There are very few pure silver companies out there; as a lot of them over the past 10 years have either gone belly-up, or have been acquired by larger entities. Most companies had to go into survival mode while waiting for higher silver prices.

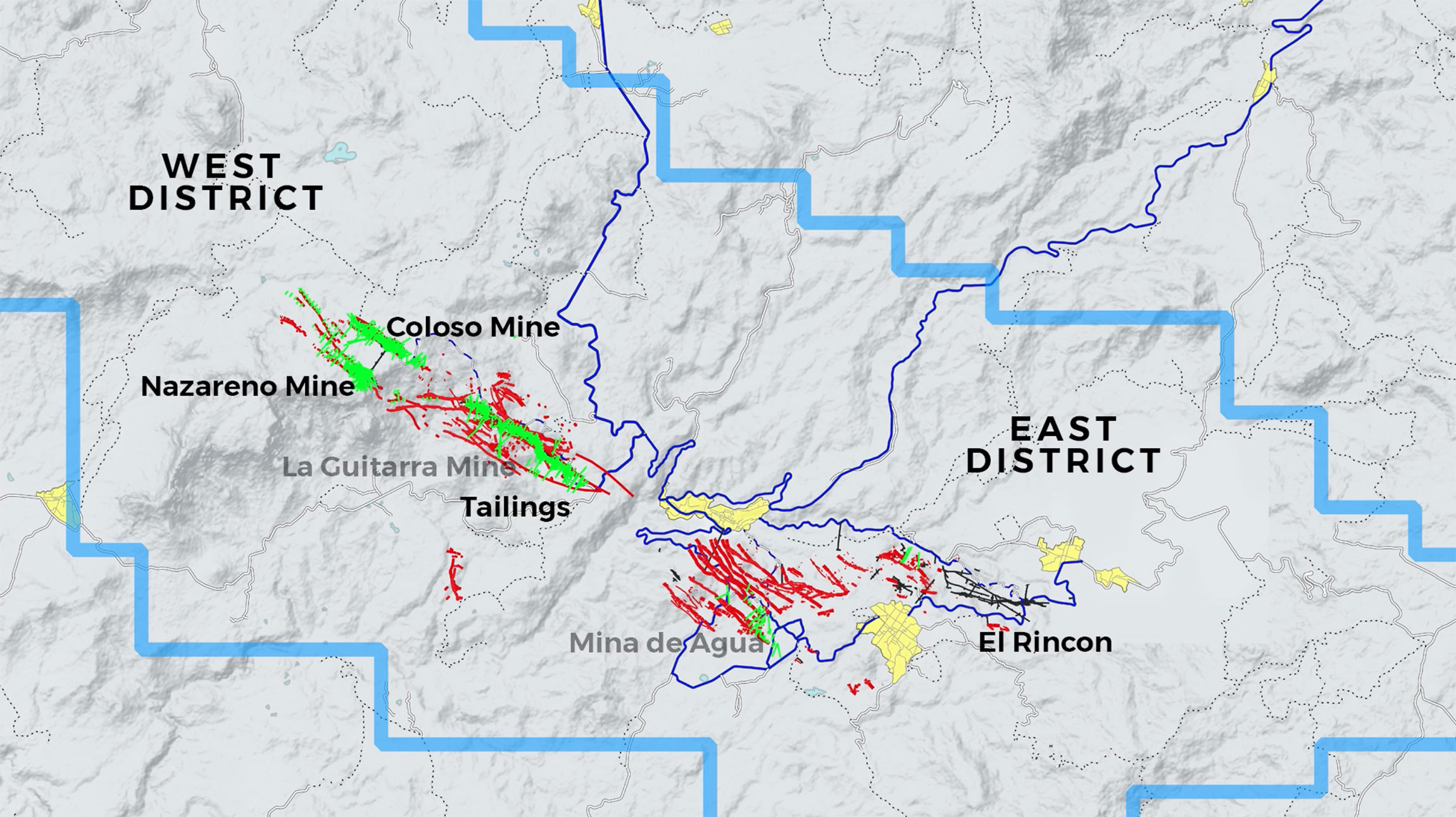

That’s how Sierra Madre Gold & Silver (SM.V) was initially created. It acquired the Tepic silver asset in 2020 as it wanted to establish itself as a silver play. And just eighteen months ago, the corporate development plan accelerated as the company acquired the past-producing La Guitarra silver-gold mine in Mexico from First Majestic Silver (FR.TO, AG). This mine is located in the Temascaltepec area of Mexico which has a mining history of about 500 years as the first mining operations in the area started in the 1500s.

