When we first discussed Taiga Gold (TGC.C) in March, we were looking forward to seeing the results of the past winter exploration season. SSR Mining (SSRM, SSRM.TO) was able to almost fully complete its drill program on the Fisher property before it suspended operations at the very profitable Seabee gold mine in Saskatchewan due to the COVID-19 outbreak.

It always takes a little while for the assay results to come in, but SSR Mining has sent Taiga Gold a comprehensive overview of the exploration results and this allowed Taiga to publish an exploration update themselves. As the exploration programs on Fisher aren’t material to SSR Mining (which produced almost half a million ounces gold-equivalent in 2019) SSR won’t report on these drill results themselves but they do make a big difference to Taiga Gold as Fisher is by far the most active project in its portfolio.

A brief recap on the Fisher property – and the greater Tabbernor fault region

Taiga Gold was spun out of Eagle Plains Resources in April 2018 whereby shareholders of Eagle Plains received 0.5 shares of Taiga Gold per share of Eagle Plains they owned.

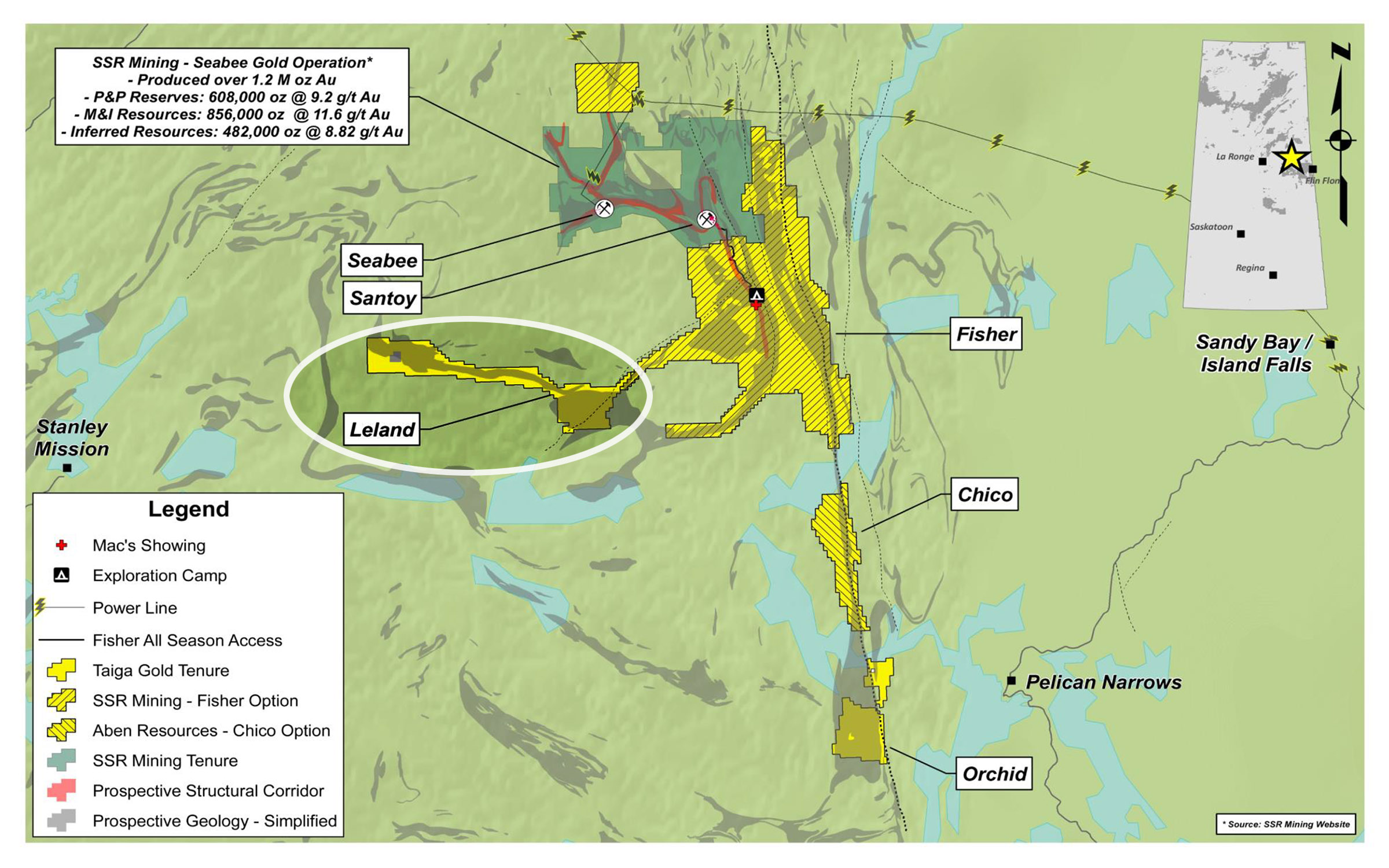

The main asset of Taiga Gold was (and still is) the Fisher gold exploration project in Saskatchewan. About half a decade ago, Eagle Plains had researched gold project acquisition opportunities amidst a market downturn and identified an area along the Tabbernor fault in the region of Claude Resources’ Seabee gold mine. A series of projects were staked, securing a large strategic position along the Tabbenor Fault just before SSR Mining swooped in and acquired Claude Resources. The Fisher property was quickly optioned to SSR Mining while Aben Resources (ABN.V) entered into an earn-in agreement to obtain a majority stake in the Chico property, located a bit further to the south along the same Tabbernor Fault. For now, the Leland and Orchid projects remain fully owned by Taiga Gold but should new joint venture partners come knocking on Taiga’s door, we have little doubt the company will be listening to any potential offers to collaborate on the exploration front.

