In the summer of last year, we explained why we were quite optimistic about Rye Patch Gold’s (RPM.V) possibility to improve the metallurgical test results on the Lincoln Hill gold and silver project. As we explained before, adding a crushing stage to the mine plan would boost recovery results and allow the company to extract more gold and silver from the ore.

In this report, we will discuss the updated metallurgical test results and will also look forward to this year’s exploration program on the company’s assets in Nevada.

The updated metallurgical test results

Rye Patch has already announced the initial results of the feasibility level metallurgical test program on the Lincoln Hill ore and the company has disclosed the preliminary results of 18 bottle-roll tests.

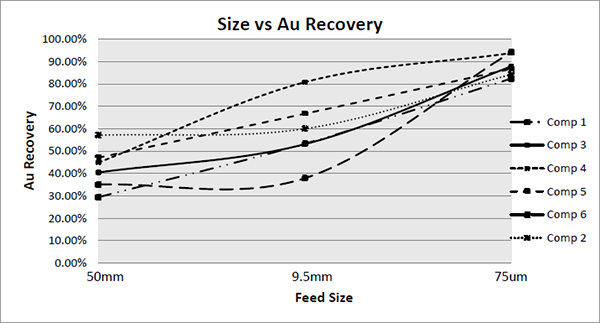

RPM has completed bottle roll tests on no less than six composites of three different feed sizes to test which feed size would result in the highest recovery rate for the gold and silver. As expected, the smaller the feed size was, the higher the recovery rate is which indeed indicates that adding a crusher to the mine plan and the flow sheet might be an excellent idea.

If you would for instance look at the next chart which shows you the correlation between the size of the ore and the recovery rate to get the gold out of it, you can clearly see a positive (inverse) correlation between the feed size and the recovery rate. Whereas the recovery rate was just between 30% and 57%, using a 50 mm feed size, this increased to in excess of 80%, and in some cases in excess of 94% once you use the smaller 75 micrometer feed size. The smaller the size of the particles, the higher the recovery rate is.

Based on the average recovery rates of all six batches, we end up with an average gold recovery of 88.2%. It’s a little bit less than at !’s (CDM.TO, NYSE:CDE) Rochester mine, but it compares quite favorable with our initial estimates of 85% of the gold recovered. As you might remember, in our September report we used an average recovery rate of 85% in our preliminary back-of-the-envelope based assumptions, so 88.2% even surpasses our initial expectations. This will result in the company producing in excess of 35,000 ounces of gold more than originally anticipated which should reduce the cash costs and increase the NPV. Also, keep in mind this is just the first pass, and it’s not unlikely that additional fine-tuning might improve the recovery rates even further.

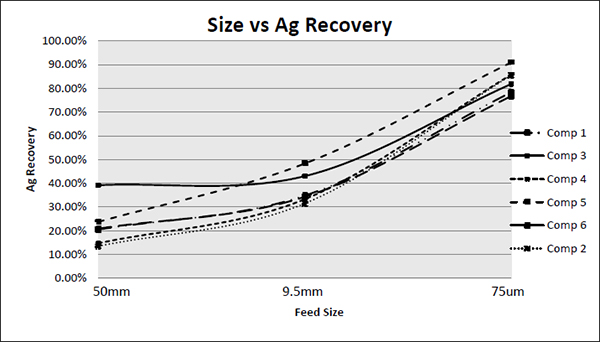

But what’s even more intriguing is the fact that it looks like the silver recovery rate will be much, much higher than anticipated. According to the PEA, the recovery rate was estimated to be 59%, which was in line with Coeur’s recovery rate of 61%. So we didn’t expect the company to release a substantial increase in the recovery rate of silver, but once again the test results have positively surprised us.

As you can see in the previous image, the silver recovery rate increases exponentially at the smaller feed size. Even though Coeur mining’s Rochester mine is recovering 61% of the silver, the initial test results of Rye Patch’ bottle roll tests conducted by the lab are indicating the silver recovery rate is actually much higher.

