Earlier this month we flew to Sonora, Mexico to visit Tocvan Ventures (TOC.C), the gold exploration company with two interesting exploration-stage projects in the state.

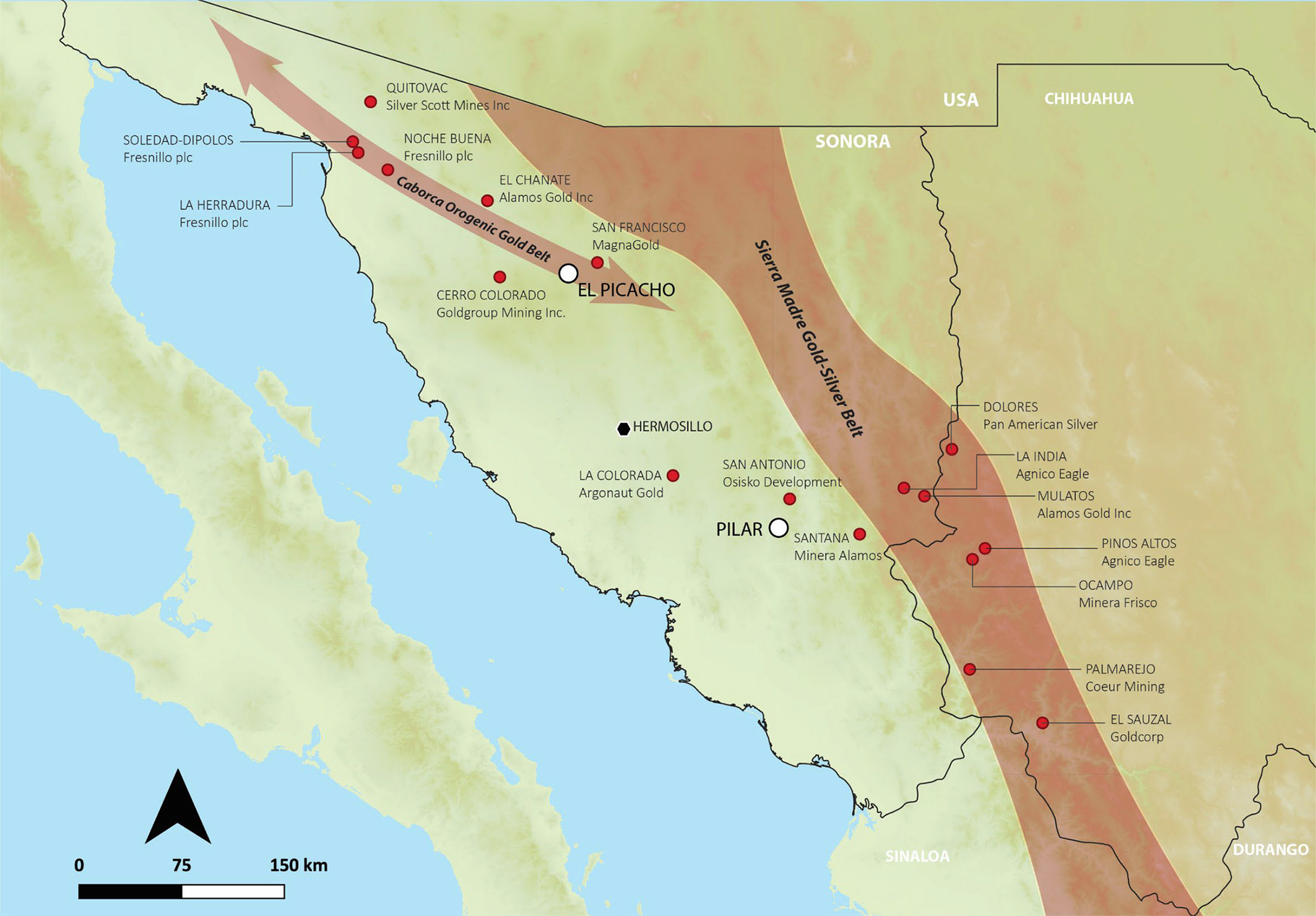

While Pilar still is the most advanced project and therefore Tocvan’s flagship project, we left Mexico with a much better understanding why the local team is so excited about El Picacho. Although it’s still early days at that project, we were perhaps wrong to solely consider it to be a high-grade gold project as evidence is mounting El Picacho could actually be quite similar to the San Francisco gold mine, just 18 kilometers away. The company will drill the San Ramon zone of El Picacho within the next few weeks and needless to say we are looking forward to those drill results.

The company will also restart drilling the flagship Pilar project this quarter and hopefully we can see assay results on either of both projects before Christmas (although we should perhaps be realistic and aim for January).