Back to Fisher. Eagle Plains was able to stake the property at a very low cost, then just weeks later SSR Mining approached Claude Resources to acquire that company for its low-cost Seabee gold mine. Discussions between Eagle Plains and SSR Mining began shortly afterward whereby SSR Mining ultimately signed an option agreement allowing it to earn a stake of up to 80% in the Fisher project.

To earn an initial 60% stake in the project, SSR Mining was required to spend C$4M in exploration within a 4 year period, as well as paying C$100,000 in cash upon signing and C$75,000 per year during that 4 year period (one final payment of C$75,000 will be due in October of this year). By January 2020, SSR Mining had already doubled the required C$4M exploration expenditures and is currently working on a 12,000-meter drill program (9,500 meters was already completed) at the Fisher which is estimated to bring these expenditures to triple the $4M obligation. As of the end of April, SSR Mining had spent roughly C$10.3M on exploring the Fisher project.

SSR Mining will only earn the 60% stake once it formally notifies Taiga Gold it has met the requirements. So at this point, the property is technically still 100% owned by Taiga Gold despite SSR having greatly exceeded the exploration spending requirements. Once SSR provides the formal notice to Taiga Gold, it will have a one year period to acquire an additional 20% interest (to bring its stake to 80%) for a C$3M cash payment to Taiga Gold. Taiga Gold will also hold a 2.5% NSR on the Fisher property of which 1% can be purchased for C$1M. On top of that, once SSR Mining decides to form the joint venture, it will be required to make C$100,000 in annual cash payments as advance royalty payments to Taiga Gold, further reducing Taiga’s reliance on capital markets.

Although SSR Mining has already spent a multiple of the required exploration expenditures to complete the initial earn-in, it still hasn’t formally notified Taiga so the exploration plans are just ongoing and are still fully funded by SSR Mining (although Taiga currently still is the 100% owner of the project).