Based on our calculations, the average recovery rate of the silver on the unweighted basis was a stunning 83%. This might mean we were even too conservative with our assumptions in our September report, as we did not account for any meaningful increase in the silver recovery rate. Considering the PEA claimed Lincoln Hill will produce approximately 2.2 million ounces of silver, a 34% increase in the silver recovery rate would result in approximately 750,000 additional ounces being produced. It’s obviously still too early to get too excited, but it does look like the total revenue of the Lincoln Hill project might be $10 million higher than originally anticipated, which could reduce the operating cost per produced ounce of (pure) gold by in excess of US$50 per ounce.

We are really excited to see the final results of the metallurgical test work, which should be available in a few weeks.

Rye Patch also plans to do more exploration work this year

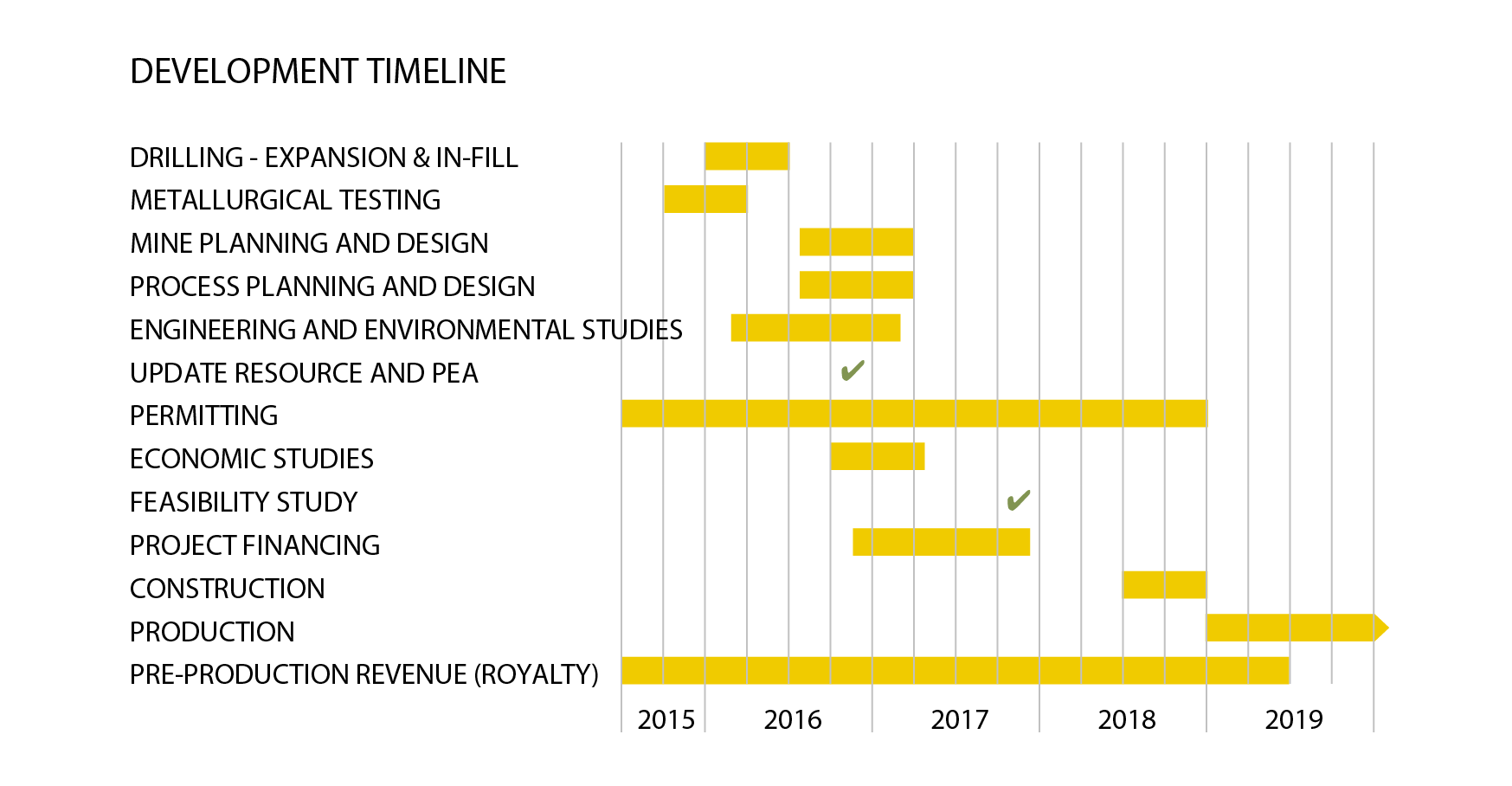

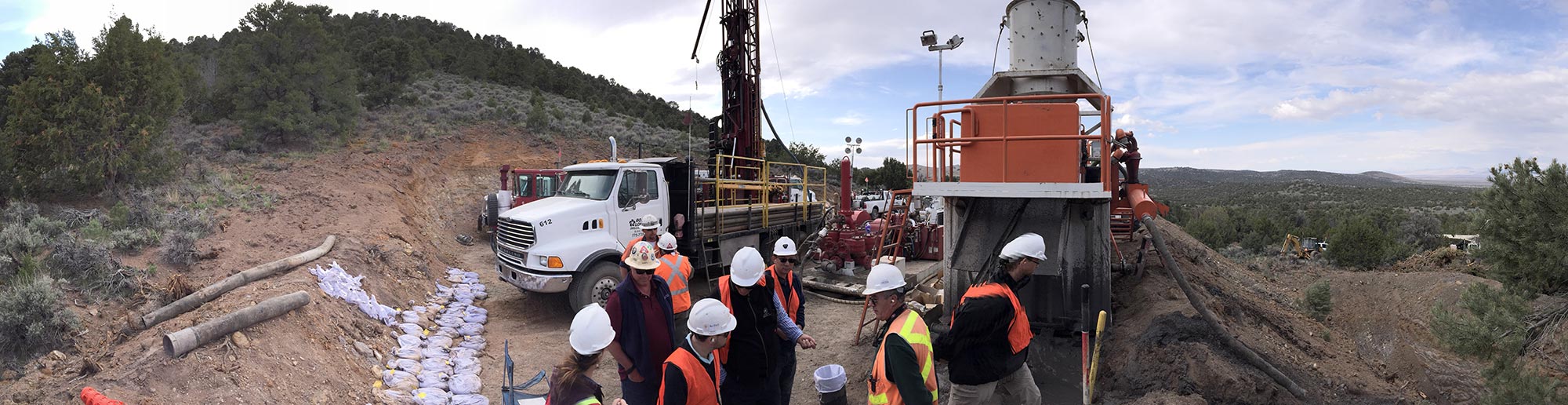

The company has also applied for a drill permit to drill more holes at the Lincoln Hill project in Nevada. RPM is still waiting for some final feedback from the Bureau of Land Management as the company specifically needs to take precautions against the Sage Grouse.

