross

While the assay results from the Regnault zone are coming in now, investors should be aware Kenorland also completed a summer drill program on its 18,000+ hectare Healy gold project in Alaska, where it’s earning in towards full ownership from Newmont (NEM, NEM.TO). We originally had hoped to see assay results from this drill program to have come in towards the end of the third quarter, but it appears we were overly optimistic.

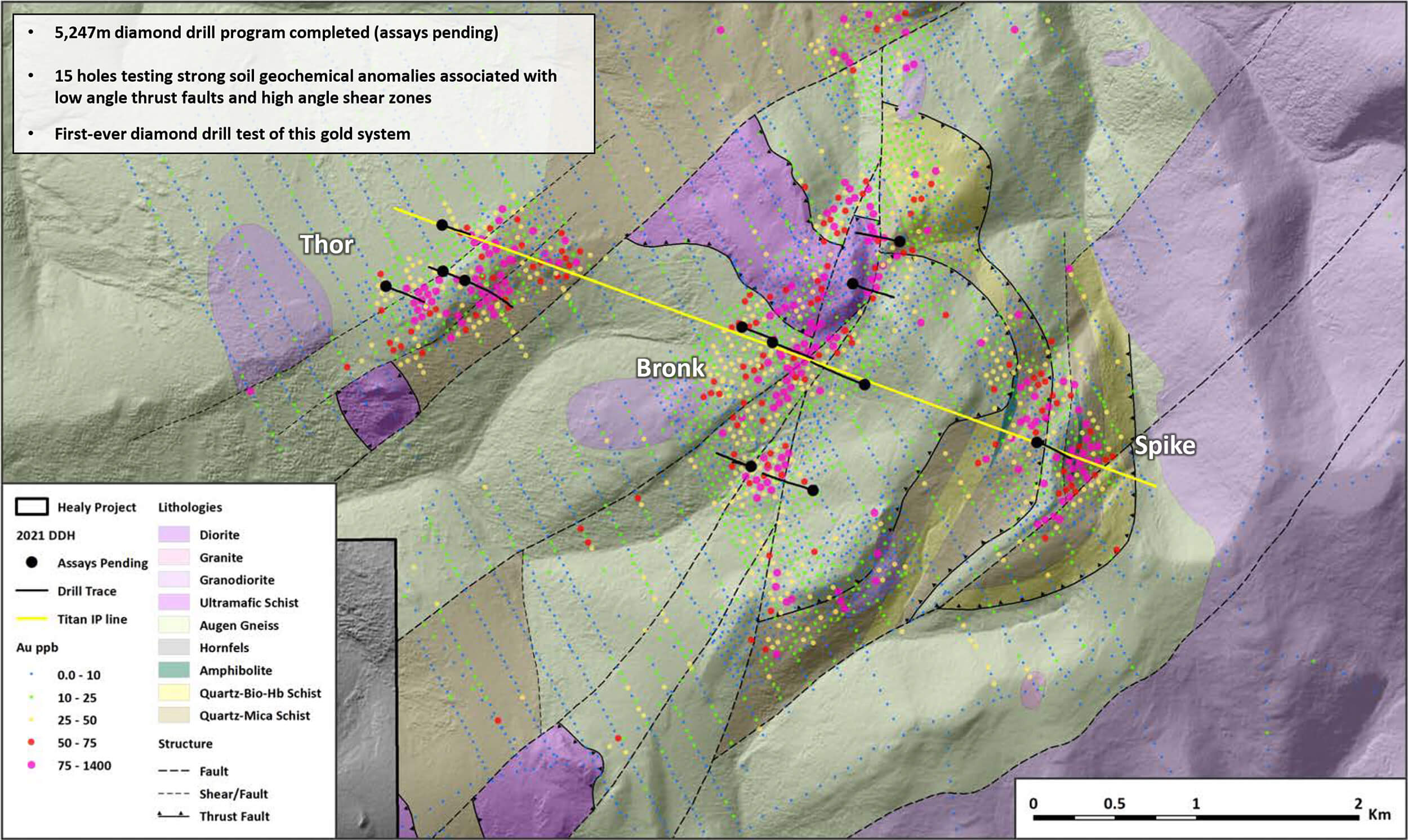

Kenorland initially planned to drill 4,000 meters in 10 holes at Healy but has upscaled the drill program to in excess of 5,000 meters of diamond drilling to test the Bronk, Thor and Spike areas. These three high-priority areas that were drill-tested were ranked based on the results of an extensive soil sampling program. The prospectivity of the Healy project is quite obvious as Newmont already conducted exploration activities in 2010-2013 but the project was dropped despite identifying the existence of what could potentially be a significant gold system. Kenorland picked up an option on the land in 2018 and has rapidly finetuned the exploration targets and is now awaiting the assays.

Keep in mind this isn’t just a wildcat drill program as Kenorland has worked in a methodological fashion to get the property drill ready. Back in 2019, a first reverse circulation drill program was completed by the company which could be considered a first-pass drill test. The RC rig barely scratched the surface as the 10 holes only reached an average depth of about 80 meters.

What’s interesting is that all ten holes actually encountered gold mineralization, in some instances starting right at surface. Of course, not all grades were economical but obtaining a 100% hit ratio is remarkable and it’s easy to understand why Kenorland was keen on getting a diamond drill rig going at Healy.

The total area covering multiple gold in soil anomalies is now about 25 square kilometers and right now, it looks like the Healy project could either be a Pogo-type project (high-grade underground) or a Fort Knox project (low-grade open pit heap leach gold) which is literally located further up the road (albeit 200 kilometers away). But before coming to any conclusions or getting too excited, let’s first wait for the assay results.