Hermosillo as a mining town

Although Hermosillo is a relatively sizeable city with a (registered) population of just under a million (comparable to Calgary or Cologne), its airport mainly serves domestic flights. There are multiple flights per day connecting the city to Mexico City so getting in and out is easy enough. There also is one daily flight to and from the USA as American Airlines connects Hermosillo with Phoenix using a small commuter airplane for the 50 minute flight over the Sonoran Desert.

As it’s a relatively small city, Hermosillo is pretty easy to get around in and to find everything one needs so it’s not a surprise Hermosillo acts as ‘mining central’ for the region. There are several drill companies headquartered in Hermosillo and as the city is quite centrally located in Sonora, it definitely acts as a mining hub.

Day 1: Pilar

On the first day of the two day site visit, we visited the flagship Pilar project. That’s the project Tocvan has been drilling in the past few years and it clearly is the most advanced project.

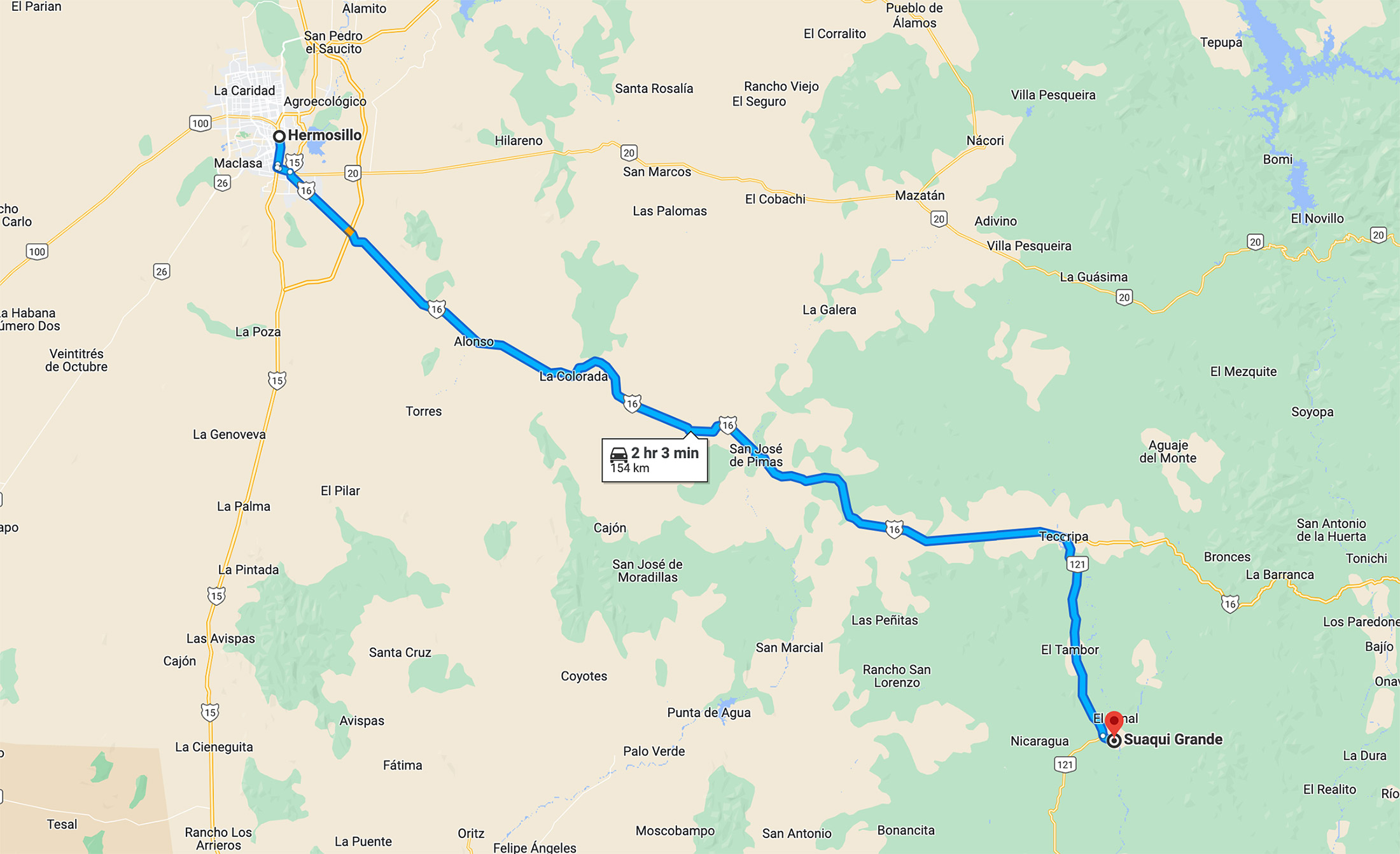

The project is approximately 150 kilometers by road from Hermosillo and just before the halfway point between Hermosillo and the village of Suaqui Grande is town of La Colorada which hosts the namesake gold mine, owned and operated by Argonaut Gold. The entire journey was on paved road all the way to Suaqui Grande before turning onto a dirt road for the final few kilometers.