SSR Mining just shared the highly-anticipated exploration results

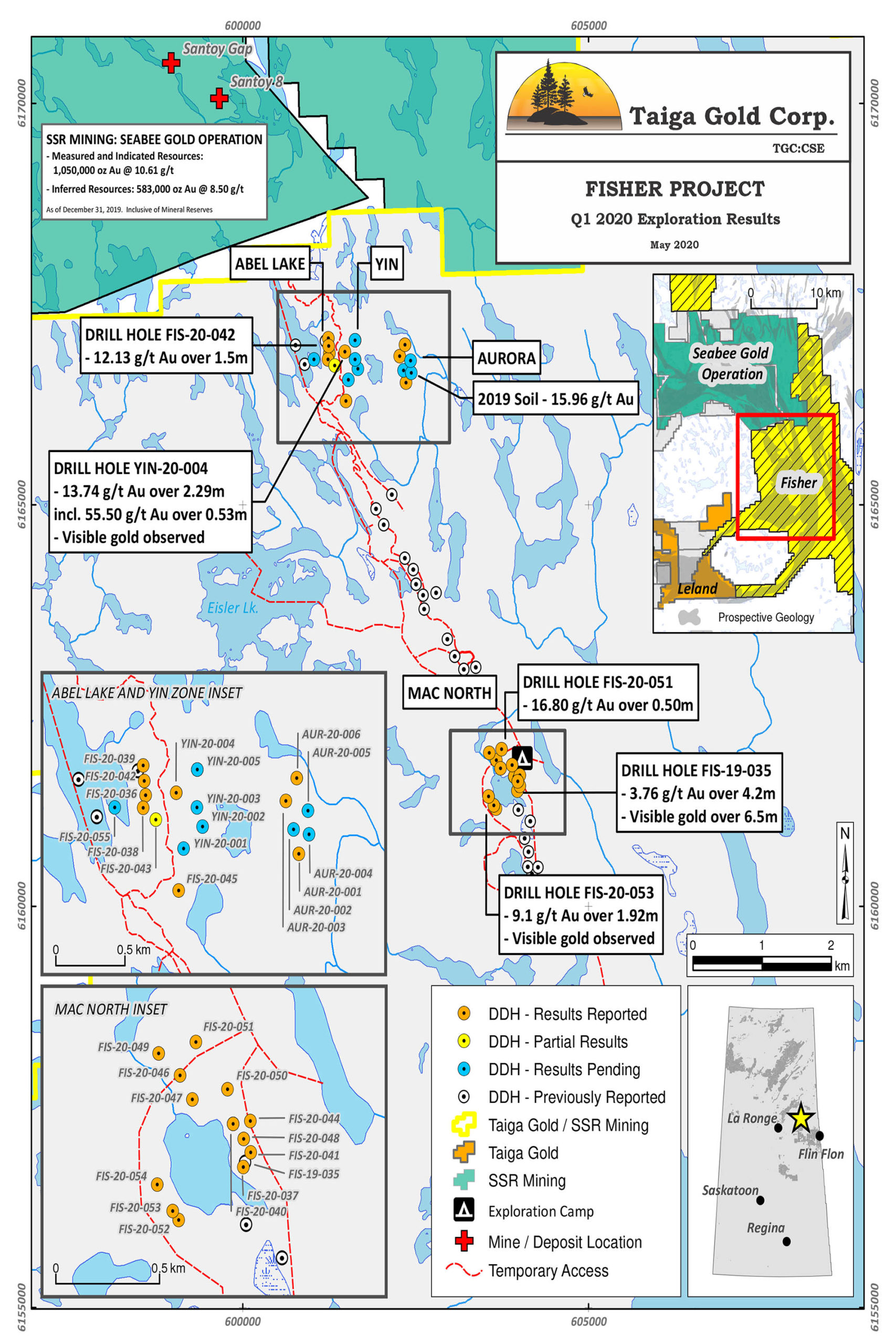

SSR Mining’s winter drill program on the Fisher property was well-timed as SSR was able to get most of the drilling done before COVID-19 disrupted the Seabee operations. The company completed 31 holes for almost 9,500 meters of drilling (indicating an average depth of just over 300 meters per hole). The assay results of 23 of those 31 holes have been shared with Taiga Gold (with the assays of five more holes and a part of hole 43 pending).

