Kenorland Minerals (KLD.V) is in an enviable position. A decision to sell a lithium property to Li-FT Power turned out to be a good move as the share price of Li-FT (which issued shares to Kenorland in the deal) has performed quite well. Kenorland monetized a portion of that position in the fourth quarter of last year. As it has invested most of its cash in Guaranteed Investment Certificate with yields close to 4%, the company is actually making coin on its cash position.

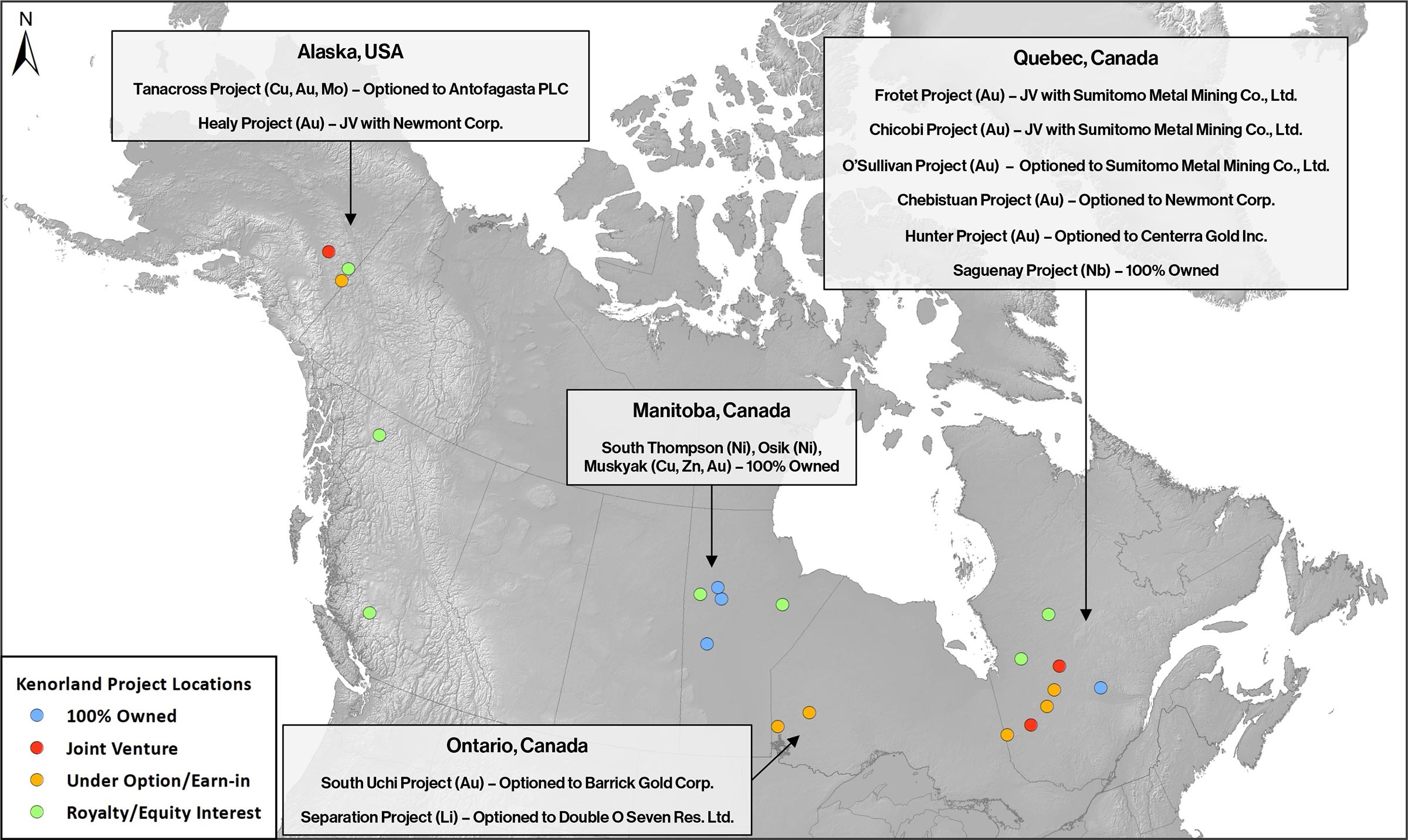

As Kenorland does not generate revenue, the strong cash position will eventually be used to fund the acquisition, staking costs and early-stage exploration costs on the properties the company is and will be working on. That’s the company’s ultimate mandate and surprisingly, the market doesn’t seem to have caught up on how low those properties are currently valued. With almost C$0.50 per share of Kenorland backed by cash and securities, anyone buying the stock now is paying just around C$0.25 per share for the entire asset base. And it’s not a stretch to see the 20% stake in the Frotet project (with joint venture partner Sumitomo owning the remaining 80%) could by itself already be worth much more than the current value implied by the current share price.

The latter also seems to be very confident in the value proposition of Kenorland Minerals as the company confirmed Sumitomo has provided notice it plans to exercise its top-up right to maintain its stake in the company at 10.1%. Sumitomo has now completed the purchase of an additional 20,006 shares at an average price of approximately C$0.78 per share for a total amount of just over C$15,500. This really is just a symbolic additional investment from Sumitomo, but it shows how much weight the Japanese company describes to the top-up right.