At the city gate of Suaqui Grande, the local team was waiting for us. Tocvan was able to attract a local female geologist to head up the efforts at Pilar and this likely goes a long way to make sure the local community understands what Tocvan is doing in the field and what it aims to achieve. A social license is important in Mexico and having a local geologist who basically lives next to the property certainly doesn’t harm.

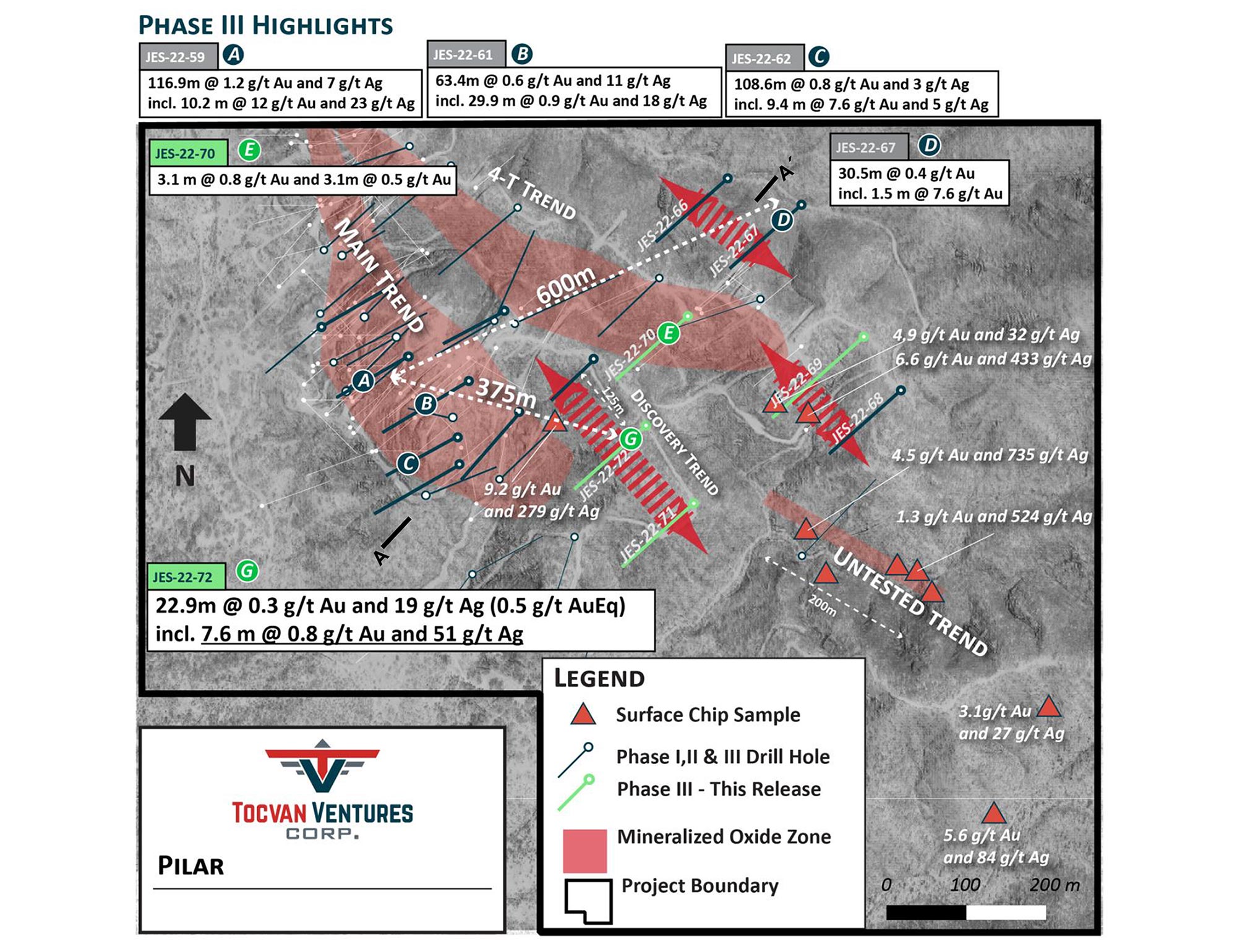

Tocvan released the assay results from the final seven holes drilled at Pilar just a few weeks before our site visit and all seven holes were drilled outside of the Main Zone. Holes 66 and 67 drilled the a new trend while holes 68-70 drilled the 4T Trend and the extension of the 4T Trend while the final two holes, JES 22-71 and JES22-72 were completed on the Discovery Trend, as you can see below.