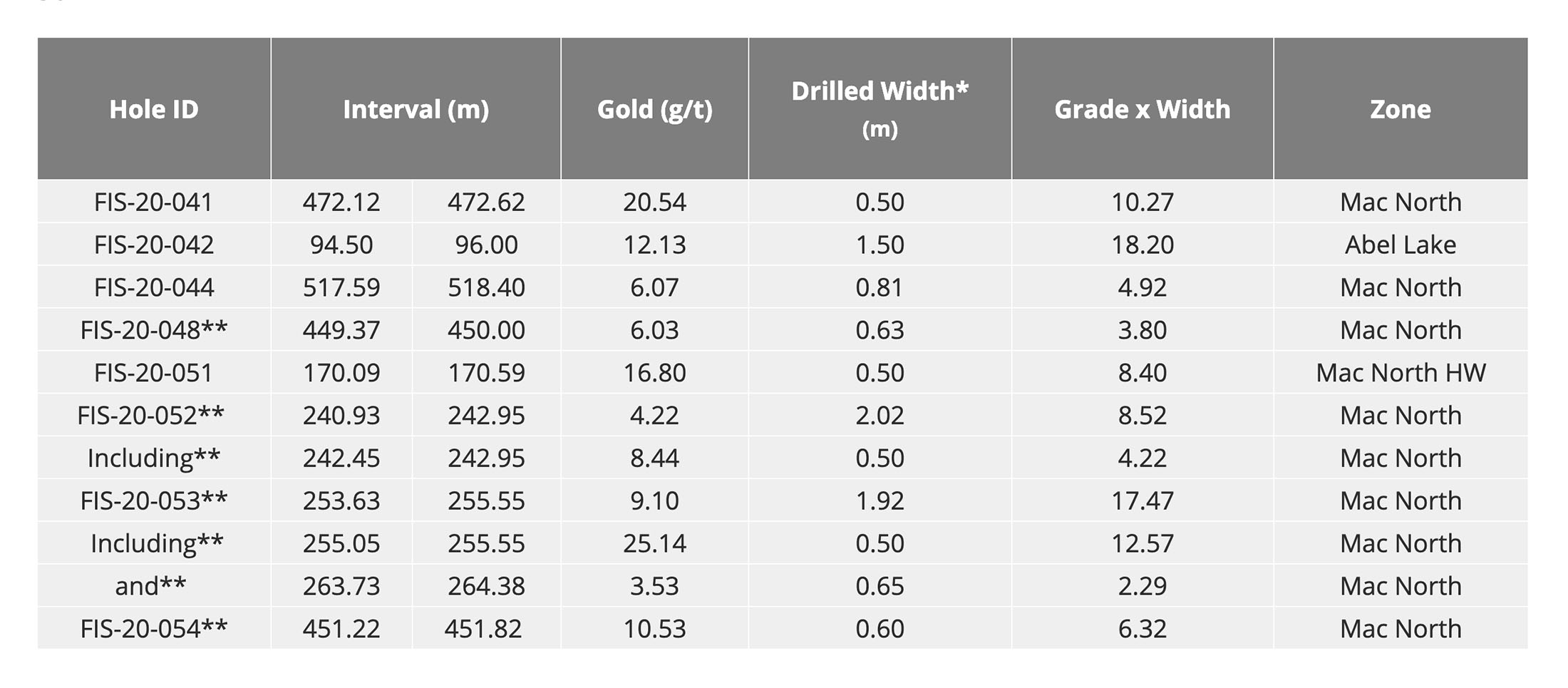

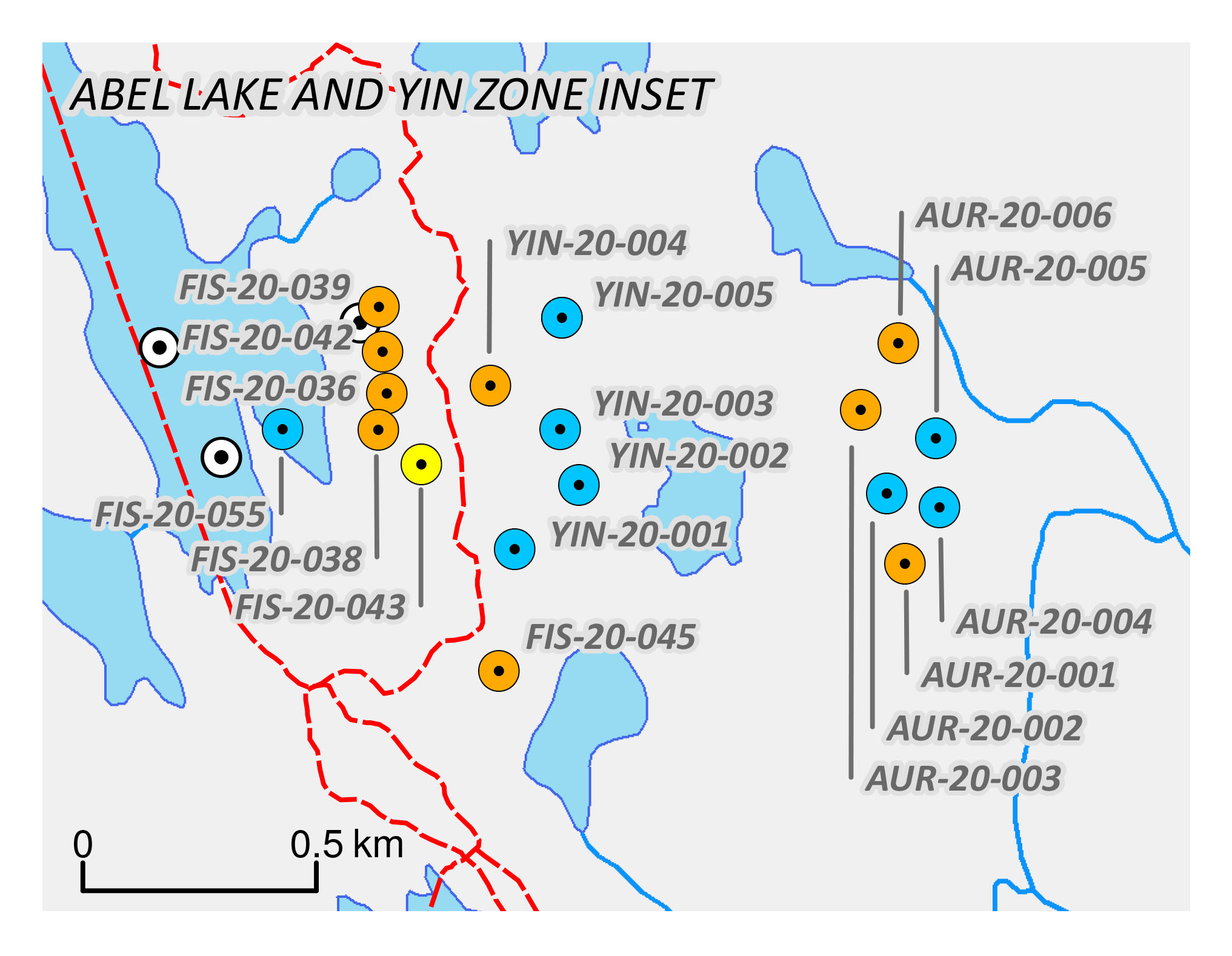

SSR was planning to methodologically test six distinct areas of interest on the Fisher property, four were tested and two deferred to later because of winter road access issues (early thaw) and early completion due to COVID 19 concerns. Of these four widely-spaced target areas tested, three resulted in significant gold discoveries – a remarkable achievement! The majority of the highlighted intervals in Taiga’s press release were zooming in on the Mac North zone, approximately 10 kilometers from the property boundary.

This zone continues to deliver and although the widths of the mineralized intervals are still quite narrow, the average grade indicates there is more than just a sniff of gold on the Mac North zone. There was a good reason for SSR Mining to revisit Mac North in the Winter Drill program and we expect SSR to continue to poke some holes into Mac North chasing the mineralization in an attempt to encounter wider mineralized areas.

