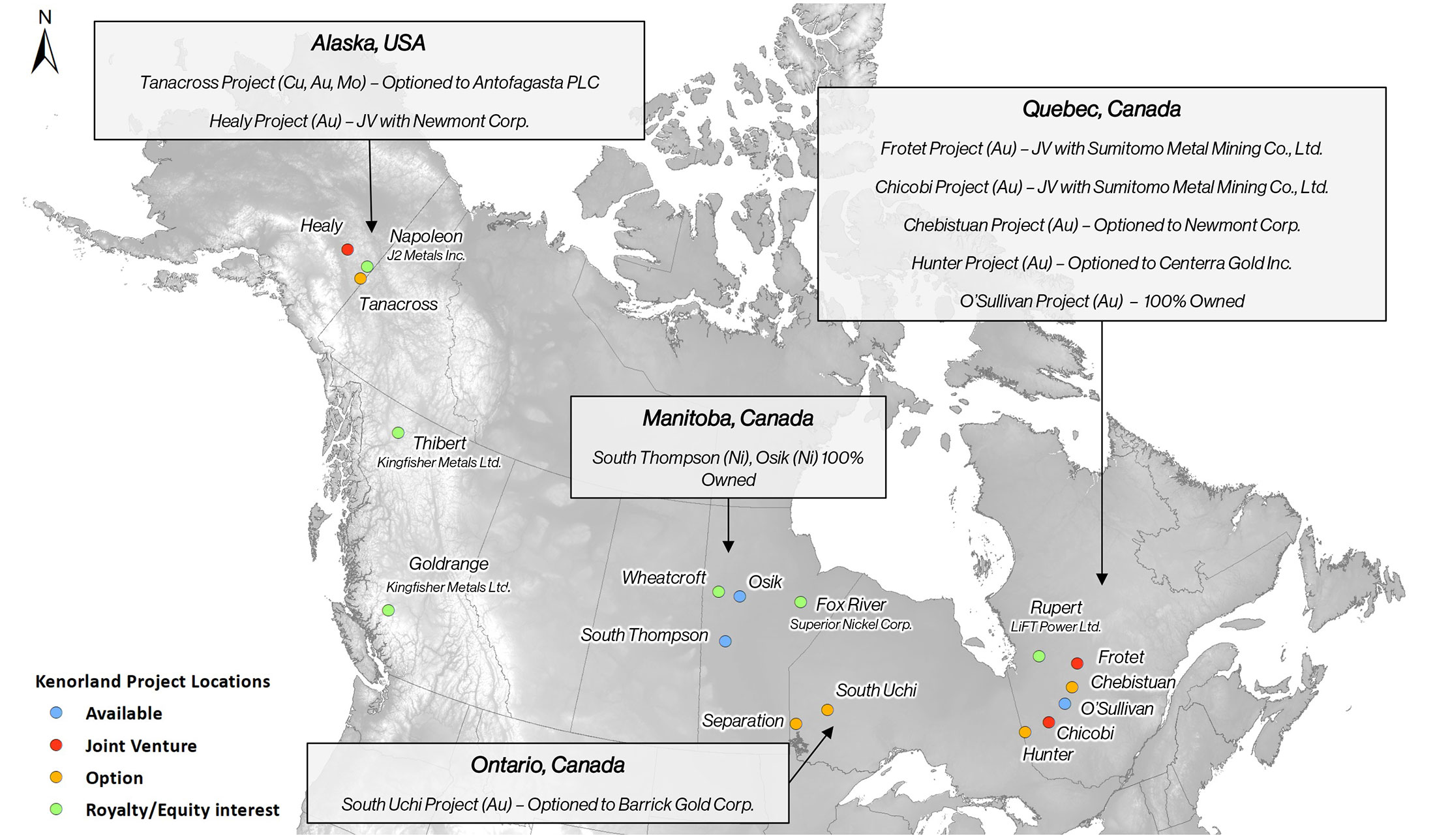

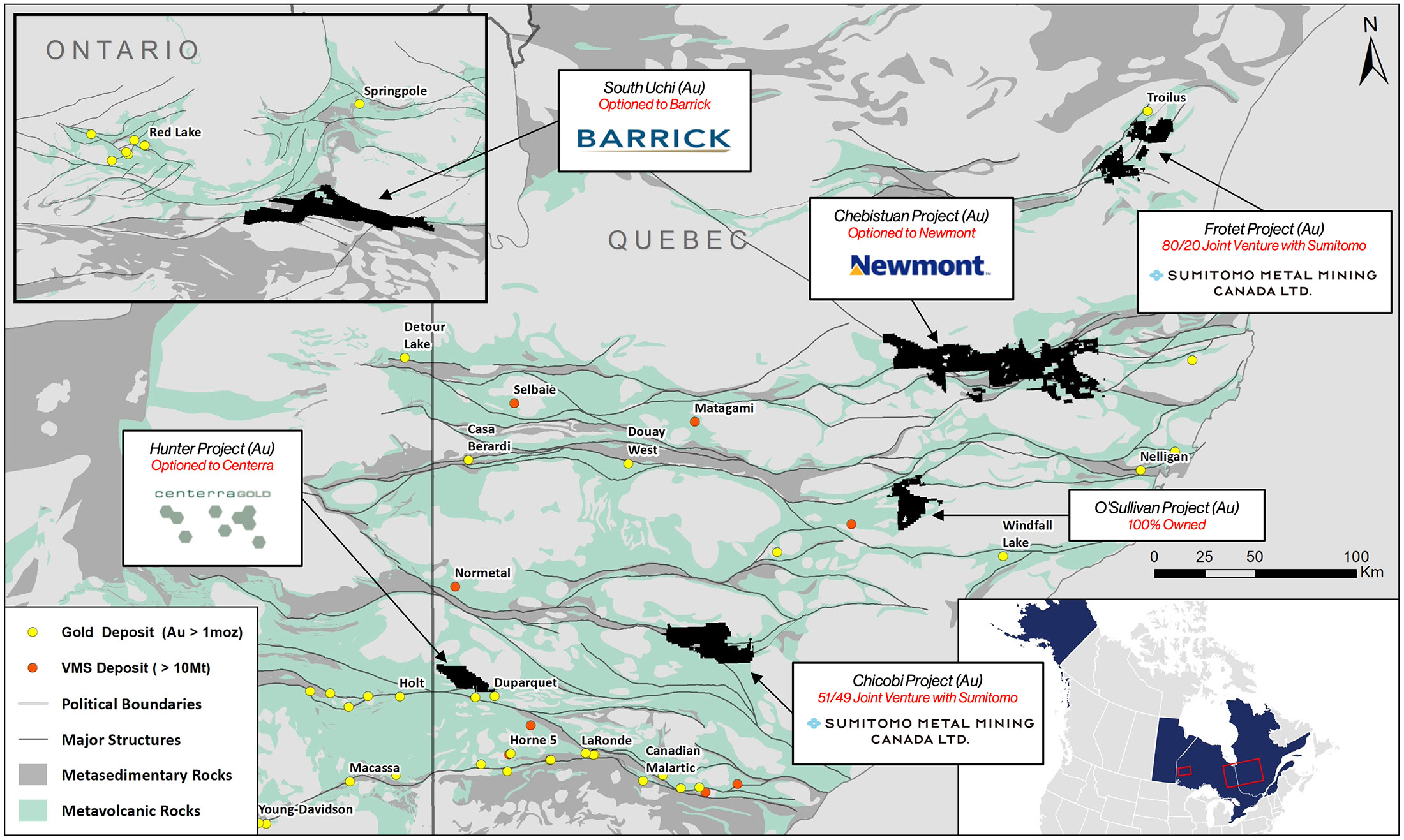

Kenorland Minerals (KLD.V) has been very busy lately as it is advancing about half a dozen exploration projects across North America. Thanks to the joint venture model Kenorland now has its fingers in a lot of pies with the vast majority of the exploration expenses being contributed by the respective partners on the projects.

In this update, we won’t spend a lot of time on the projects as we expect to see more detailed exploration plans and programs for 2023 soon, but we wanted to take a minute to point out something the market may have missed. Back in 2021, Kenorland sold a greenfields lithium project to Li-FT Resources (LIFT.C) and that company started trading last summer. That’s important for Kenorland as