Although these results were a little bit of a mixed bag and the encountered grades were lower than what we have been seeing at the Main Trend, this seven hole drill program did confirm the continuity of the oxide-hosted gold mineralization at Pilar. The new holes confirmed the gold mineralization is widespread and now it is up to Tocvan’s geologists to try to put the pieces of the puzzle together. 0.3 g/t gold could be viable in Mexico (especially with 19 g/t silver even if the recovery rate for silver would be just 20-25% in a heap leach scenario) so although the higher grade intervals from the Main Trend could not be replicated (yet), the drill results accomplish one important thing: building scale and tonnes.

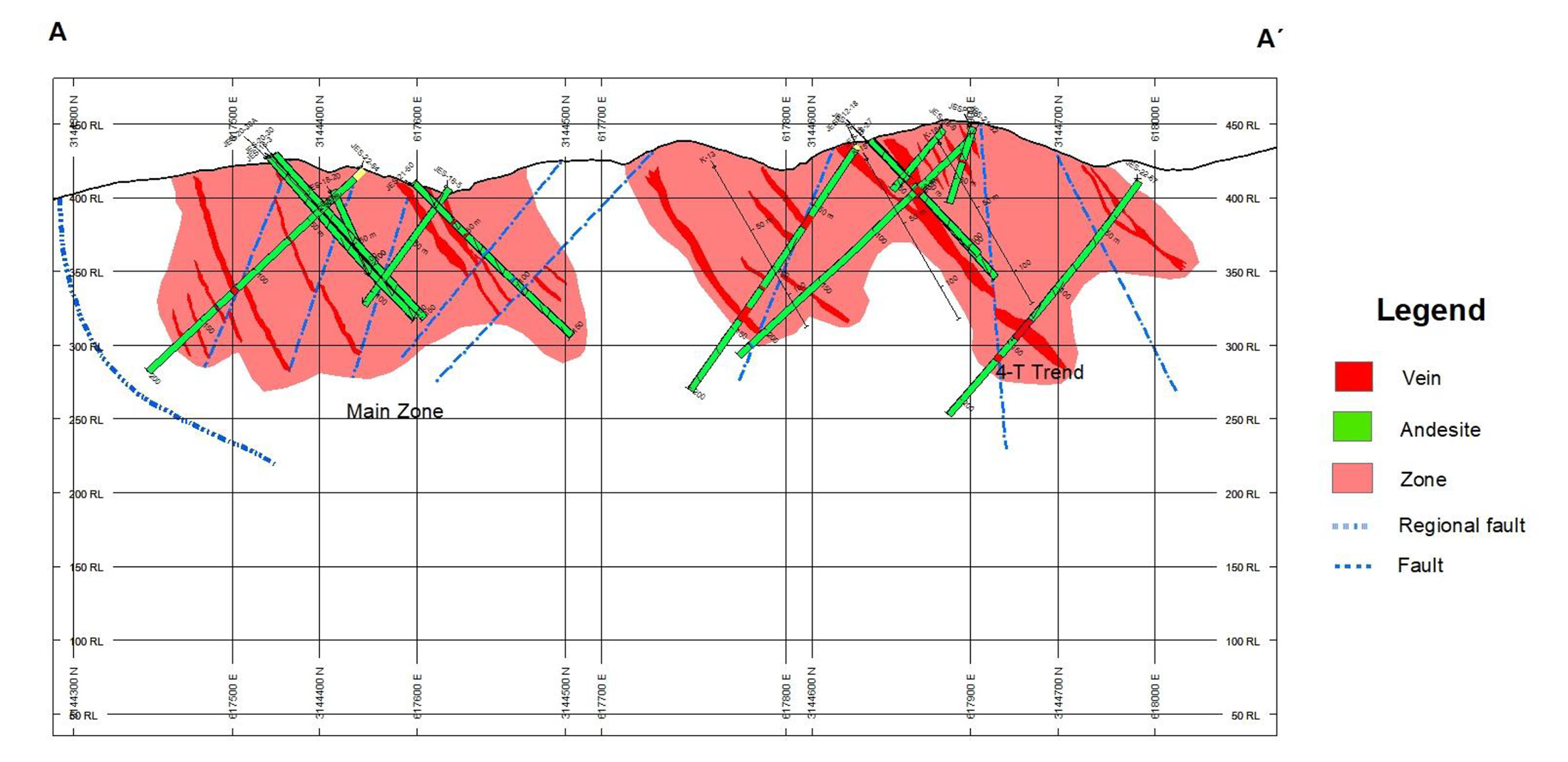

The seven hole drill campaign to drill-test the secondary trends was decided on subsequent to a successful drill campaign that returned encouraging results from Pilar’s Main Zone where diamond drilling retuned 117 meters of 1.2 g/t Au and 109 meters of 0.8 g/t Au in drill holes 125 meters apart. Based on the currently available drill data, we estimate the Main Trend to be approximately 400 by 125 by 80 meters resulting in approximately 10-10.5 million tonnes. If we would assume an average gold grade of 0.5-0.6 g/t, the Main Trend likely already hosts 160,000-200,000 ounces of gold. Clearly not enough to even think about a mine plan as the required critical mass to develop a new mine is larger than that. And the 4-T trend is now shaping up to indeed add tonnes to the global inventory.

We think half a million ounces (across all zones) seems to be the minimum, and that’s why the recent drill results are very encouraging as despite the lower grade material, Tocvan is definitely increasing the scope of its 4-T Trend and the structure running parallel to that trend.

Exploration isn’t easy and a lot more work needs to be done. Tocvan is currently planning a 5,000 meter drill program at Pilar. Approximately 40% (2,000 meters) of these meters will be allocated to infill drilling. The remaining 3,0000 meters will be allocated to exploration drilling and step-out drilling, exactly to try to reach that critical mass needed to think about initiating an economic study on the project.

Another important element that needs to be considered before even wondering if an exploration project could be economically viable is the metallurgy. It’s great to have a few hundred thousand ounces of gold in the ground, but what’s the point if you cannot recover them at a profit?

Tocvan has completed an initial metallurgical test program. It actually used the local lab of Minera Castor, a nearby heap leach gold mine which (although not widely advertised) shares a technical team that also did quite a bit of work on Agnico Eagle Mining’s (AEM, AEM.TO) La India mine. Despite these credentials we should keep in mind the lab is uncertified and additional verification in a certified lab is ongoing.