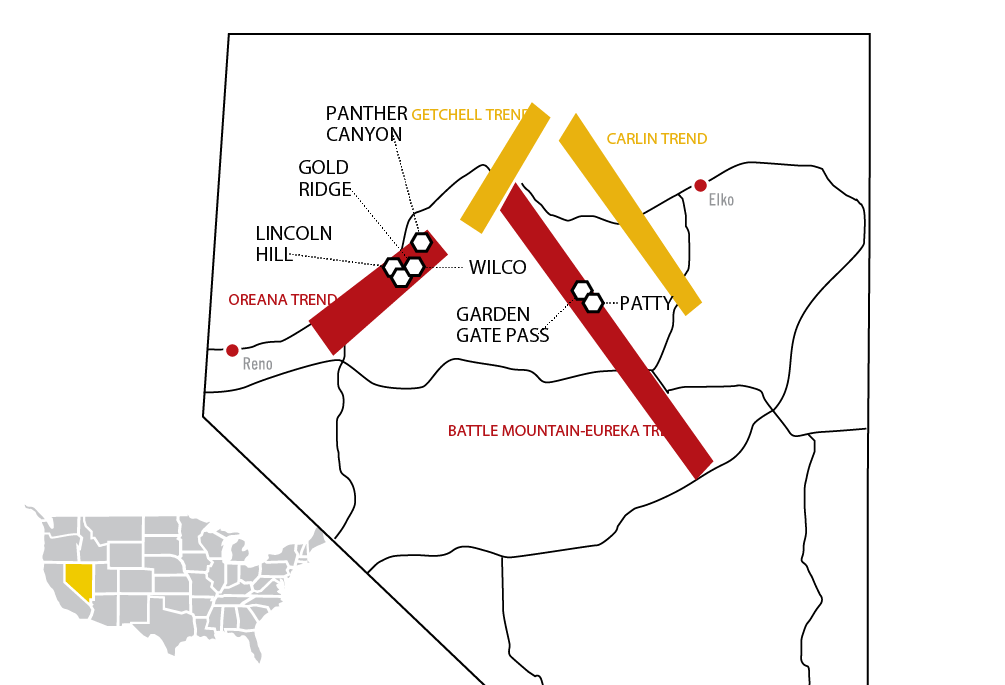

We expect the company to receive the drill permit by the end of this year, and this will allow the company to ‘disturb’ a total area of approximately 100 ha for a 20,000 meter drill program. As you can expect, the majority of this drill program will be focusing on infill drilling at the Lincoln Hill project, with an additional 5,000 m to be drilled at the Gold Ridge project which is just a few miles away.

Receiving the drill permit will take a few more months, so we are not expecting to see any meaningful drill results before the end of this year. However, we do expect the company to release some more exploration results from its newly staked Panther Canyon gold project which is located just a few kilometers away from Gold Ridge. More importantly, these claims cover the historic Rye Patch Gold mine in Nevada.

This mine was discovered in 1860 and has produced in excess of 600,000 ounces of silver in the subsequent 10 years (and of course, the mining efficiency 150 years ago was much lower compared to the modern mining techniques). A new gold-silver zone has been traced over the strike length of 2.7 kilometers and up to 300 m wide and what’s really interesting here is the fact that the southern part of the zone is silver-rich, whilst the northern part is seeing higher gold values. This means that Rye Patch has increased its surface area on the exact strike length it wanted to be on, as it now has a dominant land package on a 25 km long gold-silver trend.

It’s very interesting to see Rye Patch was able to scoop this property up, after the previous owner let its claims lapse last year. Holding these claims is actually quite cheap as a total annual cost is approximately US$20,000. Rye Patch has started a mapping and surface rock chip sampling program this week which should help the company to further define drill targets that could be followed up on this fall or winter.

Conclusion

We aren’t expecting to see any substantial drill programs (or results) on RPM’s projects this year (we expect the bulk of the infill drill results will be released in early 2017), but we are very pleased to see the initial results of the metallurgical test work is exceeding our expectations. Not only is the average gold recovery rate a little bit higher than we expected, we are extremely pleased with the much higher recovery rate of the silver, which might provide a huge boost to the project’s net present value as the potentially higher silver production will reduce the cash cost per produced ounce of gold as the value of the byproducts that are being sold will increase.

With an enterprise value of just US$20million (and a robust working capital position), Rye Patch Gold is in an excellent position to continue to work on its properties to create more value for its shareholders. Increasing the land package in a very promising gold silver trend is evidence of the company’s long-term strategy, and we are looking forward to see some initial exploration results from the Panther Canyon project.

Rye Patch Gold is a sponsor of the website, we hold a long position. Please read the disclaimer