the 1.75 million shares it received as consideration for the transaction currently have a market value of approximately C$15M. This means that in excess of the current market capitalization of Kenorland is backed by cash & investments.

The exploration activities

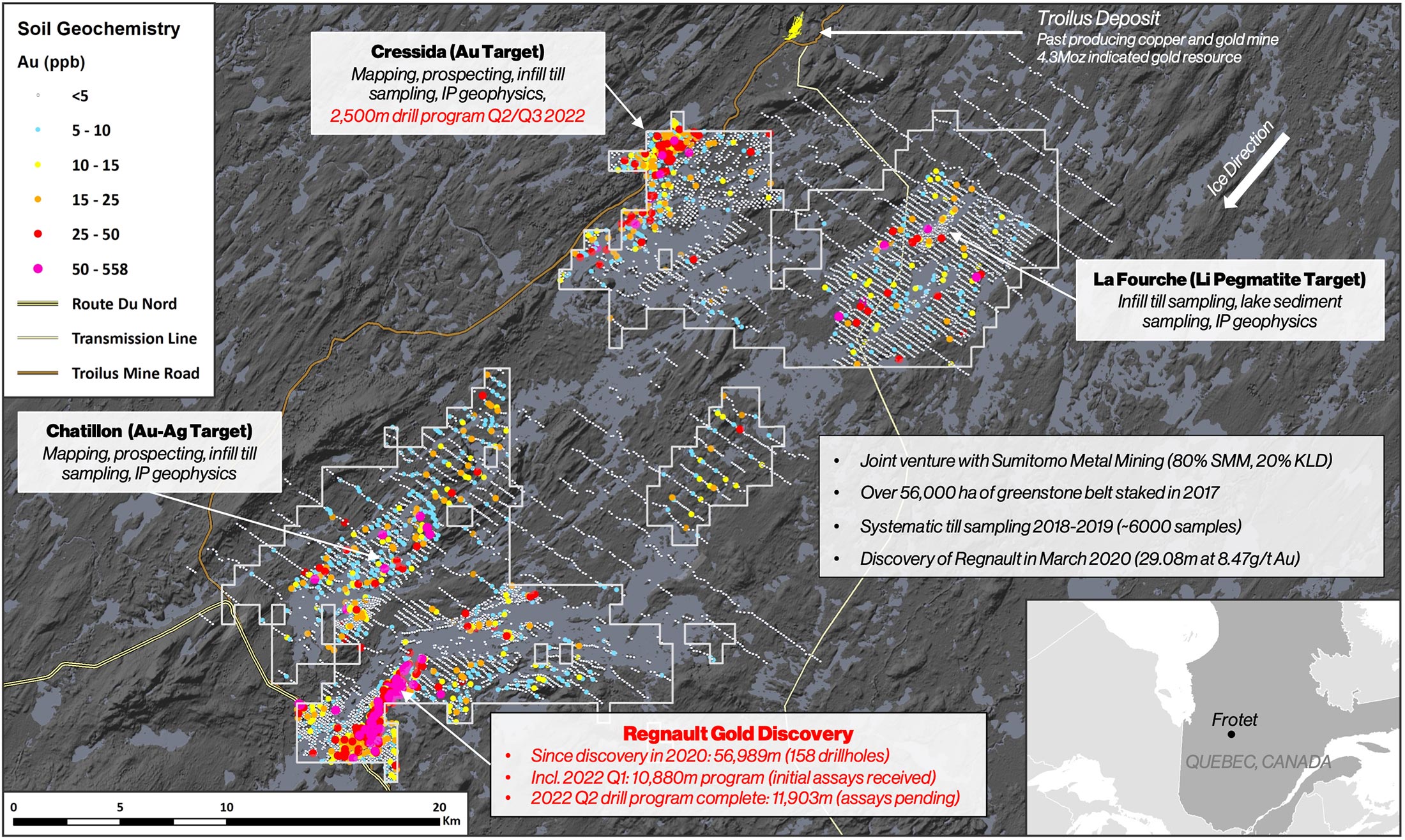

It had been a while since Kenorland reported on results from the flagship Frotet project where the company has a joint venture with Sumitomo. The partners were focusing on rapidly adding tonnes and ounces to the Regnault discovery and just last week, Kenorland reported on the final assay results from the Frotet summer exploration program while it also provided a preliminary look under the hood as to what we can expect to see in 2023.

There also have been updates on both Chicobi and Tanacross.

