At the end of April, we were in Mexico to visit Sierra Madre Gold and Silver’s (SM.V) La Guitarra mine and mill. Sierra was recently able to (finally!) close the acquisition of the mine and mill from senior silver producer First Majestic Silver (AG, FR.TO) which gave up the property for US$35M in stock and a 2% NSR (of which 1% can be repurchased by Sierra Madre). The transaction took a very, very long time to close as Sierra Madre had to wait for the official approval from the Mexican antitrust regulators. That approval was finally obtained earlier this year which allowed Sierra Madre to close the financing, close the deal and get reinstated for trading about a year after its initial trading halt. Even though the transaction took a long time, it is a major transformative acquisition for the company and their shareholders.

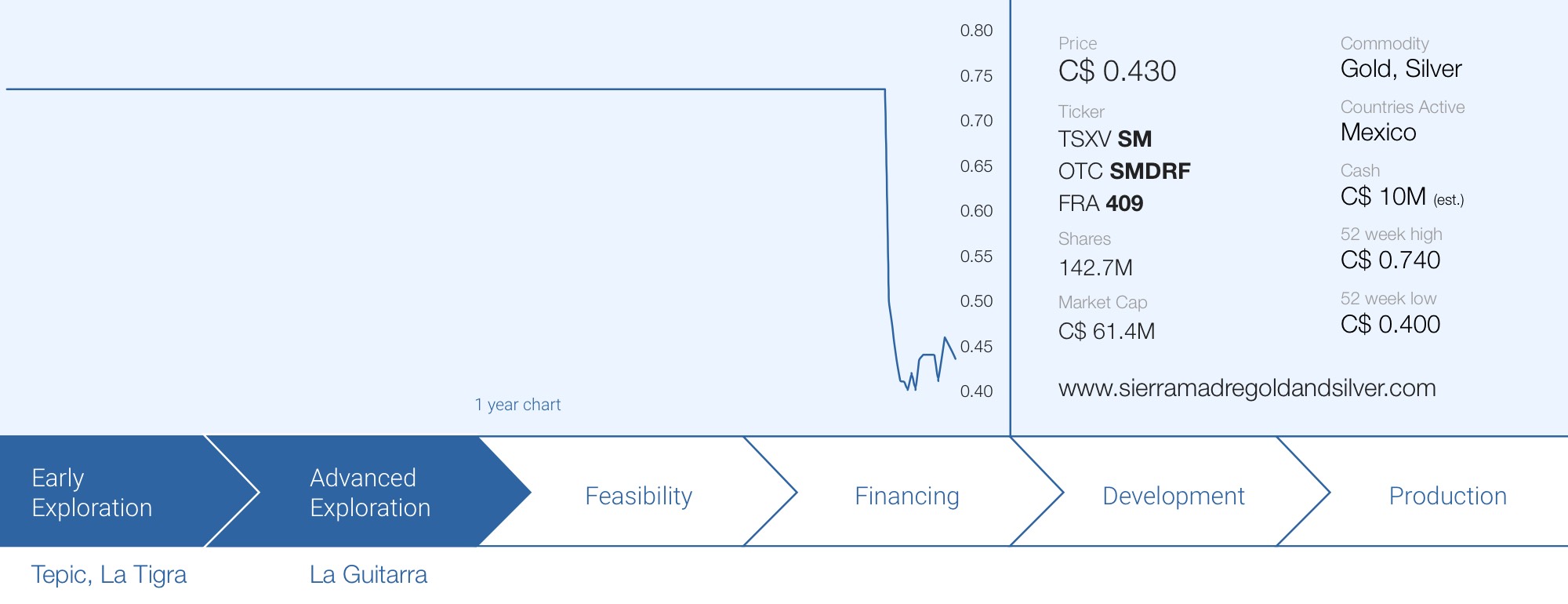

Although the silver price is now higher than where it was trading when trading in the company’s shares was actually halted, the share price lost about a third of its value when trading was reinstated. A substantial portion of the selling pressure was likely caused by a ‘flight to liquidity’. And you can’t really blame people for selling a (portion of their) position after not having been able to trade in the company’s securities for about a year. And despite the declined share price, Sierra Madre’s performance is not worse than most of its peers in the silver exploration sector in the comparable period.