The recent developments on the exploration front

Exploration is obviously ongoing on several properties which ensures Kenorland can report a continuous news flow. Not that the market really seems to care these days, but spending partners’ money is still better than sitting on your hands and thinking about better times.

In a portfolio-wide exploration update, Kenorland confirmed the total budget for this year’s exploration seasons will be C$33M, of which about C$29M will be funded by partners.

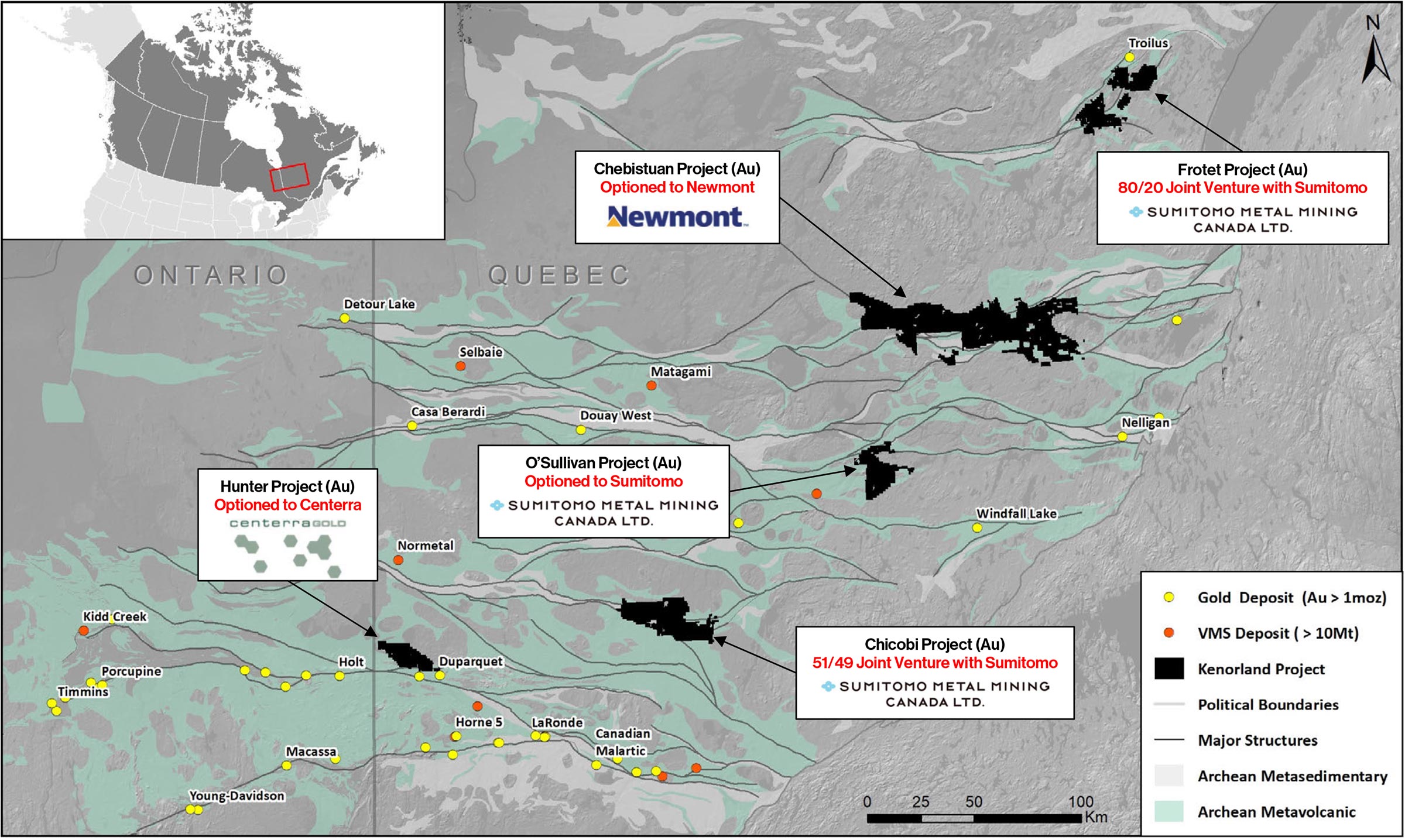

Frotet, Québec

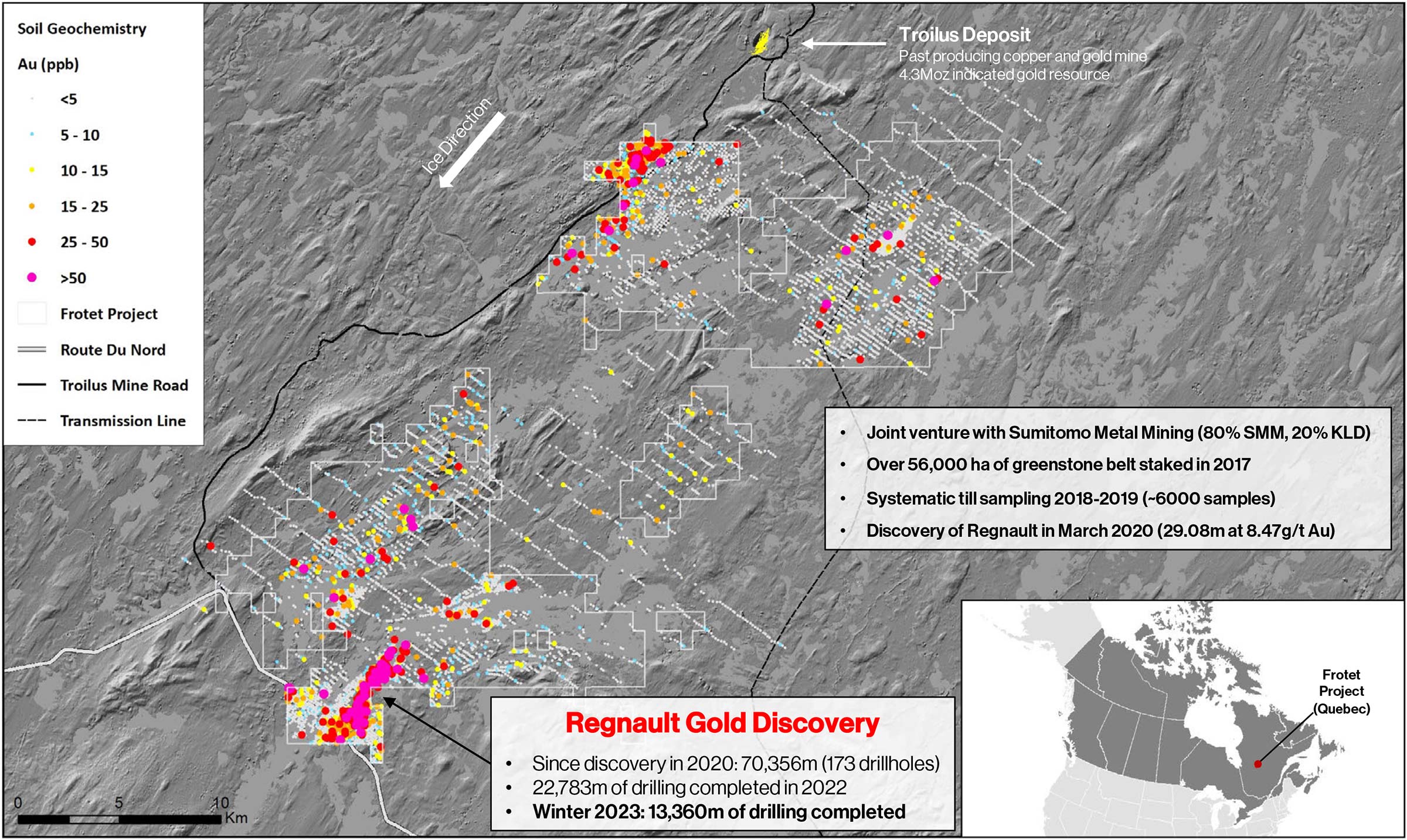

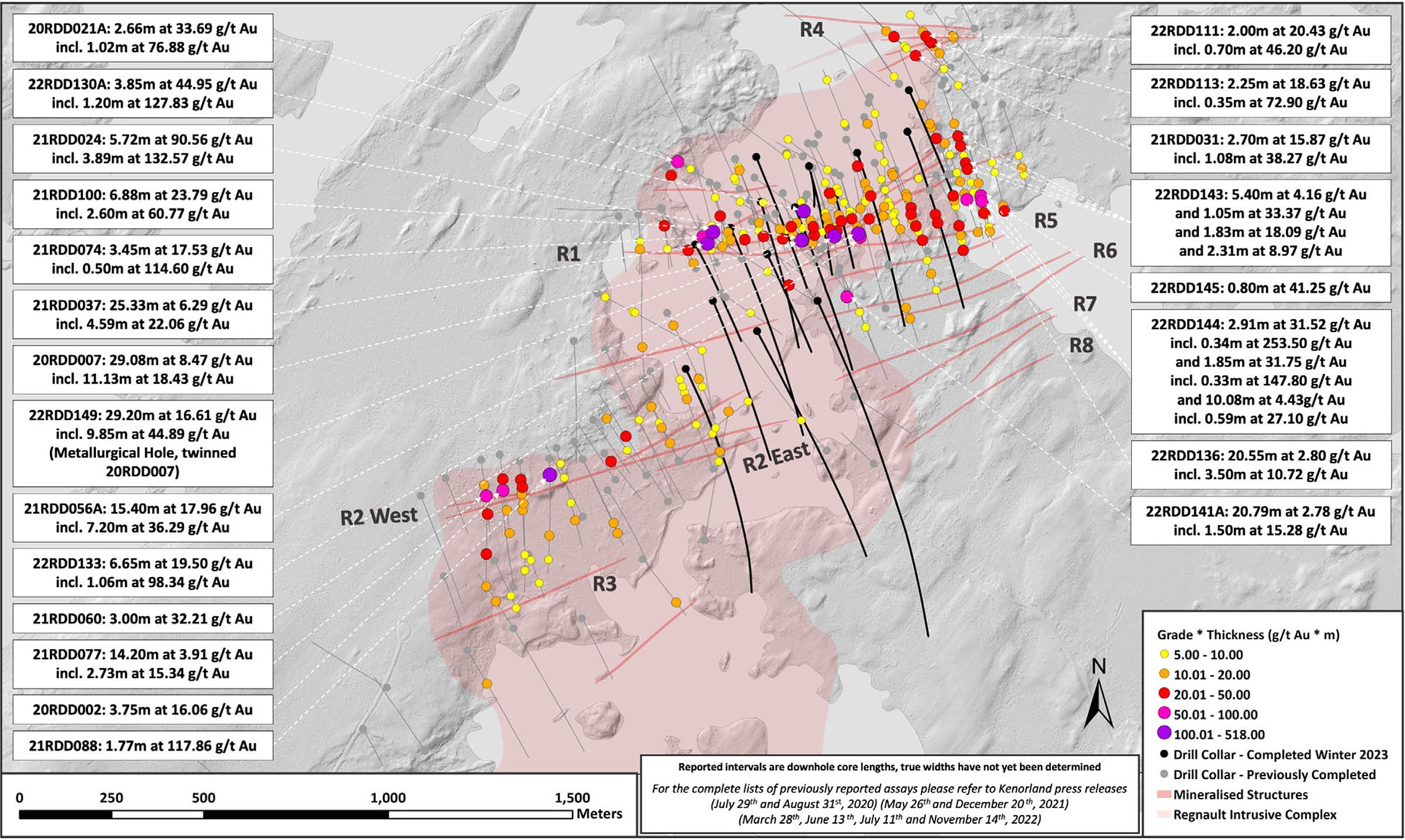

The most exciting asset in Kenorland’s portfolio to us still is the Frotet gold project where the Regnault discovery is really shaping up nicely (and CEO Zach Flood commented ‘Regnault is becoming remarkably predictable’). Kenorland released additional drill results (the first batch of the winter 2023 drill program) from the first seven holes. In total, 15 holes were drilled for a total of 13,360 meters of drilling. The total meterage reported on in the first seven holes is just under 6,700 meters.