Frotet

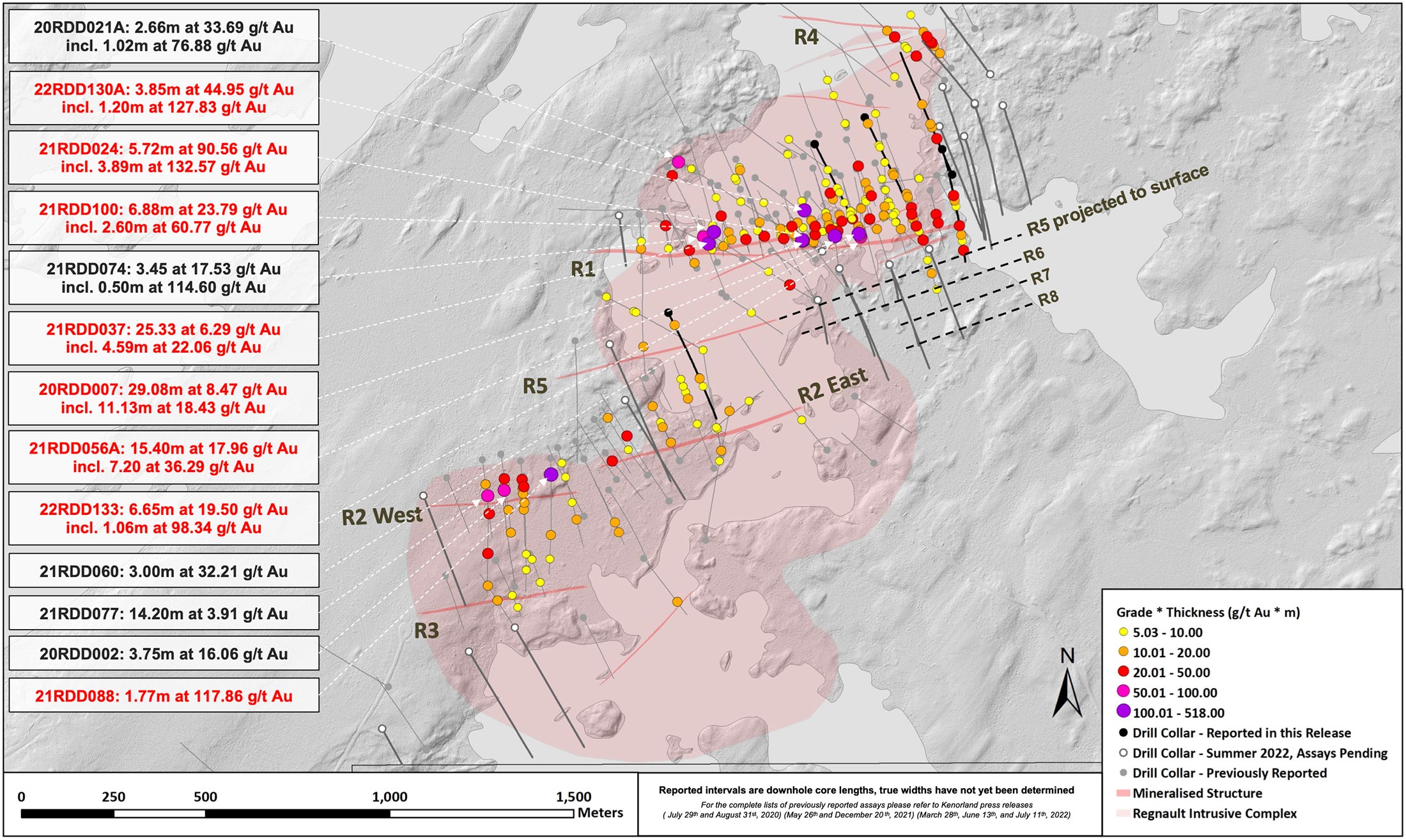

Earlier this month, Kenorland reported on the remaining 31 holes drilled at Frotet. 23 of those holes were drilled at the main Regnault zone while the company also completed 8 holes for a total of just over 2,500 meters of drilling on the Cressida target.

The assay results from the Regnault zone were good. The summer program extended the strike length of the R1 zone by approximately 100 meters to the east and this brings the current strike length to in excess of a kilometer while the joint venture partners still haven’t found the limits of the mineralization.