According to the old technical report on the Seabee mine, the mining width at Seabee ranges from 2-26 meters and zones as narrow as 2 meters are being mined, as long as the gram-meter value exceeds the 18-20 (so 2 meters at 9 g/t gold would work, 4 meters at 4g/t would not be ideal). So while the grades are interesting at Mac North, the width of the mineralization needs to increase.

Interesting results, but what caught our attention were the assay results from the Yin zone. This zone is close to the border with the land package of the Seabee mine and a stone throw east from the Abel Lake zone where the 2020 drill program encountered 1.5 meters containing 12.13 g/t – which appears to be a mineable width as even with some mining dilution the grade of such an intercept should be sufficient to be economic.

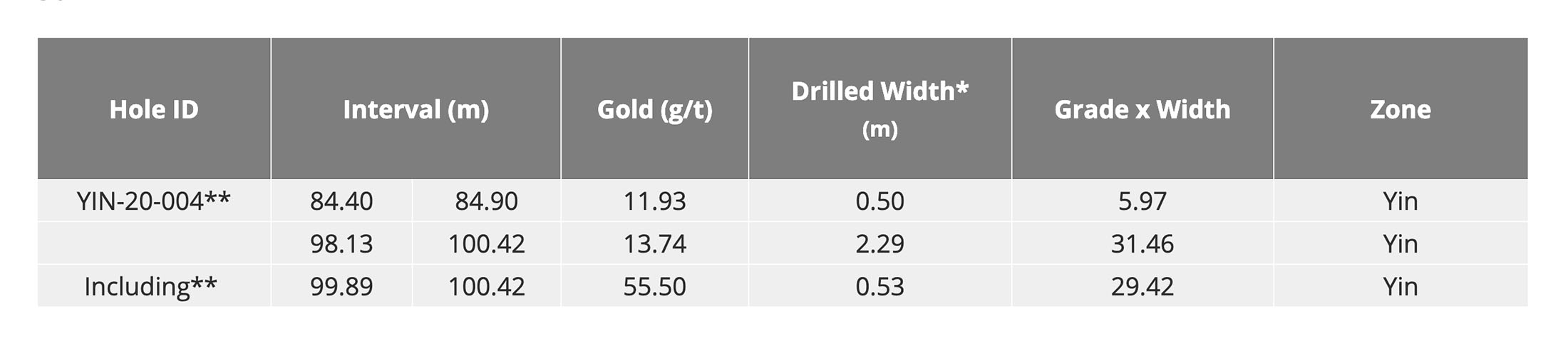

Six holes were drilled into the Yin zone, and the five assay results that are still pending are all part of the Yin zone. The first hole that has been reported confirmed the presence of near-surface high-grade gold with 0.5 meters of 11.93 g/t gold starting 84.4 meters downhole followed by 2.29 meters of 13.74 g/t gold less than 15 meters deeper.