Four samples (with a head grade ranging from 0.4 g/t gold to 5 g/t gold) were submitted to the Mexican lab and the gold recovery rate ranged from 88.9% to 96.9%. And that’s obviously very good.

Achieving a recovery rate of in excess of 85% for all four samples is an excellent result and although we realize a column leach test will always yield better results than recovering gold in a heap leach scenario there are three elements here that could explain the relatively high recovery rate.

First of all, when looking back at the 2021 bottle roll tests conducted by SGS, the recovery rate of this year’s program doesn’t even appear to be extraordinary high. The average recovery rate in the bottle roll tests was 90.6% and 91.6% for a sample with a head grade of 0.63 g/t gold and 1.15 g/t gold respectively. So although these column leach tests have a higher average recovery rate, the increase definitely isn’t spectacular.

Secondly, it is possible the samples have a relatively high amount of cracks which would increase the surface area subject to the leach solution and thus directly increasing the leach area. And finally, the Mexican lab used a rapid drip approach rather than using a consistent drip which is usually applied in column leach tests.

While it is quite uncommon for a North American exploration company to use the lab of a nearby mine, it’s important to know that SGS, one of the world’s leading data verification firms, has reviewed the data and according to CEO Sutherland, there was ‘nothing fundamentally wrong’. Additional tests are now conducted at the certified SGS labs to double-check the head grade and tail grade of the samples that were used for analysis.

The company will gather another bulk sample in October and November to gain further insight on recovery rates at Pilar. It sounds like Tocvan will use the same facility, but the work will be overseen by an independent QP to make sure all standards are being adhered to.

Day 2: El Picacho

On the second day of the visit, there was a rather easy drive North on a nicely paved highway which connects Hermosillo with Tucson with a border crossing in Nogales which may sound familiar. Not only was there a local Oxxo almost exactly at the side road leading to El Picacho, it was impossible to miss the leach pads and waste dumps of the San Francisco gold. Most Canadian gold mining investors will remember that mine as it was initially successfully mined by Timmins Gold before it ran into difficulties and ownership changed hands a few times. The San Francisco mine is currently owned and operated by Magna Gold (MGR.V). For the time being at least, as Magna Gold’s most recent balance sheet doesn’t bode well for the future and while the mine is still producing at just under 50,000 ounces of gold per year, it’s not generating any cash flow for Magna Gold.