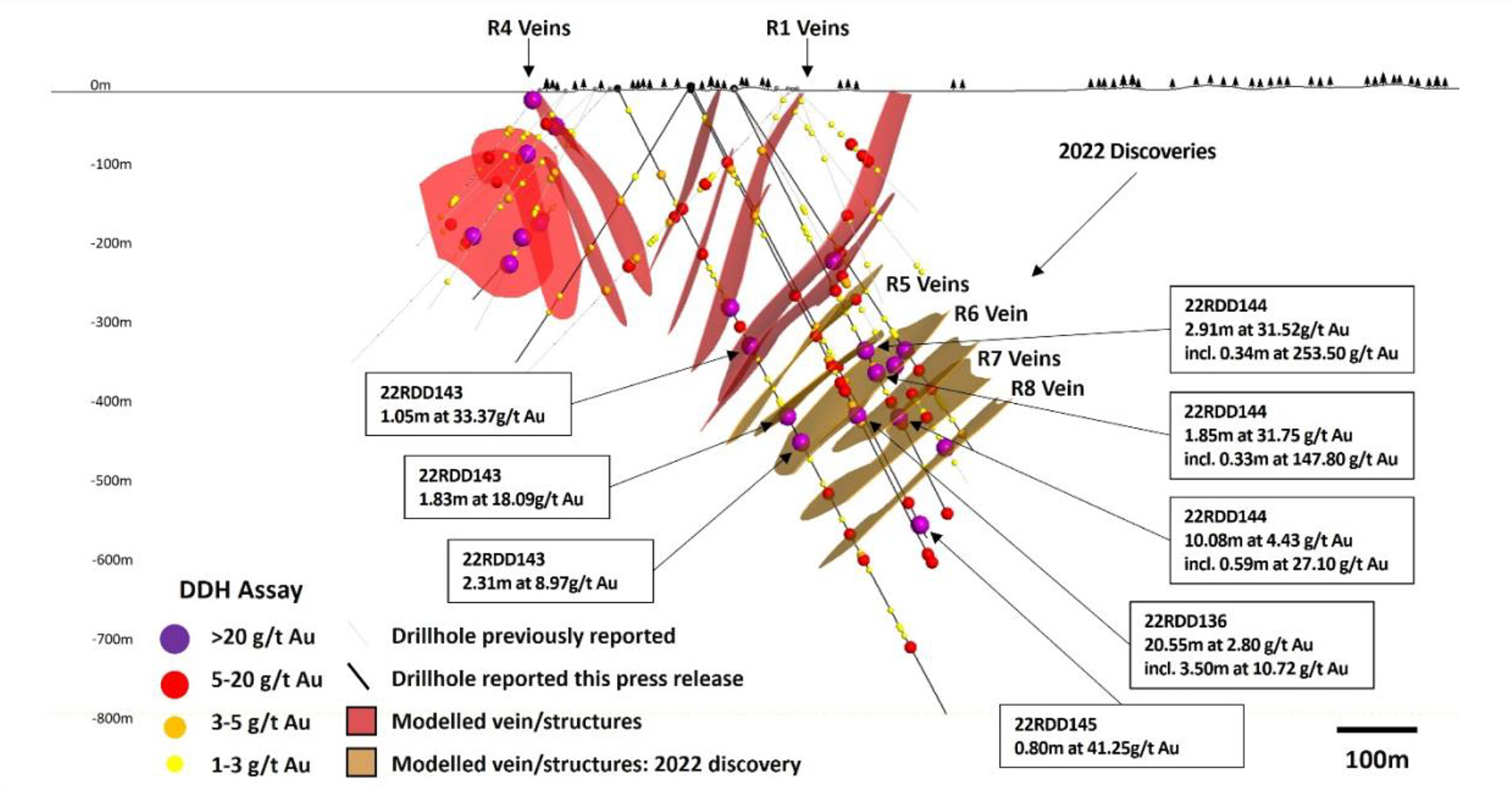

Even more important than increasing the strike length of the R1 vein structure is the further expansion of the R5, R6, R7 and R8 vein sets which appear to be running parallel to the main vein systems, thereby increasing the potential to add some serious tonnage to a future resource. The summer drill program confirmed the continuity of those for veins towards the east with some pretty impressive results. On the R5 zone, for instance, a 200 meter step-out hole (200 meters is quite an aggressive step-out distance in these vein systems) delivered almost 3 meters of just over one ounce (!) of gold per tonne, including an ultra high-grade interval of 0.34 meters of 253.5 g/t gold. But even if you would isolate those 34 centimeters from the entire 2.91 meter interval, the remaining 2.57 meters would still run at 2.15 g/t. Less impressive, but still valuable rock with a rock value of in excess of US$120/t at $1700 gold.

We see a similar result at the R6 vein where a 100 meter step-out towards the east intersected 20.55 meters of 2.8 g/t gold including 3.5 meters of 10.72 g/t gold (indicating the remaining 17.05 meter interval carries an average grade of 1.17 g/t.

At the R7 and R8 vein sets, Kenorland stepped out to the west which means the summer drill program added meters and tonnes at every vein system. We dare to bet Sumitomo is very pleased with the results of the exploration program and the upcoming winter drill program will be the largest drill program ever conducted at the Regnault discovery. The joint venture partners are anticipating completing 25,000 meters of diamond drilling (on top of the almost 57,000 meters of drilling that has already been completed by now), focusing on completing additional step-out holes to extend the strike length and the depth of the currently known mineralized system to the south of the R1 vein system.

Kenorland and Sumitomo will continue to step out on the R5 vein system and will test the gap zone between the R2 and R3 veins and the R6, R7 and R8 veins. To make sure the 25,000 meter drill program will be completed within two months, Kenorland will use four drill rigs. Drilling is anticipated to start by the end of January.

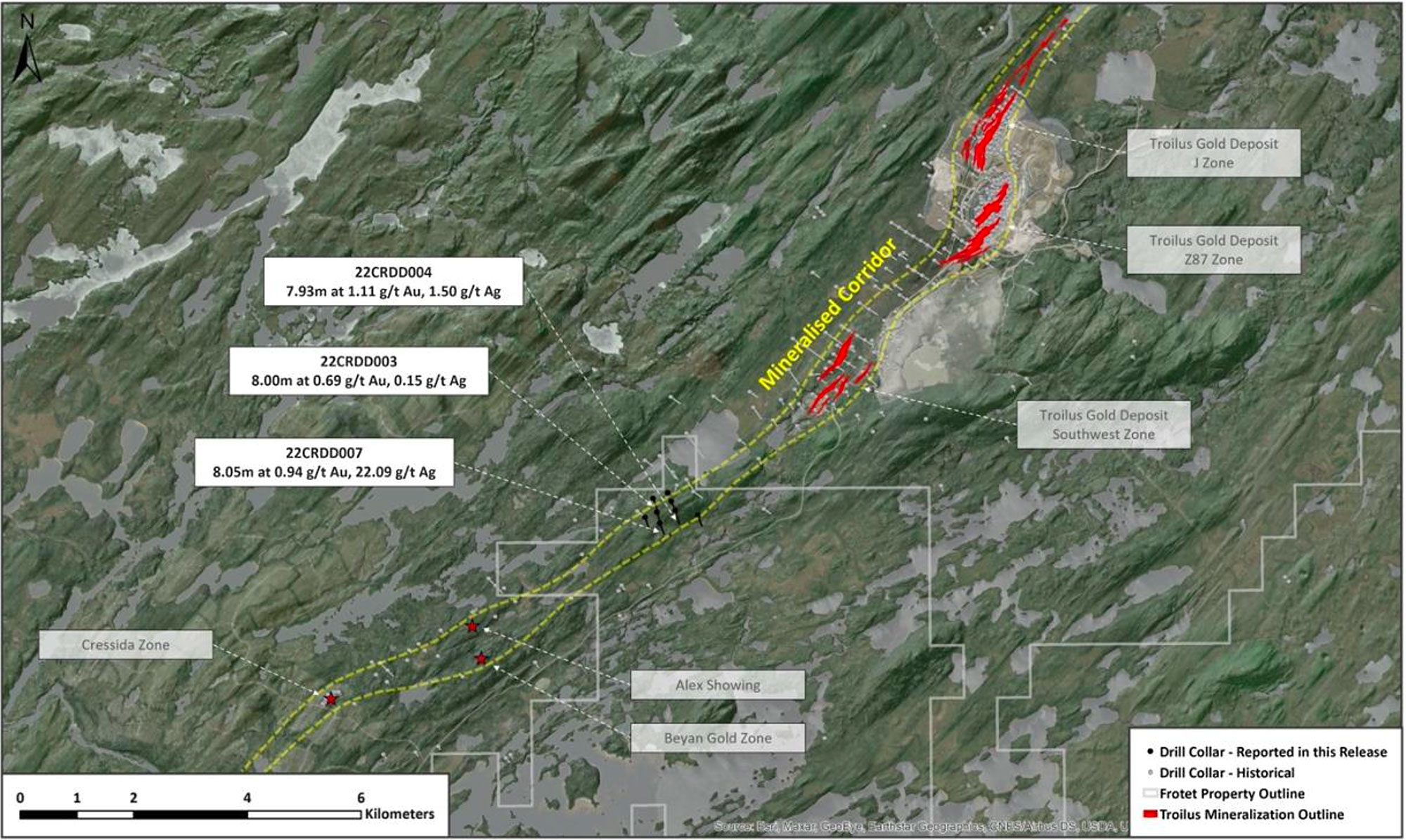

While the main focus still is on Regnault, Kenorland also disclosed the results from a 2,511 meter drill program at Cressida, which is located on the northwestern side of the Frotet project. Cressida is located directly along strike and within the same corridor that hosts the past-producing Troilus gold mine, currently owned by Troilus Gold (TLG.V).