Where applicable, we will refer to the historical resource estimate on La Guitarra as published by First Majestic Silver in its FY 2021 Annual Information Form. Unless indicated otherwise, you should assume that is the historical resource we are referring to (there are no NI43-101 compliant resources on La Guitarra at this time). Sierra Madre has also filed an updated technical report on SEDAR.

Accessing the mine site

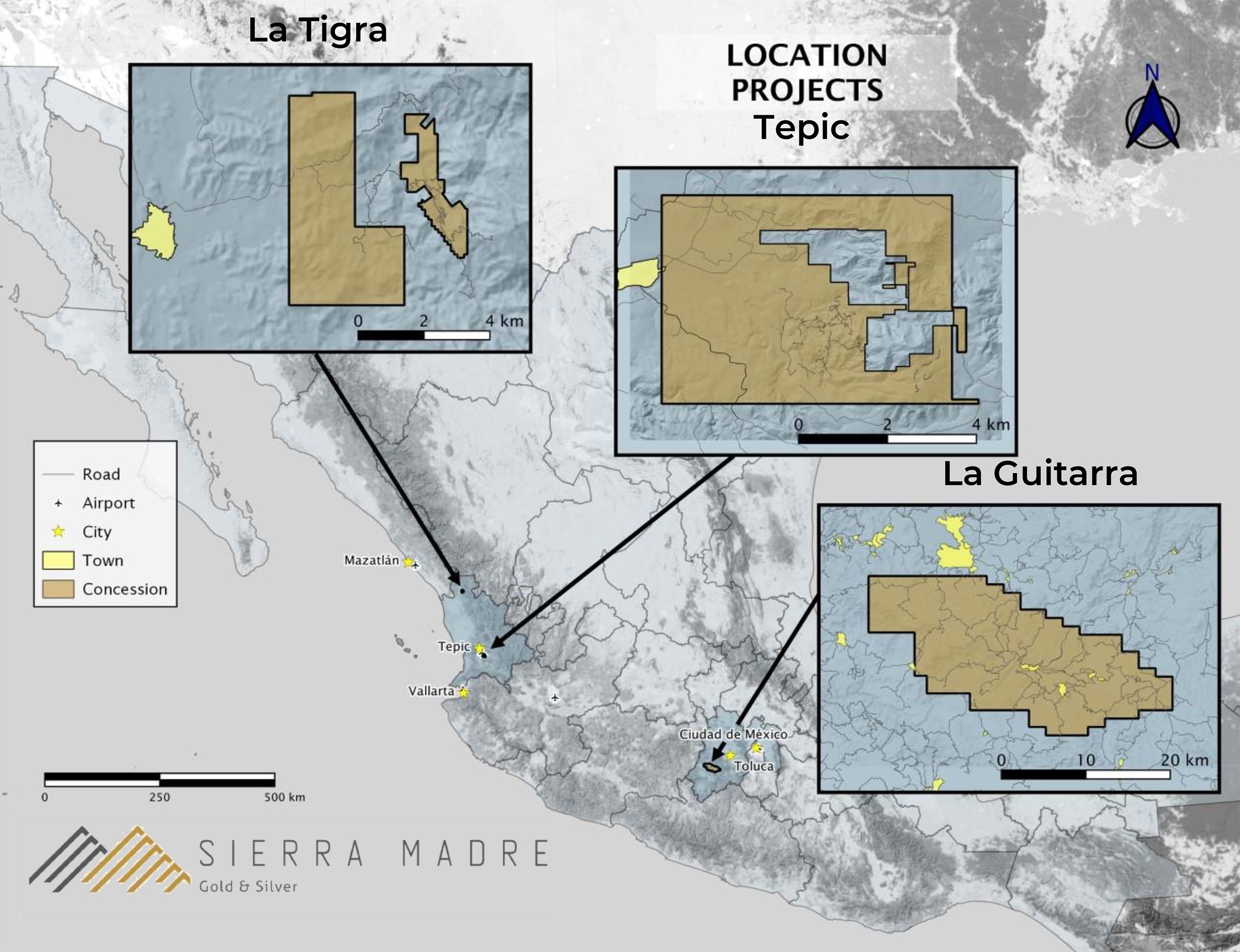

It doesn’t happen very often you have to fly into the capital of one of the largest cities in the world as the easiest point of access to a mine site. However, that’s exactly the case at Sierra Madre as its new flagship property, La Guitarra, is located about 1.5-2 hours west of Mexico City (depending on the traffic situation in the metropole). This basically means you can get from London Heathrow to the property in about 14 hours and from Toronto in just about 5 hours. That’s almost unheard of and the fact La Guitarra is so easily accessible definitely is a bonus.