So to us, San Francisco was really just a landmark, a nice-to-see relic of what once was a great mine, located less than 20 kilometers from the Picacho project area.

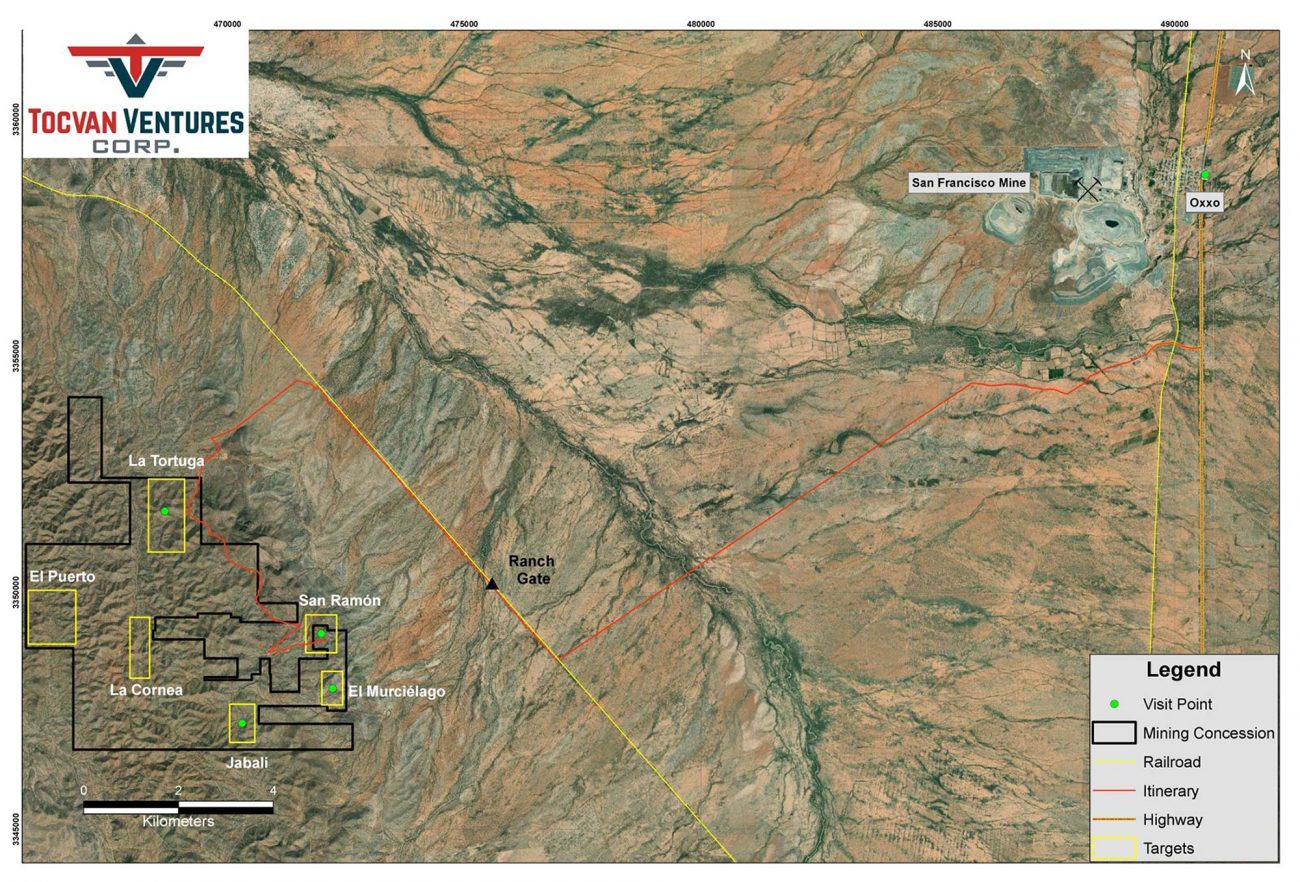

After leaving the paved highway, a well-maintained dirt road took us right to the El Picacho project. Easy access, despite the fact the rainy season had just ended. Our first stop was the La Tortuga zone, located on the northern end of the land package, followed by the San Ramon zone, Murcielago and Jabali prospects. Unfortunately there wasn’t enough time to visit the Puerto and La Cornea zones (and it really is a luxury problem to have multiple high-priority exploration targets on the land package).

Previous operators have taken and analyzed in excess of 2,500 samples with almost 200 of these samples returning an average gold grade of in excess of 1 g/t and 32 samples returning grades exceeding 10 g/t gold. El Picacho currently consists of twelve mining concessions for a total area of just over 2,414 hectares (24 square kilometers) with approximately 6 kilometers of prospective trends.