According to the company “Two drill holes crossed a strongly altered and mineralised mafic-felsic volcanic contact identifying a new mineralised system. Hole 22CRDD004 intersected 7.93m at 1.11 g/t Au and 1.50 g/t Ag, and hole 22CRDD007 located 330m to the southwest of 22CRDD004, intersected 8.05m at 0.94 g/t Au and 22.09 g/t Ag. These results represent a previous untested mineralised horizon within the Cressida area, which is open along strike and at depth for future exploration opportunities.”

While the Cressida target is very much alive, it makes sense to focus on the Regnault discovery as that’s where the lowest-hanging fruit is and where Kenorland can likely get the biggest bang for its buck.

Chicobi

Earlier this quarter, Kenorland announced its Japanese partner Sumitomo has completed all requirements to establish a 51% stake in the Chicobi gold project in Quebec. By spending C$4.9M on exploration, Sumitomo has completed the required work and decided to establish a 51/49 joint venture and both companies will now contribute to additional exploration activities on a pro-rata basis but both parties have now also settled on a C$1.5M exploration plan which will be fully funded by Sumitomo.

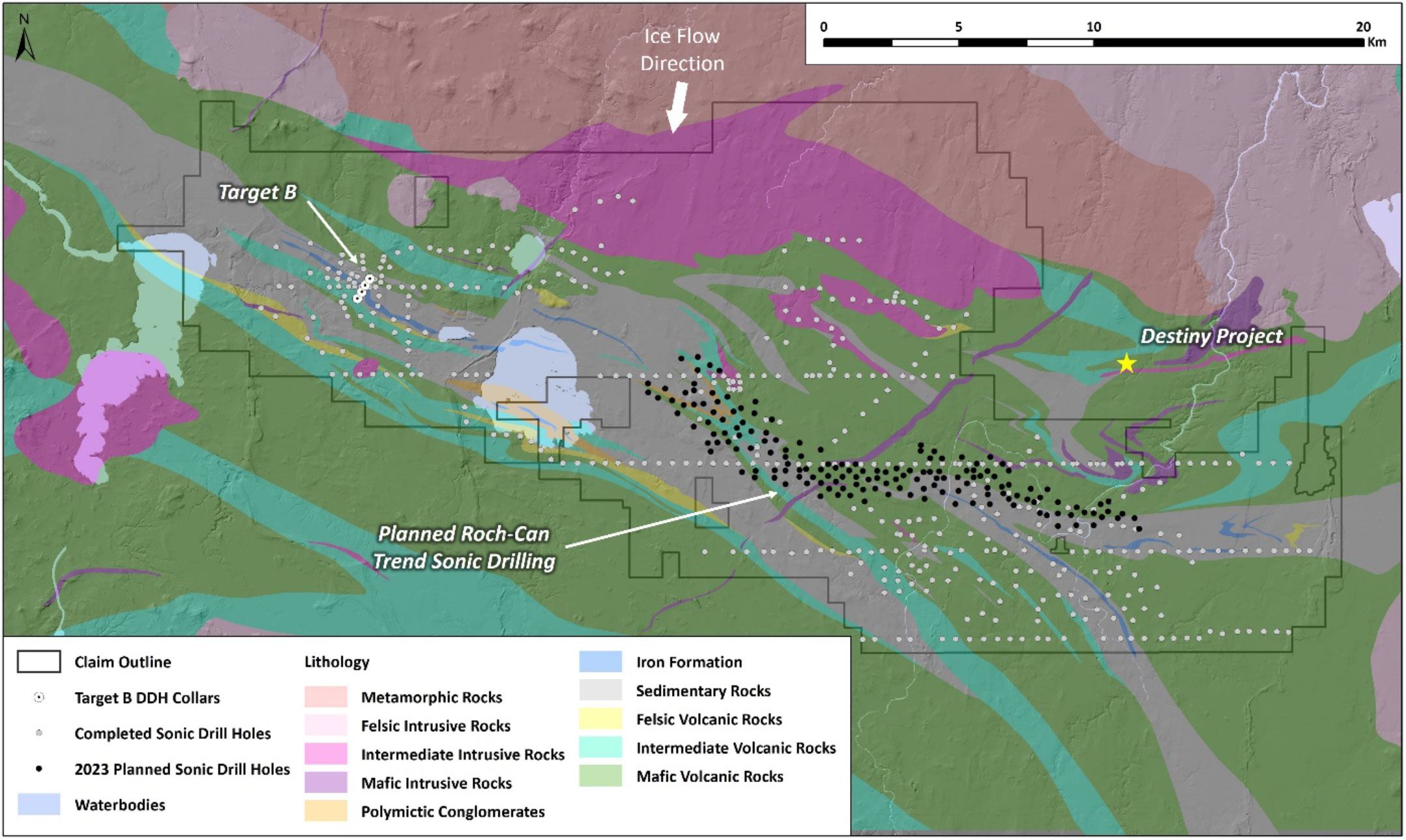

This C$1.5M plan will include 160 sonic drill holes for geochemical sampling along the Roch-Can trend which transects the Abitibi greenstone belt where previously drilled sonic holes identified a 17 kilometer long trend with anomalous gold, silver and zinc values in the glacial till.

As you may remember, Sumitomo and Kenorland (the operator of the exploration activities at Chicobi) completed four drill holes for a total of just over 1,900 meters in April of this year. That small drill program was drill-testing Target B but no significant values were detected and an additional round of sonic drilling for geochemical sampling along the trend could potentially help to narrow down the exploration targets further.

Most other companies would likely have canceled the agreement after those four holes, but the fact Sumitomo is continuing to work on the project clearly shows the difference in mentality between Western companies and the Japanese powerhouse. While Western companies traditionally want to see immediate or almost-immediate results, Sumitomo is clearly more patient and wants to make sure no rock remains unturned.