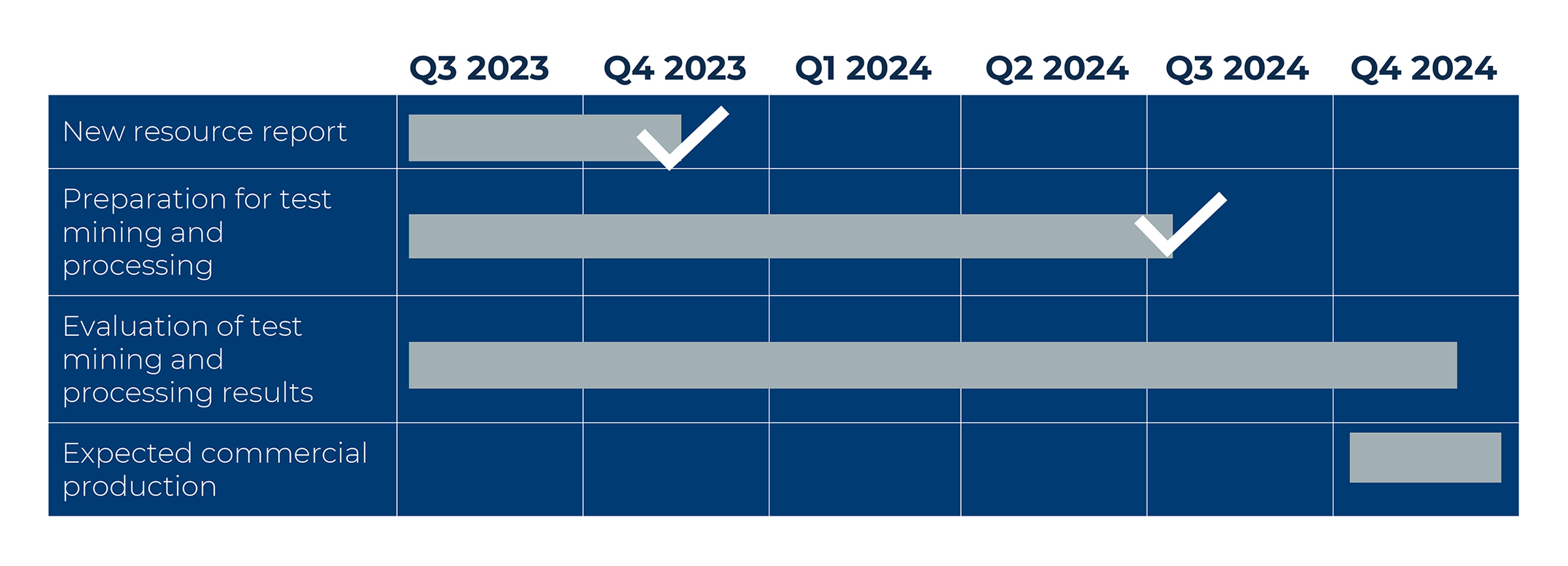

And suddenly everything went faster than planned. As La Guitarra came with a fully permitted and functioning mill, it became a no-brainer for the company to focus on potentially reopening the La Guitarra mine. Within 13 months they did exactly that. Sierra Madre started test underground mining in early June of this year, followed by the start-up of the mill at the end of the month. Meanwhile, Sierra Madre had secured US$5M in debt, through a financing from First Majestic Silver and signed an agreement with MRI Trading which secured the offtake rights on the concentrate. As per the offtake agreement, Sierra Madre receives approximately 90% of the estimated concentrate value as a provisional payment, resulting in collecting US$1.05M in provisional payments in July and August, before disclosing that they generated total revenues of $2.4M by the end of September (which is a testament to the acceleration of the production as well as the cash flows). More concentrate has been shipped since this update, so the total received revenue is obviously already higher by now.

We think the company is now getting close to a pivotal point in its existence. We are looking forward to the Q3 results, but rather than focusing on the numbers, we are really interested in the wording and additional color provided by the management team. As the ramp-up of the La Guitarra mill is ongoing, we anticipate the company’s output to continue to increase towards the end of the year, when the 500 tpd steady-state milling scenario should be achieved; which is full commercial production.

The stars are aligning for Sierra Madre as the sole external factor (the precious metals prices) is providing a very strong tailwind.