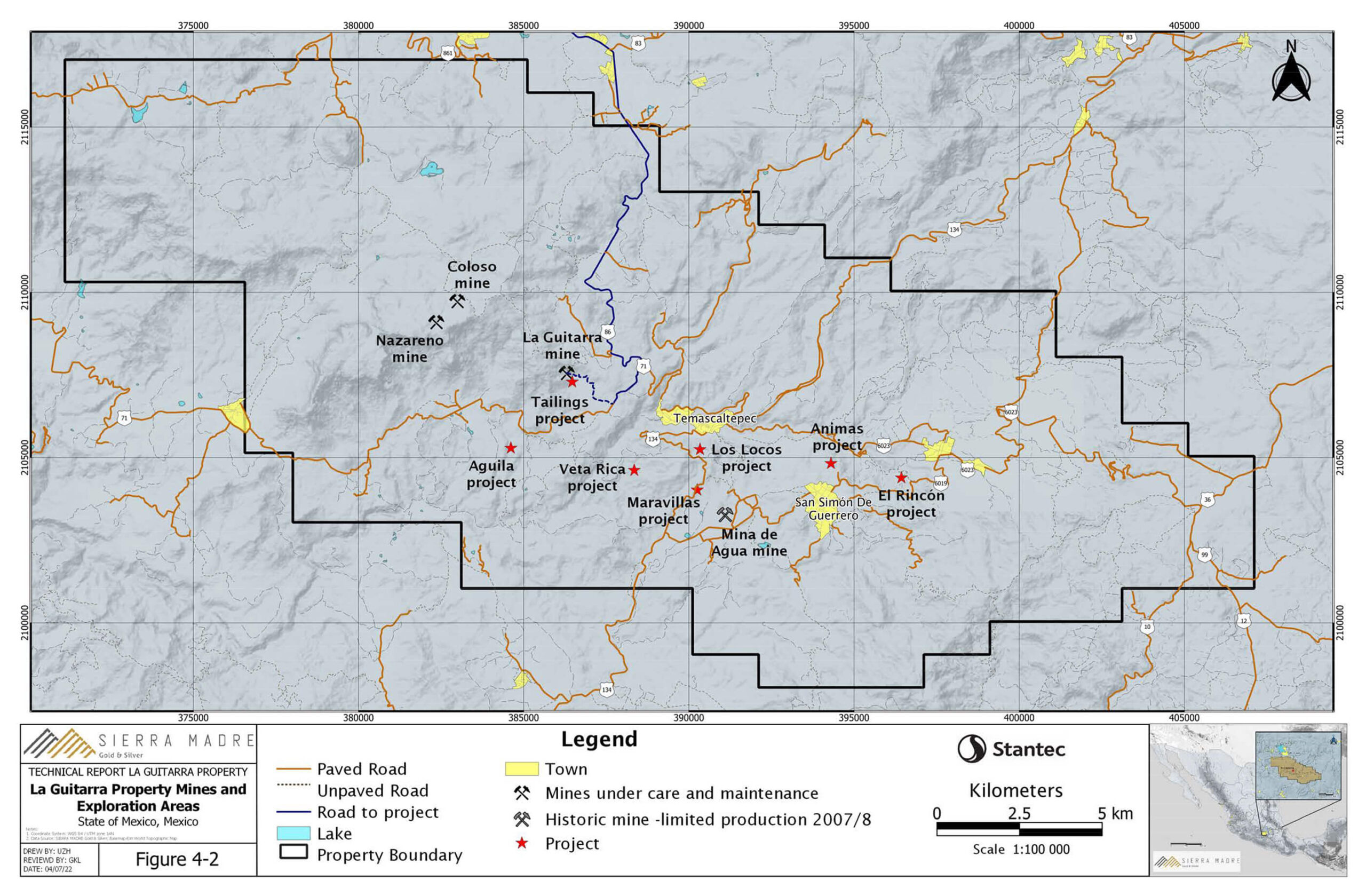

La Guitarra is located in the Temascaltepec mining district, approximately 70 kilometers southwest of Toluca (a large town with a population of approximately 1 million with a small international airport). The land package acquired by Sierra Madre contains three mines that were recently operated (La Guitarra, Coloso and Nazareno) while there is a fourth historical production center. The total size of the project is about 40,000 hectares (close to 100,000 acres) but as land holding costs in Mexico are increasing the longer you hold the claims, we would expect Sierra Madre to downsize the land package to keep the annual taxes more bearable. Of course, we don’t expect this to happen overnight and we sincerely hope the company will first do some ‘condemnation’ exploration activities to make sure it isn’t relinquishing anything that could potentially have value.

As the La Guitarra mine was recently in production, the existing mining concessions remain in good standing. That’s important as it means La Guitarra should not be subject to the proposed review of the mining law in Mexico. The mining concessions were typically granted for a period of 50 years, and the oldest concession was granted in 1983 (with an initial expiry date in 2033) while the youngest concession was granted in 2007 (with an expiry date in 2057). It’s also important to understand that not only does the La Guitarra mine have its mining concessions in good standing, according to the technical report (filed on SEDAR) the operating license, water use permit and environmental permits remain on good standing as well. This means that once Sierra Madre feels comfortable to reopen the mine and restart the milling activities, there shouldn’t be any regulatory hurdle prohibiting the company from doing so. The local communities are on board as well as the current surface rights access agreement (for just over 60 hectares) is valid until 2027 (this is the area the mill and infrastructure are located on). Another 420 hectares of surface rights has been leased for a period of 22 years, which will expire in 2037.

The project comes with a historical resource calculation reported by First Majestic (disclosed in the 2021 Annual Information Form) containing 701,000 tonnes of rock at 228 g/t silver and 1.22 g/t gold in the measured and indicated resource category. And 1.04 million tonnes at 240 g/t silver and 0.71 g/t gold in the inferred resource category. According to First Majestic’s calculations, this results in 7.45 million ounces of silver-equivalent in the measured and indicated category and just over 10 million ounces silver-equivalent in the inferred resource category. Sierra Madre will produce an updated resource report by the end of 2023. There has been over 236,000 metres of drilling over 1,400 drill holes at La Guitarra, so we expect the new resource number to be substantially more.