Tanacross

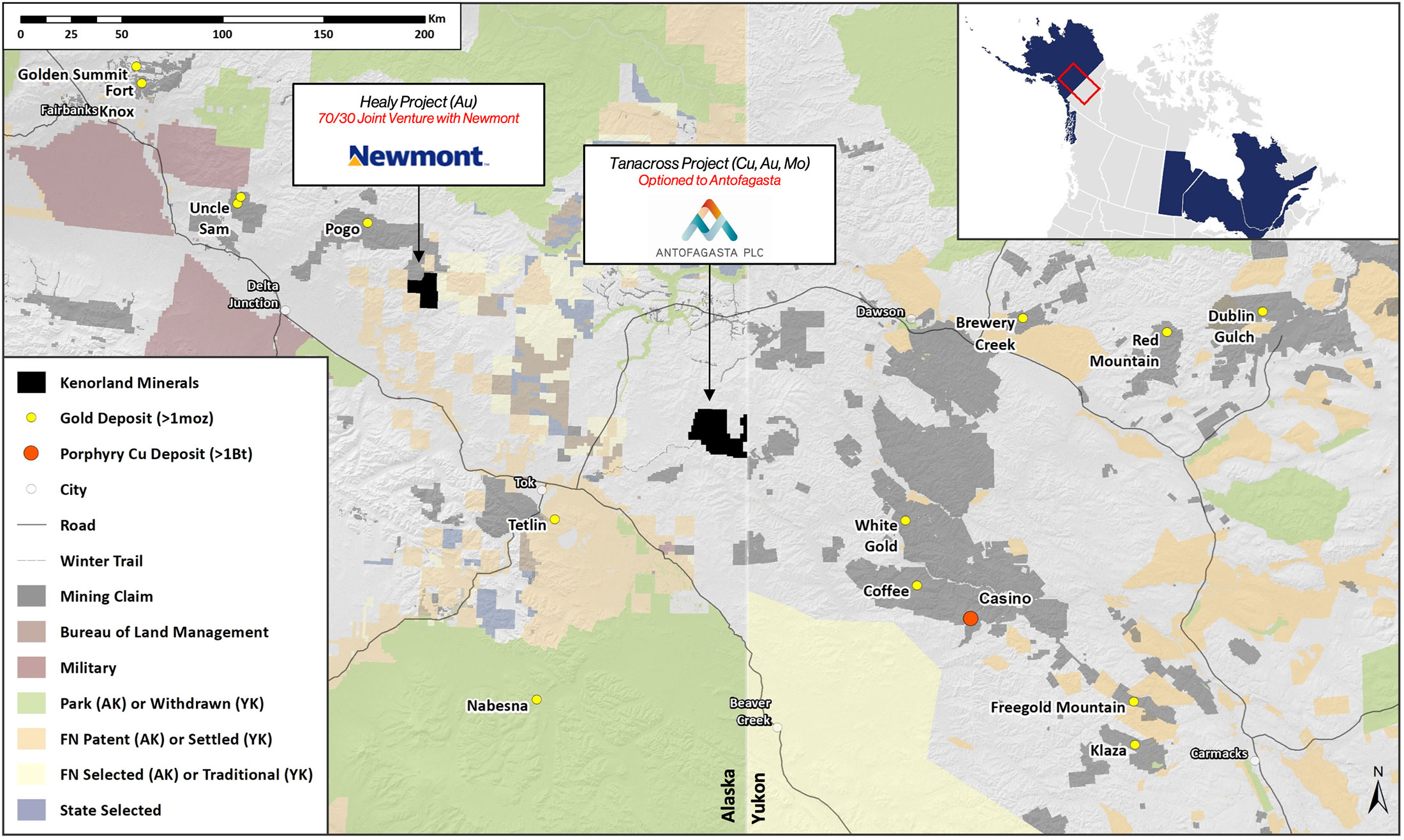

At Tanacross, Kenorland and joint venture partner Antofagasta (ANTO.L) have completed the 2022 summer exploration program.