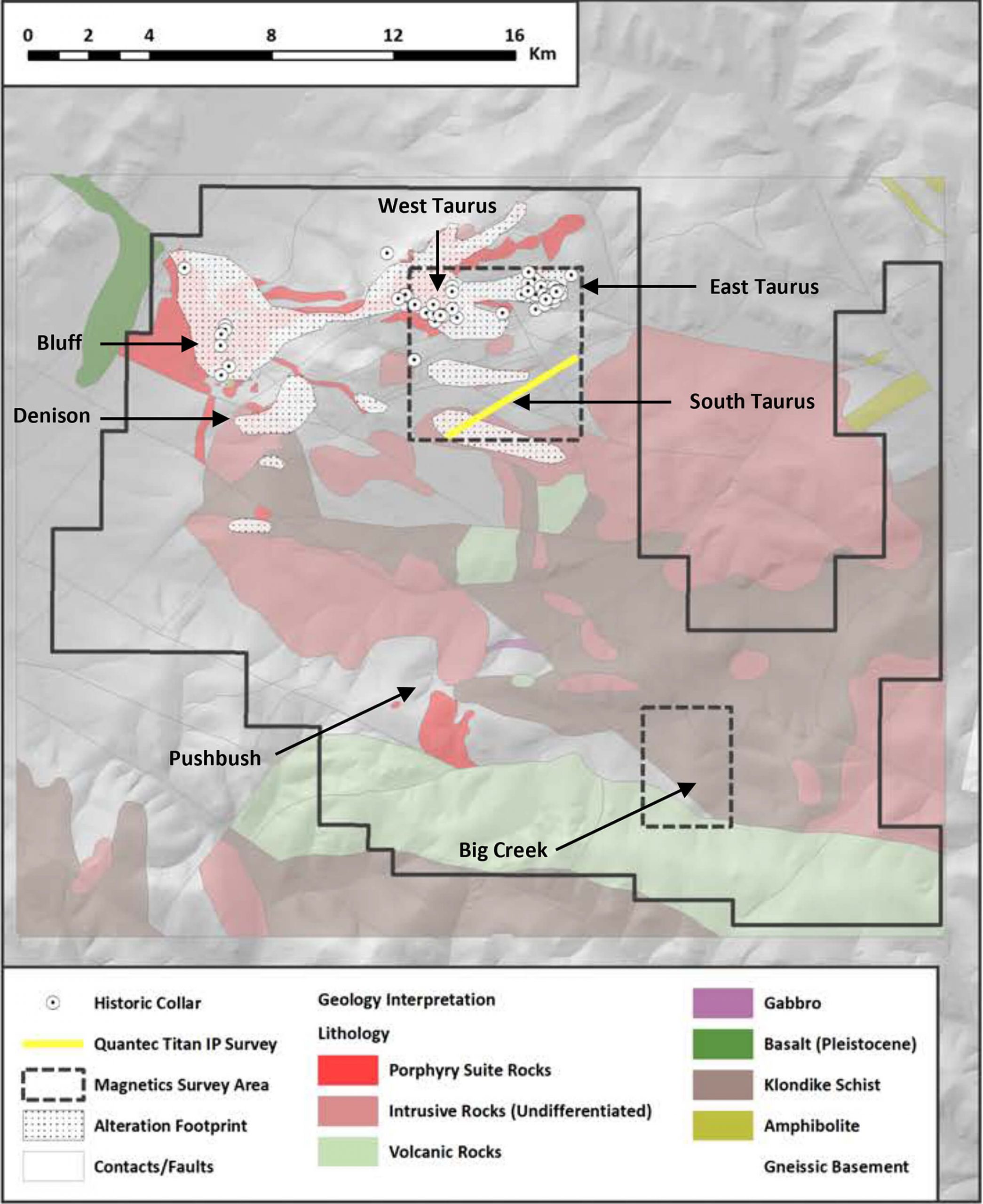

But Kenorland has more irons in the Alaskan fire than just Healy. When we asked CEO Zach Flood what he’s most excited about for 2022, his answer was to get the fully owned Tanacross project in Alaska ready to drill.

Conclusion

The first set of drill results from the Regnault discovery confirms the exploration theory as the drill bit intersected high grade gold along strike confirming grades and widths encountered in previous drill programs. The company still has to report on almost 8,000 meters of additional drilling and will likely soon kick of an additional drill program that has already been budgeted and scheduled as part of the existing exploration budget.

It’s our understanding we will see a much larger drill program in calendar year 2022 (likely stretching out into 2023 as well as a portion of the program will be drilled during the winter months) and we hope to see a drill program exceeding the 30,000 meters in the current budget. Kenorland and Sumitomo will still have to agree on the details of the fiscal 2022 drill program but we expect to see a definitive plan by the end of the current quarter.

Sumitomo still appears to be keen on the Frotet project and the size of the fiscal 2022 drill program will likely be a good indicator of how aggressive Sumitomo would like to tackle the project. Additionally, the decision from the Japanese conglomerate to acquire a strategic position in Kenorland on the equity level at a premium to the share price also is a clear positive as it’s a great vote of confidence while Kenorland keeps its treasury at healthy levels.

Of course, Kenorland is much more than just the Frotet project and in the coming year, we expect to see more reportable results from the Alaska exploration programs.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland Minerals is a sponsor of the website. Please read our disclaimer.