The 15 hole drill program was designed to test the depth extent and strike length of new vein discoveries made in 2022, and the drill bit focused on a very specific area where drilling was pretty sparse. Considering all seven first holes encountered high-grade mineralization, the eastern vein discoveries and known mineralization in the west are now deemed to be ‘linked’, resulting in a mineralized corridor of approximately 1.8 kilometers long.

It looks like joint venture partners Kenorland and Sumitomo Metal Mining Canada are getting a good grip on the mineralized structures as the drill bit intersected several high-grade and ultra high-grade gold zones. The company used an interval of 3.15 meters containing 138.74 g/t gold as its headline result and although that interval was boosted by a 0.40 meter interval of 476.4 g/t, it’s hard to call this ‘smearing’ as the remaining 2.75 meter still contains almost 90 g/t gold.

And that was not just accidental. Looking at the ultra high-grade results in for instance holes 23RDD163, 167 and 162 we actually see a similar situation.

23RDD163: 15.00m at 14.88 g/t Au incl. 2.00m at 57.15 g/t Au at R1

23RDD167: 3.15m at 138.74 g/t Au incl. 0.40m at 476.40 g/t Au at R5

23RDD167: 3.43m at 43.23 g/t Au incl. 0.44m at 174.30 g/t Au at R5

23RDD162: 7.10m at 12.24 g/t Au incl. 1.70m at 45.14 g/t Au at R2-R8 Gap

23RDD159: 1.20m at 55.70 g/t Au (new vein discovery)

— Press Release May 31, 2023

Seeing these very strong results from Regnault makes it easier to understand why Sumitomo exercised its top-up right earlier this year. Although Sumitomo already owns 80% of the property, it looks like the Japanese-owned company is happy to continue to support Kenorland at the current valuation. While the recent top-up decision was just symbolical, it is good to see Sumitomo is definitely still backing Kenorland.

Kenorland and Sumitomo were planning for a 10,000 meter summer drill program but perhaps that number will be tweaked a bit after seeing the very strong drill results of the 2023 winter drill program. For now, we’ll stick with the official guidance of 10,000 meters but we wouldn’t be surprised if the joint venture partners decide to scale it up.