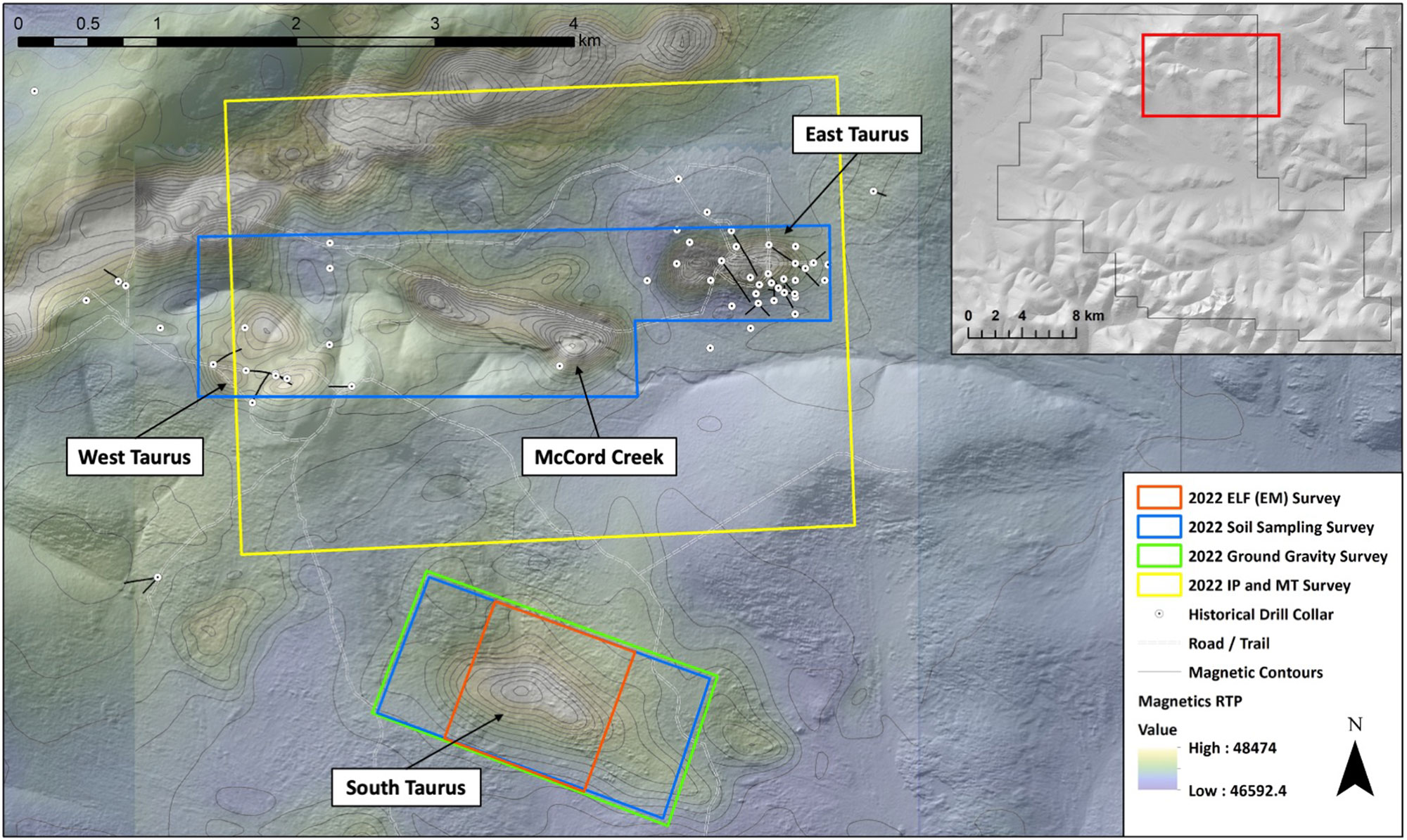

The summer program included several geochemical, geological and geophysical surveys on the four most important targets on the project. At South Taurus, the company has already completed ground gravity and extremely low frequency electro-magnetic surveys on top of the traditional soil sampling program. South Taurus is an area of interest because it is a magnetic and conductive anomaly associated with anomalous values discovered during a soil geochem program.

On the West Taurus, East Taurus and McCord Creek zones, Kenorland and Antofagasta will complete a 42 line kilometer Induced Polarization and Magneto-Tellurics survey in combination with more mapping and soil sampling. The exploration program has now been completed and hopefully, we will see the results later this quarter.

The total budget for the 2022 campaign (as well as some fixed costs for 2023) is US$2M. That’s a first step towards the US$30M exploration funding commitment from Antofagasta which can earn a 70% stake in the project over an eight year earn-in period with US$30M in required exploration expenditures, US$1M in cash payments and up to US$4M in success payments.

Let’s talk about the securities portfolio

As of the end of June, Kenorland had a working capital position of just over C$5M. The KLD management is smart enough to avoid seeing the cash and working capital being drained to a level that could result in the market starting to speculate against the company. If Mr Market smells blood (when it knows a company has to raise cash), it’s entirely possible a vicious spiral gets created.

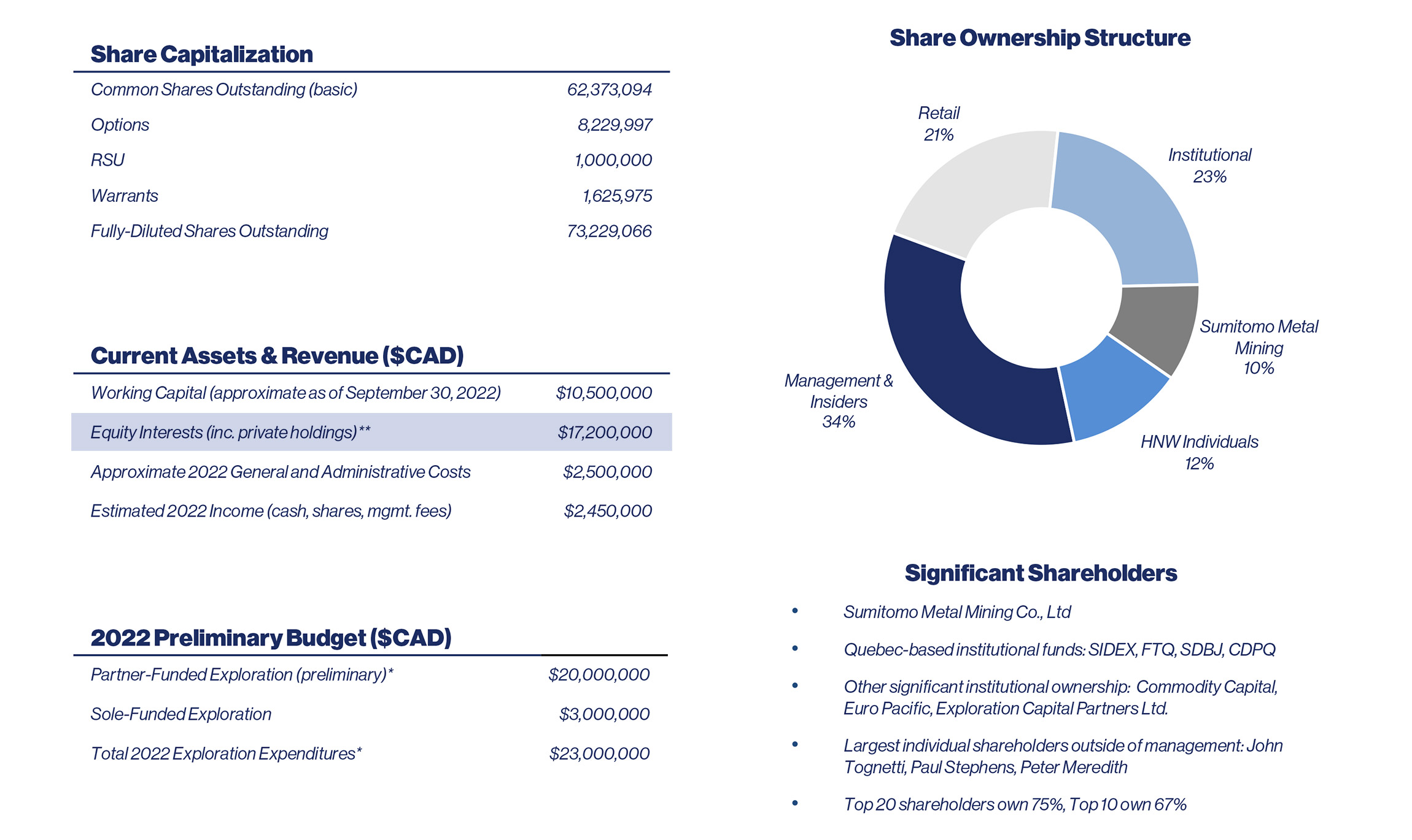

That’s not the case at Kenorland. The management doesn’t want its treasury to reach an alarm phase and it successfully completed a raise in September (which means the Q3 financials which will likely be published in a few weeks will show a very healthy cash and working capital balance). On September 9th, Kenorland announced its plans to raise C$6.3M by issuing 9 million shares at C$0.70 per share. Not only is it a very strong move to raise funds without having to attach even just half a warrant, Kenorland was actually able to upsize the placement to a total of C$7.49M by issuing a total of 10.7 million shares. Sumitomo elected to maintain its 10.1% interest in the company and subscribed for almost 1.1 million new shares by investing almost C$800,000.