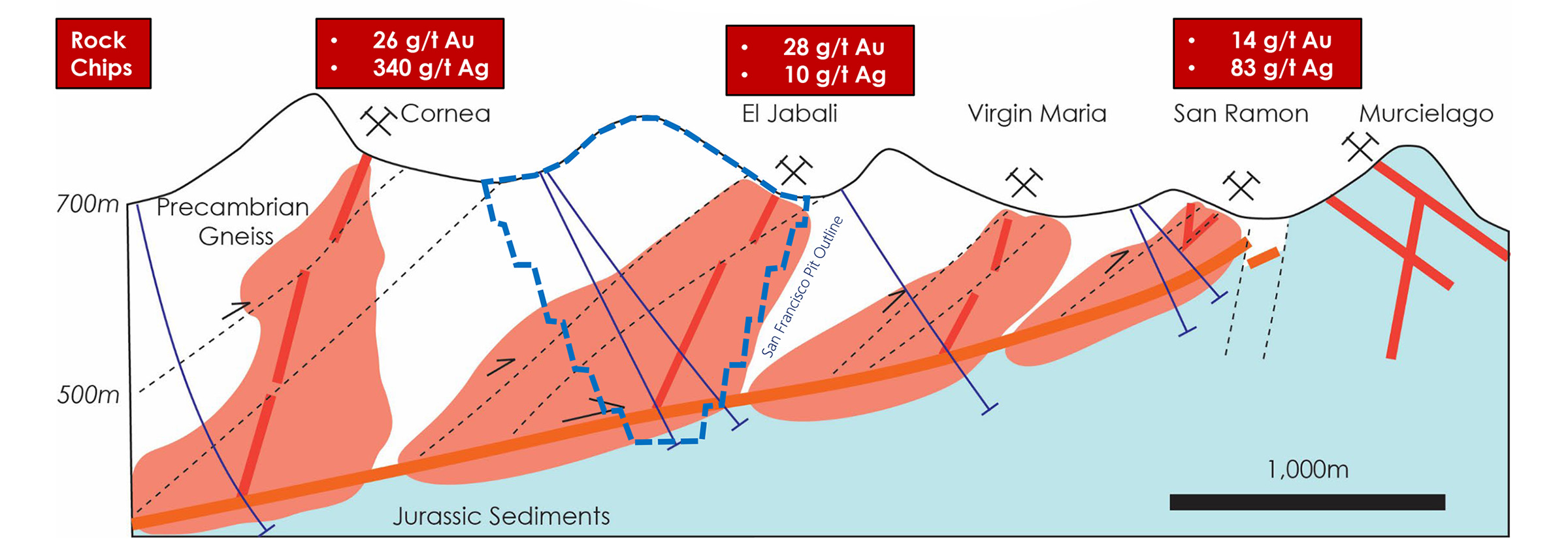

We initially thought El Picacho to be a structurally controlled high-grade gold system (as all historical mining activities were focusing on high-grade veins), but recent exploration activities have indicated there are more similarities to the nearby San Francisco mine than we originally thought. According to CEO Sutherland, the geology and structure is pretty similar to San Francisco. And although the high-grade areas are still important, the company has widened its exploration approach and El Picacho is now believed to host the same low grade and heap leachable mineralization characterizing the nearby San Francisco mine.

And perhaps it’s not a coincidence Tocvan has projected the open pit outline of San Francisco on the crosscut of its exploration (the blue striped line below).

As disclosed by the company, El Picacho will be drilled this quarter. Tocvan will initially focus on the San Ramon prospect where a 500 by 500 meter high-priority zone has been outlined and previous owners never followed up on intriguing drill results from about a decade ago. A previous operator drilled two holes in the San Ramon zone, both encountering gold with for instance 7.6 meters of 0.73 g/t gold and 10.7 meters containing 0.67 g/t gold and more recently, the company completed the surface evaluation and data compilation at San Ramon.