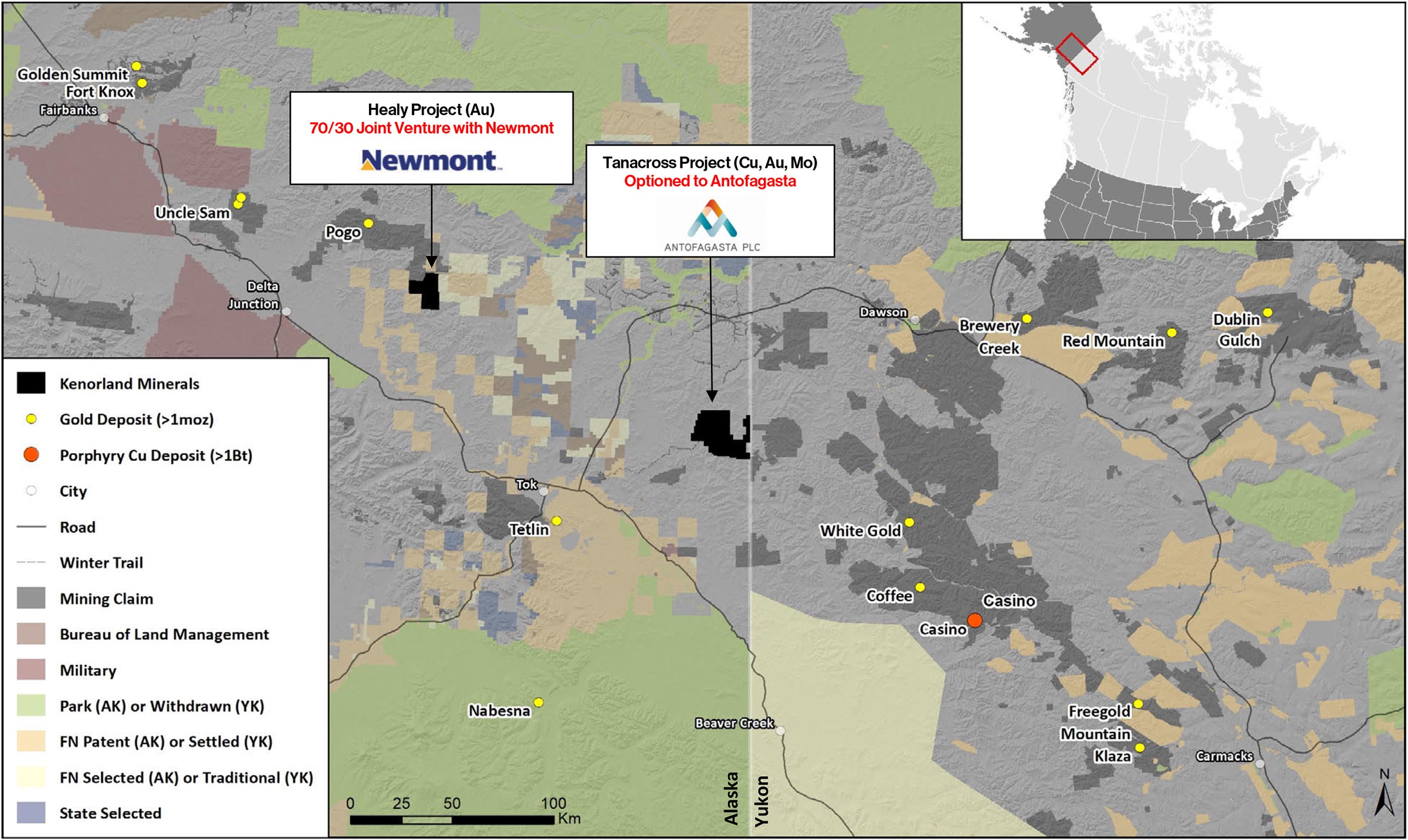

Tanacross, Alaska, USA

While we definitely like the Frotet project best, let’s not forget Kenorland has plenty of other assets in the portfolio. Some will be drilled or explored in a partnership and Tanacross is one of those assets.

Kenorland is gearing up for a 4,500 meter diamond drill program at Tanacross, funded by earn-in partner Antofagasta (ANTO.L) which can earn a 70% interest in the property. In order to establish that stake, Antofagasta will have to make US$1M in cash payments followed by a US$4M success payment should Antofagasta complete its exploration commitment to the tune of US$30M over an eight year period while completing a PEA. Once Antofagasta completes the earn-in agreement by completing the US$35M in cash payments and exploration commitments, both parties will form a 70/30 joint venture