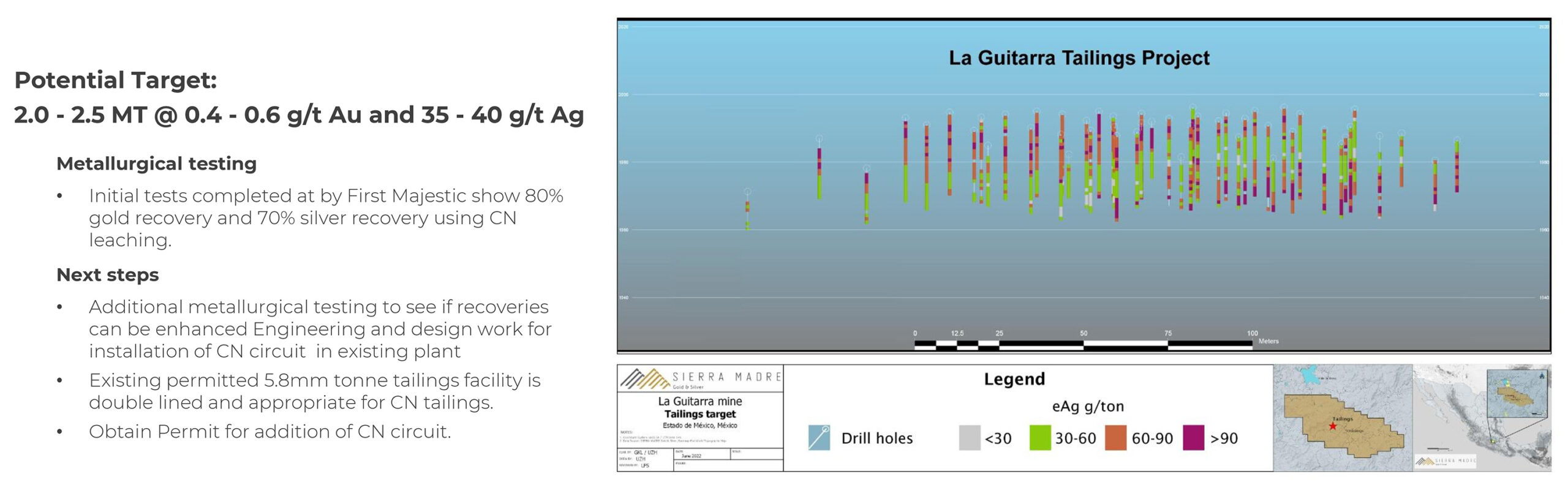

An additional bonus feature of the La Guitarra district is the easy access to the existing tailings which could potentially be reprocessed. Initial metallurgical test work (completed by First Majestic Silver) shows about 70% of the silver and about 80% of the gold can be recovered using cyanide leaching. Considering the total targeted tonnage on the tailings facility is 2-2.5 million tonnes at 0.4-0.6 g/t gold and 35-40 g/t silver, applying the respective recover rates on the lower end of those grades would result in a recoverable production of 1.5-2 million ounces of silver and about 20,000 ounces of gold. Using the higher end of the potential target you are looking at 2.5 million ounces of silver and 35,000 ounces of gold.

While those aren’t shocking numbers, it again is a case of ‘every ounce and dollar counts’. If those tailings are available and amenable for cyanide leaching, there is no reason why Sierra Madre shouldn’t explore the possibilities here and figure out if reprocessing the tailings could unlock additional value. We should learn more about this in the next few quarters.