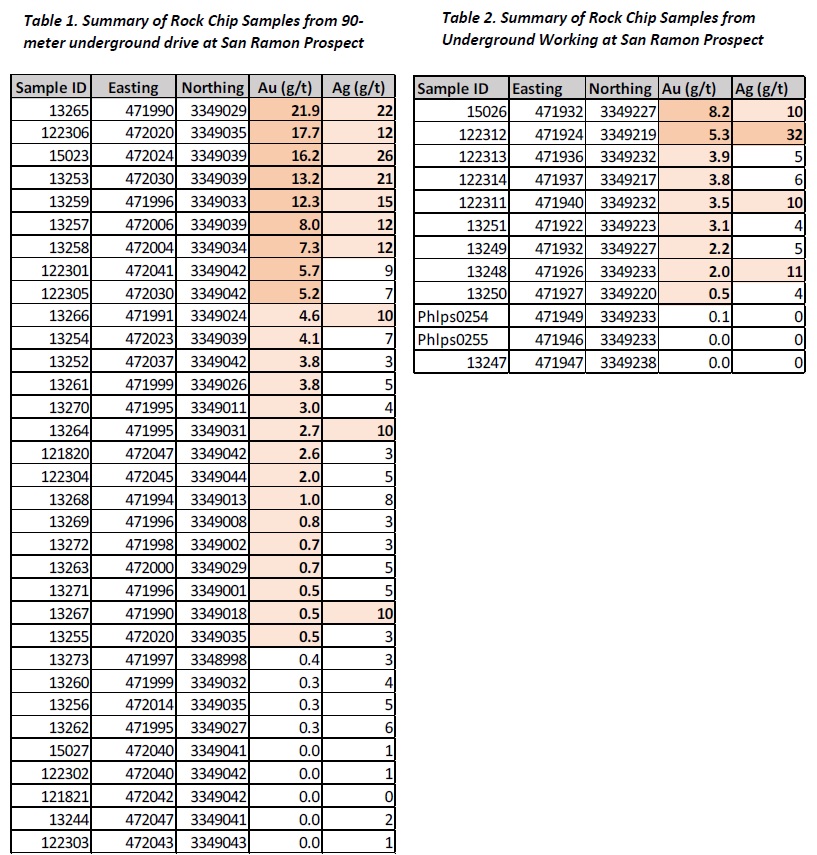

The company wanted to follow up on two historical exploration programs completed by Timmins Gold in 2008 and by Millrock Resources (MRO.V) in 2016. These two companies sampled the underground drive with excellent results as the Timmins exploration program encountered an average gold grade of 5 g/t based on 28 chip samples. Of course there is quite the variation as the encountered grades ranged from 0.3 g/t gold to 22 g/t gold. And about ten years later, Millrock send a handful of samples to the lab for analysis and the nine rock chip samples contained gold grades between 2 and 18 g/t.

And just a few hundred meters to the north from the underground drive, a second underground working was also sampled by Timmins gold and the nine samples submitted for analysis returned values between 0.5 g/t and 8.2 g/t gold with silver values up to one ounce per tonne. The average grade of 3.6 g/t is also quite encouraging but of course, these are just samples and drilling will have to confirm how prolific these old workings and their surroundings really are.

Of course it still is early days at the San Ramon prospect but Tocvan seems to have confirmed the status as ‘Prospect Numero Uno’ on the El Picacho project. The interpretation of the results of the various exploration programs confirm the presence of gold-bearing mineralization along a 500 meter trend, open in all directions. The mineralization has been traced to a vertical depth of approximately 60 meters but it also remains open at depth.

San Ramon is interesting because there’s plenty of history on that specific zone. But let’s not forget the company is also permitted for 2,000 meters of trenching and it will likely complete a substantial trenching program on San Ramon (to define future drill targets). Additionally, the Cornea trend (2,300 meters) and the Jabali trend (450 meters) will likely be trenched as well to generate drill targets for future exploration programs.

These exploration activities will take a while, and the company expects to remain busy until the summer of next year.

Conclusion

Tocvan’s share price has been sliding as just a few larger sell orders are enough to push the share price down. That’s very unfortunate as the current capital raise scheme with Sorbie Bornholm uses a 20 day VWAP to price the monthly tranches of the equity financing deal it has agreed on. But as the only way to create value for the shareholders is to continue its exploration activities, there’s very little Tocvan can do but continue to evaluate their projects.

The site visit allowed us to get a better understanding of the two main projects in Tocvan’s portfolio. While the Pilar project still is the company’s flagship project, we now have a better understanding of the El Picacho project as well and although that project is in an earlier stage, we are looking forward to seeing the assay results from the upcoming drill program to see if Tocvan can indeed prove up the existence of broader lower-grade gold mineralization at El Picacho.

At Pilar, our main ‘concern’ was the lack of critical mass. While we believe the company has outlined a 250,000-300,000 ounce resource, that still isn’t large enough to warrant initiating economic studies. And that’s fine, as Tocvan is diligently ticking all the boxes and the upcoming 5,000 meter drill program will give the company a better idea of where it stands.

Disclosure: The author has a long position in Tocvan Ventures. Tocvan Ventures is a sponsor of the website. Please read our full disclosure.