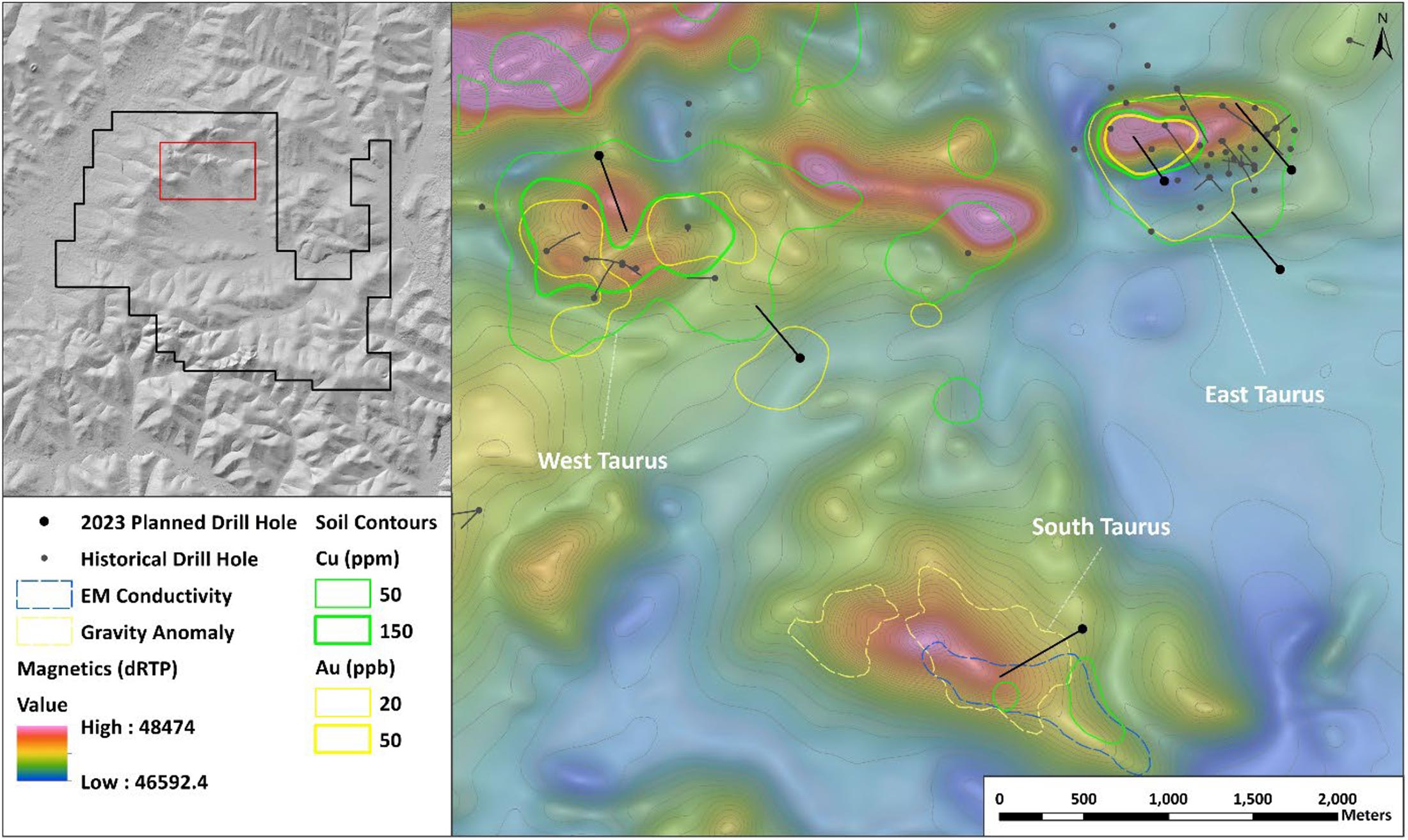

The drill program will focus on the East Taurus, West Taurus and South Taurus zone and Antofagasta and Kenorland clearly feel confident the project is ready for another drill program after about a year of preparatory work. Last summer, Kenorland completed an extensive surface exploration program which resulted in the completion of a sampling program with no less than 800 infill samples taken and analyzed. Additionally, an IP and MT survey were completed on the West Taurus to East Taurus trend while the South Taurus zone was subject to an EM and ground gravity survey.

The total budget for the 4,500 meter summer drill program is estimated at US$3.8M and will be fully covered by Antofagasta as part of its US$30M spending commitment. Kenorland is the operator and will likely earn an operator fee of (or close to) 10% of the budget. Antofagasta already spent US$2M on the 2022 exploration efforts which means that after completing this year’s summer drill program, Antofagasta will already have spent close to US$6M on Tanacross exploration activities.

Other projects

Kenorland did an excellent job in being as transparent as possible on the upcoming exploration programs. We’d like to refer you to the company’s press release here but have copied the summaries below as well.

Chebistuan Project, Quebec: A maiden diamond drill program was recently completed at the Deux Orignaux target area. This target area was defined by gold and pathfinder element anomalism in glacial overburden identified following multiple phases of systematic geochemical surveys, beginning with a regional program in 2021 covering the entire 159,690-hectare property. The maiden drill program included 2,170m of diamond drilling over seven holes testing across structural targets defined by detailed magnetic and induced polarization (IP) surveys completed last year. Results from the drill program are expected to be released towards the end of the second quarter. The Chebistuan Project is held under an earn-in agreement with Newmont Corporation.

O’Sullivan Project, Quebec: The Company recently completed detailed electromagnetic (EM), IP, and drone (UAV) magnetic surveys covering the Pusticamica North target area. The target area was delineated by coherent gold-in-till anomalism along the northern shore of Lac Pusticamica which coincides with strong deformation along a major felsic intrusive-volcanic contact. Summer 2023 planned exploration work includes a lake sediment geochemical survey, detailed mapping and a regional airborne versatile time domain electromagnetic (VTEM) survey. The geophysical and geochemical surveys, which cover a large portion of the target area beneath a lake, will assist in future drill targeting. The O’Sullivan Project is held under an earn-in agreement with Sumitomo Metal Mining Canada Ltd.

Chicobi Project, Quebec: Land access and permitting is well underway for the next phase of sonic drilling (drill-for-till geochemical sampling) along the Roch-Can trend. The Roch-Can trend is located along a major first order structure within the Chicobi Deformation Zone (CDZ) which transects the Abitibi greenstone belt. Limited historical drilling and previously completed sonic drill holes have identified an alteration corridor spanning 17 kilometers in strike length and broadly associated with Au-Zn-Ag

anomalism within the bedrock and glacial overburden. The two phase (summer and winter) sonic drill-fortill program is planned to commence in the third quarter of this year. The Chicobi Project is currently held under joint venture with Sumitomo Metal Mining Canada Ltd.

Hunter Project, Quebec: Following an initial property-wide drill-for-till sonic program, completed in 2022, the Company is currently carrying out a detailed drone magnetic survey along with land access and permitting efforts in preparation for a follow-up detailed sonic drill program covering priority target areas identified from the initial regional program. The follow-up sonic drill program is expected to commence during the third quarter. The Hunter Project is currently held under an earn-in agreement with a subsidiary of Centerra Gold.