The 2.29 meters of 13.74 g/t is quite impressive but has been boosted by the narrow ultra high-grade interval of 0.53 meters containing a jaw-dropping 55.5 g/t gold preceded by 0.5 meters of 4.03 g/t gold (while the rest of the 2.29 meter interval was barely mineralized).

However, that one Yin hole could be very interesting. Not only does the gold mineralization occur close to surface, the grade is pretty good as well and the hole – which was continued to a total depth of 195 meters – continued to pick up traces of gold with a few 1-meter intercepts with average grades between 0.11 and 0.45 g/t gold.

This also means we are looking forward to seeing the assay results from the five remaining holes at the Yin zone. As you can see on the image above, those were drilled east of the discovery hole at Yin, and any (preliminary) continuity of the gold mineralization could be of interest given the proximity to the producing Seabee mine.

SSR Mining is currently working on the interpretation of the assay results and once the lab provides an update on the eight remaining holes, SSR will very likely put another strategic exploration plan together. Given the decent results on the Fisher property, we expect SSR Mining to continue its exploration efforts as part of the earn-in agreement with Taiga Gold.

A joint venture deal with SKRR Exploration on the Leland project

Last week, Taiga Gold also announced it entered into an agreement with SKRR Exploration (SKRR.V) whereby the latter can earn up to a 75% stake in Taiga’s Leland gold project which is also conveniently located in the Greater Seabee district, almost directly south from the Seabee mine.