Sierra Madre has made a lot of progress in the past few quarters

Just last week, the company announced it has reached an average daily throughput of 428 wet metric tonnes per day at the La Guitarra milling facility, during an 18 day period in October. It is clear the equipment can handle higher volumes as Sierra Madre confirmed it reached a daily peak of 504 wmt. We expect to see a continuously smooth ramp-up towards the company’s target of 500 tonnes per day.

This means that within four months after starting up the mill again, Sierra Madre has been able to increase its throughput very substantially, while the recovery rates increased as well. The average recovery rate for the silver has remained stable at around 78% while the recovery rate for the gold increased from 74% to 87% throughout the past four months. That is an interesting development as previous owner First Majestic only reached a 79% gold recovery rate before the mine was placed on care and maintenance in 2018.

Since the start of the test mining operations, the company has delivered just over 690 dry metric tonnes of concentrate to MRI Trading. The average precious metals grades in the concentrate were 2,903 g/t silver and 34.74 g/t gold. This indicates the total silver and gold content was 64,400 ounces and 771 ounces respectively.

As the throughput of the mill is still increasing, we can expect the concentrate volumes to accelerate and Sierra Madre has indicated it expects to ship 350 tonnes of concentrate per month once the mill has reached its steady-state production rate of 500 tonnes per day. Assuming the same silver and gold grades as on a YTD basis, this implies an annual production of 0.4 million ounces of silver and 5,000 ounces of gold. Applying a silver:gold ratio of 80, this represents a silver-equivalent production of 0.8 million ounces per year based on the YTD concentrate grades. Keep in mind, La Guitarra produced 1.02 million ounces silver-equivalent (with 0.6Moz silver) in 2017 (the last full year of operations) at an AISC of $19 per ounce of silver. To be fair, the stated concentrate grades are still in a test processing phase and mines usually takes a number of quarters to fine tune recoveries. As the gold price and gold recoveries are substantially higher, we think it is reasonable to expect to see a higher by-product revenue per produced ounce of silver, which may reduce the all-in sustaining cost per produced ounce of silver.

The balance sheet is still robust, and should improve from here on

As of the end of June, the most recent cutoff date for the company’s financial results, Sierra Madre had a positive working capital position of approximately US$2.8M. While that still is a pretty tight position for a company that wanted to restart a mine, the lack of any substantial capital raise (other than the small C$0.5M raise) seems to indicate the current incoming cash flows are covering all bases at Sierra Madre. And while this is standard language, in its Q2 report, Sierra Madre mentioned it expected the current working capital position and anticipated incoming cash flows to be sufficient to cover all its expenses and expenditures for the next 12 months. Talk can be cheap, but we expect the company to show considerable improvement in its cash flow results in the next few quarters.

That’s of course just a hunch. But it is clear the current silver price is very forgiving and the total revenue of US$2.4M generated in just the first few months after starting the test mining operation is very encouraging; especially as the company is still just ramping up the operations at its mill. As the mill throughput increases, the operations will become more efficient and this will result in a golden combination (pun intended) of higher production at a lower cost per unit. Since the company’s revenue announcement, more concentrate was shipped to its offtake partner, with more revenues being generated.

The next catalysts

We think the company’s Q3 report could be a strong catalyst. We won’t see a massive amount of free cash flow yet, but it would be great to see the company go on record stating it reached the break-even status on the cash flow front, while it is working towards reaching the 500 tonnes per day throughput. Additionally, commercial production will be announced before the end of this year.

While the Q3 report could be an important catalyst to show the market Sierra Madre is on the right track, it really is the Q1 2025 report we are looking forward to. Given the current strength in the silver price and considering the operations appear to be running pretty smooth, we anticipate the company to report a positive free cash flow as early as the fourth quarter of this year! (of course assuming the silver price remains strong for the rest of this quarter).

We also expect the company to communicate their plans for 2025 (and beyond). Not just production-related but also exploration-related, because let’s not forget about the massive exploration potential at La Guitarra. The company recently released it discovered and delineated a new vein outside of the 2023 resource calculation and it actually already started test mining this vein. Additionally, Sierra Madre has started the test stope development of a block of mineralized material in the Doncellas vein.

But there’s more than just the near-mine exploration and development.