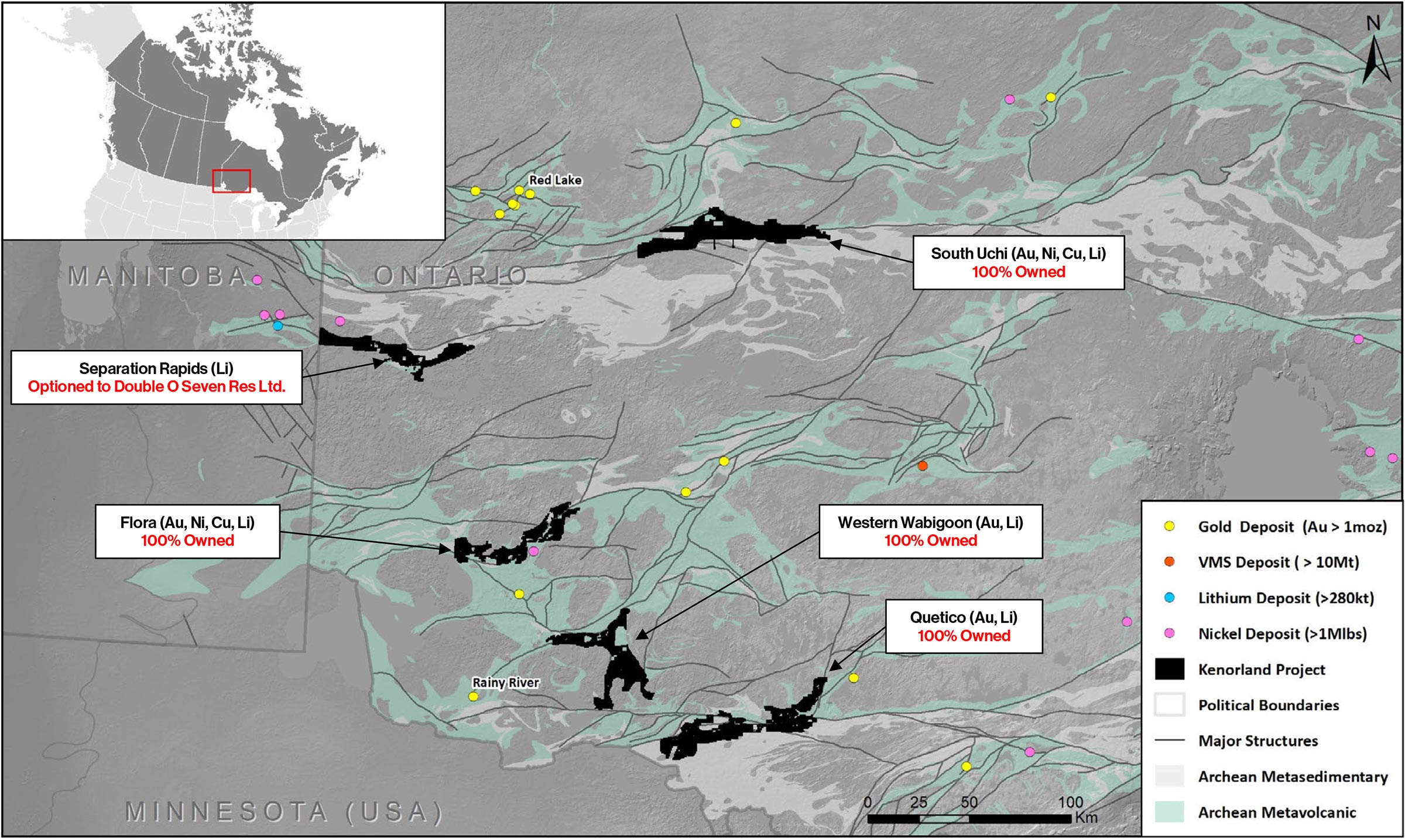

Separation Rapids Project, Ontario: In 2022, the Company completed a regional till geochemical survey, focused on LCT pegmatite systems, covering a large portion of the 46,362-hectare property. Results from the 1,183 till samples collected identified three priority target areas defined by anomalous and coincident lithium and cesium in till. A detailed follow-up geochemical survey and prospecting, covering all three priority target areas, is planned for this summer. The Separation Rapids Project is currently held under an option agreement with Double O Seven Mining Ltd., a private B.C. corporation.