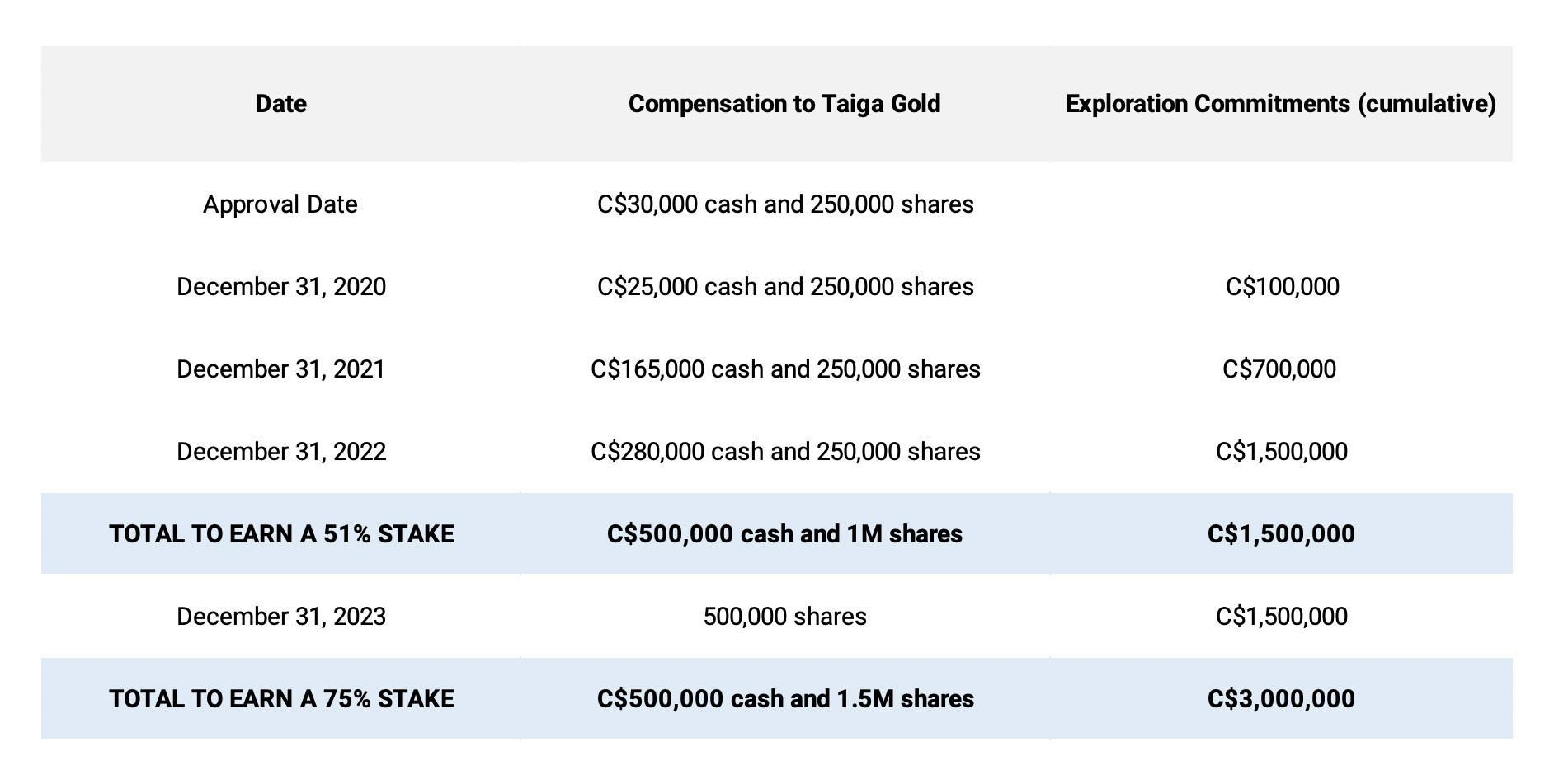

To earn its 75% stake, SKRR will have to make cash payments totalling C$500,000, issue 1.5M shares to Taiga as well as commit to spending C$3M on exploration before the end of 2023. We have summarized the earn-in terms in the table below.

While SKRR is working towards its initial 51% stake, Taiga Gold will remain the operator (and will very likely earn an operator fee, usually 5-10% of the amount spent on exploration and this will further help to keep Taiga’s corporate cash burn under control.

We are also pleased to see the relatively heavy share component of the earn-in deal. The initial 1M shares are currently worth in excess of C$300,000 and if SKRR Exploration indeed hits a home run, Taiga Gold will be surfing on their waves with its share position and remaining 25% exposure to Leland. SKRR is run by a very respectable team which includes Ron Netolitzky and Ross McElroy, both legendary Saskatchewan explorers (Ron earning a place in the Canadian Mining Hall of Fame and Ross winning the Bill Dennis award for exploration success in 2014). They also have a very effective marketing team which will undoubtedly bring additional attention to the area.

Parent company Eagle Plains also had some news

It’s impossible to discuss Taiga Gold without referring to the ‘parent’ company Eagle Plains Resources (EPL.V). Eagle Plains has been around for a while as a ‘project generator’. It finds/stakes/acquires projects which it subsequently tries to advance either using its own money or the money from potential optionees that would then be earning a majority stake in the project. But rather than just keeping all properties, Eagle Plains has decided to spin out the projects that are sufficiently advanced to fit in the portfolio of a standalone company.

And although we will continue to focus on Taiga Gold as the company has a clear exit strategy with SSR Mining drilling the Fisher property, it does make sense to keep an eye on Eagle Plains as well.