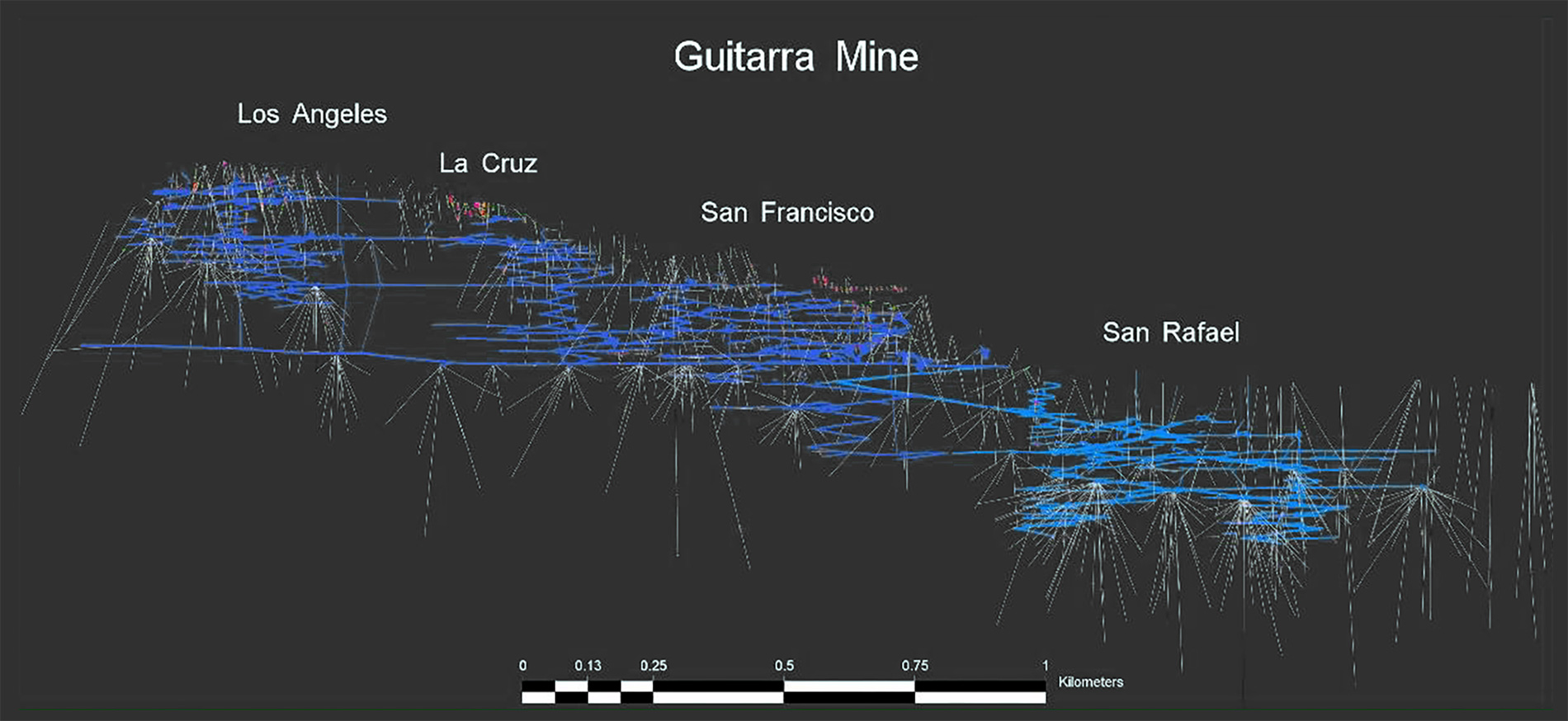

The La Guitarra property currently hosts 59 known veins and vein systems, and we are pretty certain COO Greg Liller is dying to drill-test some targets.

Of course, the company’s first priority is to get the test mining production up to 500 tonnes per day, as that will serve a dual purpose: not only will it shows the market there is a new silver producer in town, the precious metals sales will likely also generate enough cash to put a meaningful drill budget together for 2025.

We expect Sierra Madre to provide a more detailed plan for its 2025 exploration approach in the near future as the La Guitarra mine and mill are reaching the anticipated 500 tonnes per day capacity. Once the company publishes its exploration plans, we will of course have a closer look and discuss the business plan with CEO Alex Langer.

Conclusion

Right now, it’s difficult to figure out if Sierra Madre is a silver producer with exploration potential, or an exploration company that should soon be self-sustaining thanks to its ‘test mining’ activities. But however you look at Sierra Madre Gold & Silver, it is clear that the high silver (and gold) price are a blessing for the company as its test mining operations should reach a cash flow positive stage sooner rather than later.

With silver above $34/ounce and gold above $2700/ounce, Sierra Madre’s restart of the La Guitarra mining operations appears to be very well-timed.

Disclosure: The author has a long position in Sierra Madre Gold & Silver. Sierra Madre is a sponsor of the website. Please read our disclaimer.