Revisiting the deal terms

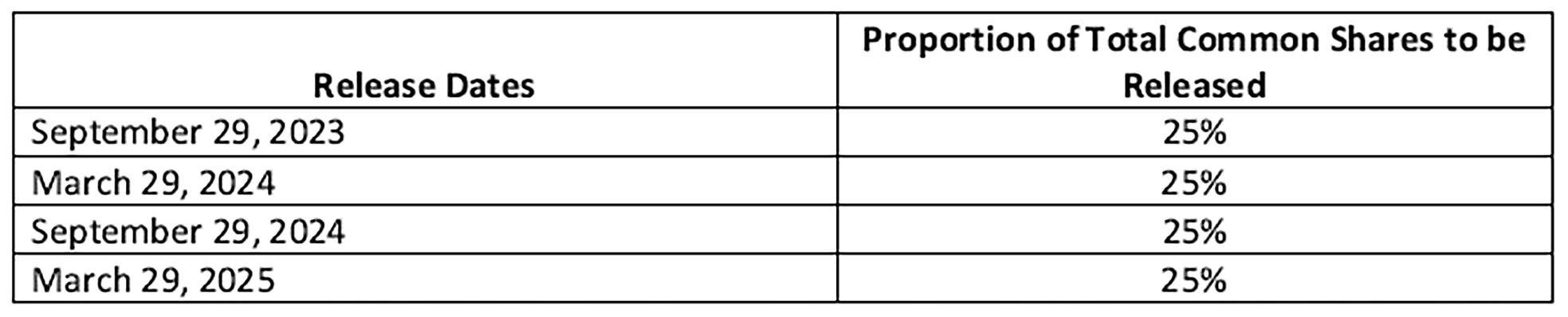

Sierra Madre acquired the asset from First Majestic Silver for a total consideration of US$35M. The entire consideration was payable in common shares (no cash payments were required!) and was settled at a deemed price of C$0.65 per share. As First Majestic took only shares in the transaction, it is fair to assume that First Majestic appears to still be quite convinced about the potential of La Guitarra and Sierra Madre’s management team. First Majestic ended up with just over 69 million shares, which are all escrowed. The escrowed shares will be released on a six month rolling basis with 25% of the share block coming out of escrow on each release date.

It was First Majestic’s original intention to distribute the Sierra Madre shares (or at least the portion exceeding the relevant number to maintain a 19.9% stake in the company) to its own shareholders but we haven’t seen an update on that front yet. We would assume those plans are still valid but we haven’t seen an update from First Majestic on this matter. According to First Majestic’s press release announcing the closing of the sale, the shares it owns in excess of a 19.9% stake are NOT subject to the resale restrictions and can be dividended out to their own shareholders at any time.

First Majestic was also issued a 2% Net Smelter Royalty, of which half can be repurchased by Sierra Madre for US$1M in cash.

As part of the purchase agreement, Sierra Madre also closed a C$10.3M private placement of shares and subscription receipts. The second tranche of 1.3M common shares and 5.1M subscription receipts closed at the end of May. Those subscription receipts will be converted into common shares, which should occur in the coming months.

The US$35M sounds like a steep price to pay for a small non-producing company, but a lot of capital has been invested in the project so far.

First, to replicate 230,000 meters of drilling would cost in excess of US$35,000,000 alone. Building a new 500 tpd facilicty with crushing, grinding, floatation, storage, tailings etc, you’re probably looking at least US$60,000,000. Over 40km in underground development, that’s closer to US$30,000,000. When you add in the equipment, permits, and goodwill with the community etc. you can see the future potential value that Sierra Madre can unlock if they are able to execute on their strategy.

A near-term producer or an exploration company?

It’s perhaps unfair to pose this as a question but it actually was the main question we had after completing the site visit.

Before heading to Mexico, the value proposition seemed pretty obvious. Sierra Madre was acquiring a fully permitted mine and mill in Mexico and therefore should be seen as a producer. The mill works nicely and could process rock tomorrow, if Sierra Madre wanted to. Of course, the company will take its time to make sure that once it switches the mill on, it won’t have to switch it off again. This means there must be a reliable mine plan, a sufficient amount of rock on a stockpile. Sierra Madre is also expected to increase production and will eventually have to increase the ball mill capacity and expand the tailings facility. Note that the floatation cells can accommodate an estimated 1,000 tpd so certain elements of the equipment are already ‘rightsized’ for a potential throughput increase. So in any case, Sierra Madre will need 18-24 months to design a plan and to start executing it. That’s fine, and that still means Sierra Madre is (and should be seen as) a near-term producer.

But the project is ‘unfinished business’ for Chairman and COO Greg Liller. Liller is a very experienced exploration geologist (getting closer to the 50th anniversary of obtaining his geology degree) and his passion for exploration was very clearly noticeable during the site visit. His energy level clearly surged and he likely felt 20 years younger when he discussed the exploration potential of the so-called Guitarra East District where very little modern exploration has taken place.

The first silver-bearing veins were discovered in the mid-1500s and there has been production from this district on an intermittent basis. The majority of the available data point in the direction of the Rincon zone, where historical reports indicate the average grade of the rock that was mined in the 1800s was 6.6 g/t gold and 880 g/t silver.

So it’s perhaps surprising past owners and operators of the Guitarra mine didn’t really dig deeper (pun intended) into the Rincon zone and subject to the exploration budget, Sierra Madre will likely want to get a better understanding of the Rincon zone as it shouldn’t be too difficult to truck rock from Rincon to the existing mill facilities at La Guitarra. There are multiple historical resource calculations and exploration targets on the East District (these were compiled in 2002 by Luismin, one of the previous owners of the Greater La Guitarra project and are non-NI43-101 compliant), but Sierra Madre could very well be the first party to apply a methodological exploration approach to figure out which role the East District could play in the story.