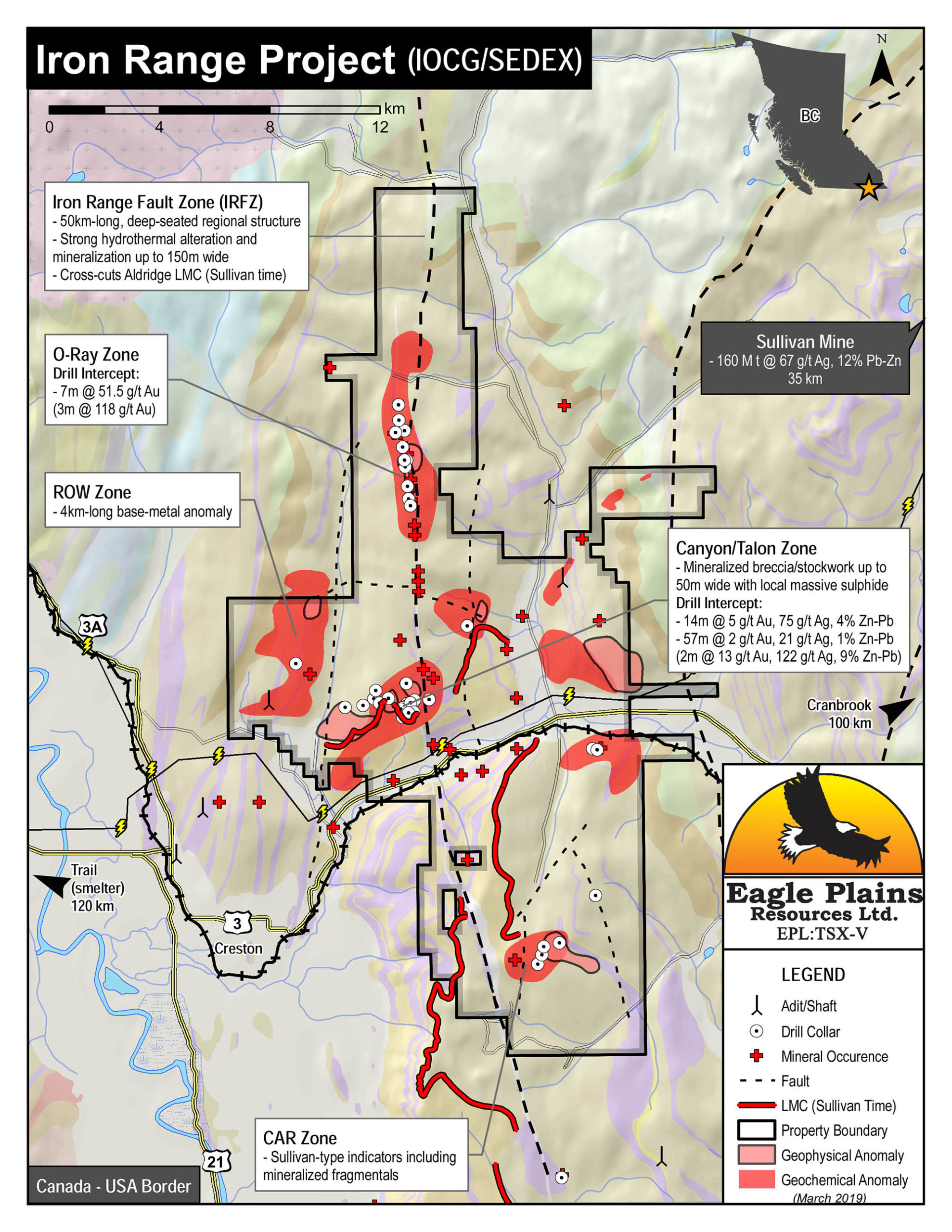

Eagle has recently signed a formal option agreement with a private company allowing the private company to earn an initial 60% interest in the Iron Range project in British Columbia. In a first step, the private company needs to spend C$3.5M in exploration expenditures and make C$250,000 in cash payments to Eagle Plains. Additionally, the private company can boost its stake to 80% by making a C$1M cash payment to Eagle Plains where after both companies will form an 80/20 joint venture to further advance the project.

Now an exploration agreement has been signed, we can look forward to seeing more exploration results from Eagle Plains as the private partner will very likely want to hit the ground running to figure out if the Iron Range property hosts the IOCG (iron oxide copper-gold) and/or Sullivan-style sedex zinc-lead-silver mineralization one has been looking for. Previous drill programs at the Talon Zone on the Iron Range did encounter gold-zinc-lead-silver mineralization and this undoubtedly is something the private joint venture company will want to follow up on.

Saving the best for last, Eagle Plains plans to deviate slightly from the project generator model and fund a single drill hole on its Vulcan Property in its hunt for the Sullivan II. The Sullivan was a world-class SEDEX deposit in Kimberley, B.C. that was mined for 92 years producing around 160Mt of 13% Pb/Zn in addition to a couple of oz of silver per ton. This is Eagle Plains backyard as their headquarters are only 50km away. This has huge potential as these Sullivan type deposits are known to occur in clusters and can be very large, yet no other has been found in the Sullivan camp despite many years of exploration by many companies. Eagle Plains has been putting this puzzle together for about 2 decades and has identified two anomalies, one significant on its own but accompanied by another very large one but a bit deeper. This 700m drill hole is targeting the smaller and shallower anomaly and planned to start in June.

Conclusion

SSR Mining’s continued investment in the Fisher property continues to pay off as the SSR exploration team continues to find gold in the prioritized zones. It’s still too early to start thinking about putting a resource together as the Fisher property is still an early-stage exploration project but the recent drill results confirm the area to be of interest to SSR Mining which is looking for additional satellite zones to keep the Seabee mill up and running once the main mine will be depleted.

The Yin discovery hole is interesting and we are looking forward to seeing the assay results of the next five holes drilled at Yin. If those also contain gold mineralization, we would expect SSR Mining to try to understand if there’s any connection between the Abel Lake and Yin zones.

We also see the announced joint venture on the Leland property as a positive development which doesn’t just emphasize Taiga’s business model and the perceived potential of the Greater Seabee Area, it will also help Taiga to have news coming out from two interesting exploration programs in the same region.

Disclosure: The author does not have a long position in Taiga Gold yet. Taiga Gold is a sponsor of the website.