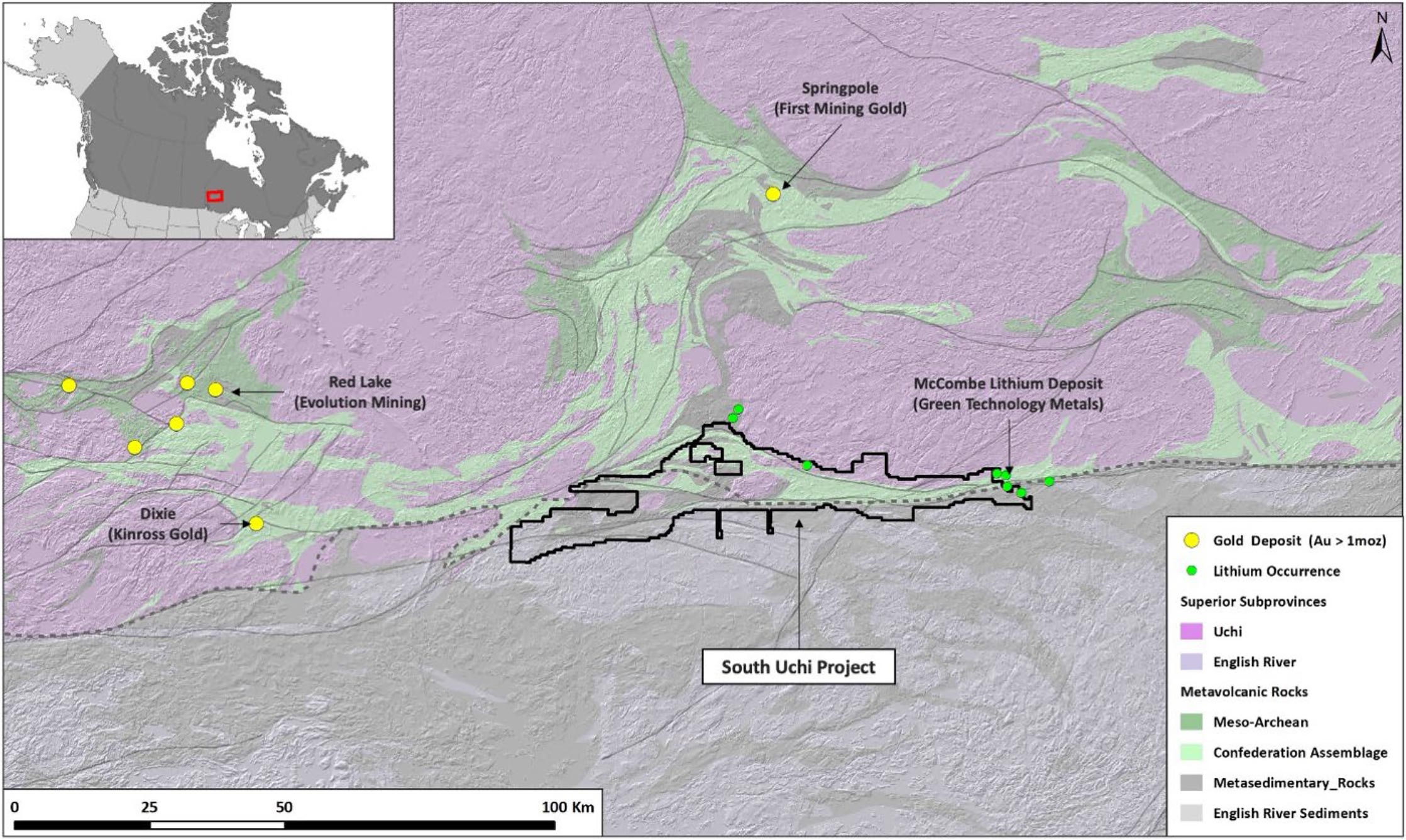

South Uchi Project, Ontario: Following the termination of the earn-in agreement with Barrick Gold Corp., planning for the next phase of exploration at the 100% owned South Uchi Project is well underway.

Priority target areas for follow-up exploration include a significant large-scale and high-tenor coincident Ni-Cu-Co glacial till geochemical anomaly along with multiple discrete Li-Cs-Ta (LCT) geochemical targets. Future exploration will focus on the discovery of both nickel-copper sulphide systems as well as lithium bearing pegmatite systems.

Kenorland is making good money on its robust cash position

The balance sheet of Kenorland is still in spectacularly strong shape. We have always been big supporters of selling the stake in Li-FT Power (LIFT.V) down as fast as possible and in December of last year, Kenorland finally pulled the trigger on selling 750,000 shares of Li-FT at C$12 per share, raising C$9M. A wise decision as the share price of LIFT has dropped to less than C$9 as the lithium rally lost momentum and we hope the remaining 1M shares will be sold soon. After all, if the property that was sold to Li-FT Power will ever be developed into a mine, Kenorland’s 2% NSR will be worth a lot more than the 1 million shares likely ever will be.

The prudent cash management and the wise decision to sell a portion of the Li-FT shares have really bolstered the balance sheet and as of the end of Q1, Kenorland still had just over C$24M in cash (with an additional C$12.5M in investments and investments in associates (this includes the remaining stake in Li-FT Power which represents about C$8M. Other important stakes are the C$1.7M in Targa Exploration (TEX.C) which were obtained through the sale of lithium properties as well (note, Targa is very illiquid), and Jayden Resources (JDN.V).

And thanks to the strong cash position, Kenorland is capitalizing on the increasing interest rates on the financial markets. Whereas the company generated C$31 in interest income in Q1 2022 (that indeed was 31 Dollar, not 31,000), the interest income increased to in excess of C$190,000 in the first quarter of this year. And as interest rates increased throughout the quarter, Kenorland should be able to post a similar net interest income result in the current quarter. The joys of having a lot of cash on the balance sheet!

Conclusion

As of the end of Q1 2023, Kenorland’s net working capital position was approximately C$18.4M. With 62.6M shares outstanding, this exploration company had a net working capital of approximately C$0.29 per share. This means that about 40% of the current share price is indeed backed by cash and other working capital elements. We would also like to highlight that the C$12.5M in investments and investments in associates is NOT part of the working capital (and this adds an additional C$0.20 per share in value). On a combined basis, almost 70% of the current market cap is backed by the net working capital position and existing investments in shares (with the obvious caveat those share positions may be too illiquid to monetize easily, so let’s take that portion of the net value with a grain of salt).

And while Kenorland will undoubtedly (have to) spend some of the cash on the exploration activities on properties that aren’t part of an active joint venture or earn-in agreement, there are very few companies in a financial shape that is as good and strong as Kenorland is.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland Minerals is a sponsor of the website. Please read our disclaimer.