According to the corporate presentation, Kenorland had a working capital position of just over C$10M as of the end of September. That’s almost 20% of the current market capitalization.

But there’s another element on the balance sheet we feel isn’t getting enough attention. In the past few months, the value of the equity interests has absolutely exploded, mainly thanks to one specific position.

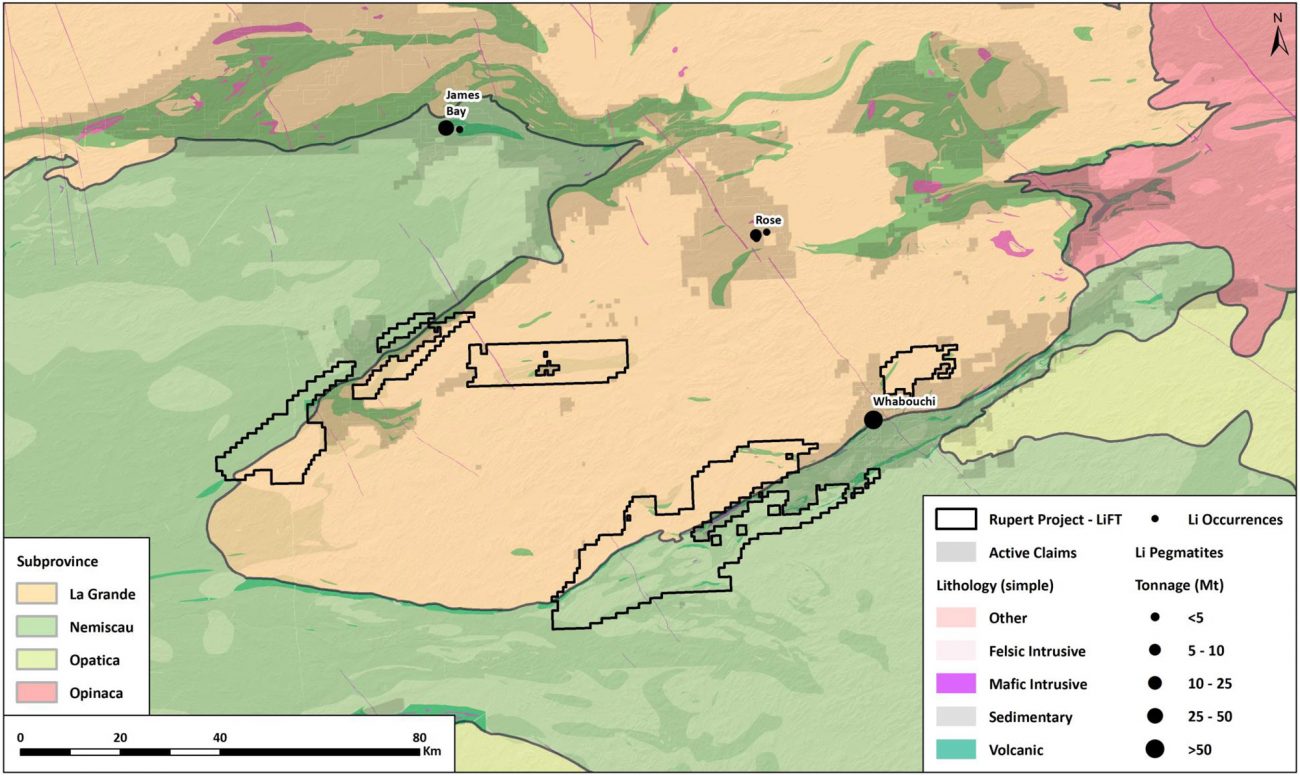

The main driver behind the increase in the value of the equity investments is the position in Li-FT Resources (LIFT.C). As part of a transaction announced in July 2021, Kenorland assigned an option to acquire the Rupert property for C$200,000 in cash and a 10% stake. Additionally, Kenorland will retain a 2% NSR.

As Li-FT went public earlier this year, Kenorland received approximately 1.75 million shares at a deemed value of C$2/share for a total final consideration of C$3.5M. Great, but since its IPO, the share price of Li-FT went ballistic and more than four-folded thanks to the strong lithium price and the renewed interest in spodumene projects. These shares should be free-trading.

Li-FT also took advantage of the availability of flow-through funds, and recently issued 428,000 shares at C$16.34 per share. Sure, flow-through placements always happen at a premium but it does indicate strong interest in the name.

Li-FT recently appointed Francis MacDonald as its new CEO. That name should sound familiar as MacDonald was the president of Kenorland until he stepped down a few weeks ago. While there may be some loyalty between Kenorland and MacDonald, let’s not forget Kenorland is an exploration company with continuous cash needs. A gradual monetization of the position in Li-FT appears to be the best way to move forward and sentiment has no place in the decision-making process. Getting C$10-15M out of the sale of Li-FT shares means Kenorland avoids having to issue 15-25 million additional shares. And should the Rupert project turn out to be successful, Kenorland will be very happy with the 2% NSR should Rupert effectively become a mine. That being said, we should obviously be mindful of the relatively low trading volumes in LIFT so it will definitely take time to monetize the position should Kenorland decide to do so.

Conclusion

Our attention and focus was on Kenorland’s exploration activities this year as the company and its partners have completed a tremendous amount of work to bring the exploration projects to the next stage. We expect to hear about the plans for 2023 soon, but in this report we wanted to highlight the exceptionally robust financial situation of Kenorland. The company is cashed up and the securities that are available for sale could add a substantial amount to the treasury should Kenorland decide to monetize its Li-FT shares (and we hope it will). In excess of 60% of Kenorland’s market cap is currently backed by cash and shares in other companies.

The current value of the position in Li-FT is a testament to the strength of the business model of Kenorland. Sure, in most occasions the company ends up with a small stake in a project, but A) it’s still better to own 20% of something sizeable than 100% of an asset you can’t do too much work on due to cash constraints and B) the asset sale to Li-FT clearly shows that’s another valid strategy to create shareholder value.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland Minerals is a sponsor of the website. Please read our disclaimer.