The East District is the least advanced and will need time and money (and blood, sweat and tears) to move towards a compliant resource estimate. But COO Liller also seemed excited about the exploration potential at and around the main Guitarra mine. We were particularly impressed with the Coloso mine, which is located a few kilometers from the milling facility. That also was the zone First Majestic was focusing on, and the technical report on La Guitarra contains a historical reserve calculation completed by First Majestic in 2018. As you can see below, historical underground reserves were estimated to contain 1.3 million tonnes of rock at an average grade of 223 g/t silver and 1.06 g/t gold for a total of 9.4 million ounces of silver (and in excess of 11 million ounces of silver-equivalent).

Although that is a historical resource and should not be relied upon, it was a good enough result for First Majestic to start constructing a production-sized drift towards the mineralized zones.

But to go back to our original question here. Should we now look at Sierra Madre as a near-term producer or as an exploration story?

We would argue it’s likely a bit of both. The near-term production potential is great as it will – hopefully – provide the company with a positive cash flow (no economic studies have been completed but we are assuming the company’s management will be smart enough to avoid putting something unviable into production, that’s just basic common and economic sense) but the real value will (have to) come from the exploration upside.

The mill currently has a capacity of 500 tonnes per day. Let’s assume the mill runs at full capacity and processes 180,000 tonnes of rock per year. This means the historical measured and indicated resources (calculated by First Majestic Silver and announced in its 2021 annual information form) will provide mill feed for about 4 years with the historical inferred resources adding another 5.5 years.

At the average grade of 299-330 g/t silver-equivalent from the historical resource, let’s assume each tonne contains 10 ounces of silver-equivalent which means that at a production rate of 180,000 tonnes per year, about 1.8 million ounces of silver-equivalent will go into the mill. About 80-85% will be recovered, so let’s say the recoverable and payable silver-equivalent production will come in at 1.5 million ounces per year.

The margin on those ounces is unknown. The company does have the exact detailed historical numbers including; energy costs, manpower costs, milling costs, etc. We don’t know the numbers but you can make your own assumptions. At a margin of $5/oz on an all-in sustaining basis, the mine will generate $7.5M in cash flow and for every $2/oz increase, an additional $3M in cash flow would be added. At a margin of $10/oz above the all-in sustaining costs, the mine will generate $15M per year. Again, this back-of-the-envelope calculation is based on just assumptions and are in no way the company’s official projection or guidance.

That’s on the mine level. Sierra Madre will need a few million dollars for corporate G&A and to cover other expenses like land holding fees and keeping the other assets like Tepic in good standing. So a 500 tonnes per day operation could maybe generate $10M per year in discretionary cash flow using a margin of $10/t. That’s plenty of cash to aggressively push forward the exploration plans and that strengthens our view we should look at La Guitarra as a district-scale exploration project with hopefully near-term cash flow.

Conclusion

We are now looking at Sierra Madre Gold and Silver from a Silver District perspective and not necessarily from the production perspective. Whilst every dollar of incoming cash flow will be very important to the company to reduce its dependence on the capital markets, every single available dollar will (have to) be reinvested in exploration. COO Greg Liller is very upbeat on the exploration potential so he will be happy to try to ‘finish his unfinished business’.

Sierra Madre’s share price seems to have stabilized in the mid-40 cent range and with just under 143M shares outstanding, the current market capitalization is less than C$60M and less than US$50M which isn’t expensive for a company with a fully permitted mine and mill in Mexico. Sierra Madre also still has about C$10M in cash on the balance sheet thanks to the concurrent capital raise, which was completed at C$0.65, about 40% above the current share price. Every single participant in that raise is currently underwater.

It took the company a year to close the transaction and the team must be excited to hit the ground running.

Disclosure: The author has a long position in Sierra Madre Gold & Silver. Sierra Madre is a sponsor of the website. Please read our disclaimer.