Tocvan Ventures’ (TOC.C) share price has been very volatile in the past few months and quarters but this didn’t prohibit the company from continuing to work on its Pilar project in Mexico’s Sonora state. The company also added a substantial piece of ground to its already existing land package and has now renamed the project to Gran Pilar; quite applicable.

The company has released drill results throughout the summer and this brings Tocvan one step closer to putting a maiden resource calculation together. With gold at $2600, we can imagine an oxide-hosted gold project will make quite a few heads turn once the dust settles in Mexico. Investors are still worried about an open pit mining ban, but that scenario is still difficult to believe, especially in states like Sonora where mining is important for the local economy.

Tocvan also confirmed that a ‘regional major producer’ has been on site over the summer for a six-week due diligence process. The company mentioned that discussions on ‘next steps’ may follow in the fall, once all the data from the summer exploration program have been received.

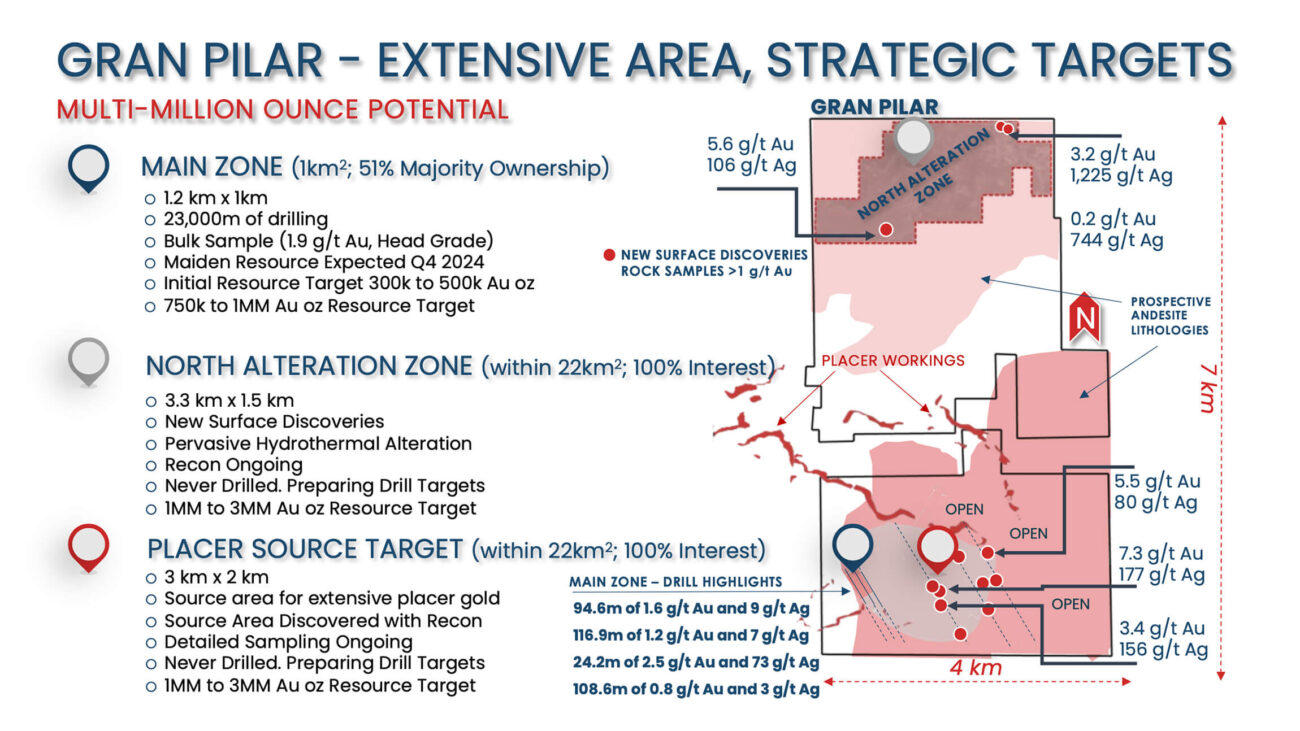

It very likely worked (and works) in Tocvan’s favor it has now expanded the Pilar project (and renamed it to the Gran Pilar project). Tocvan currently owns 51% in the approximately 1 square kilometer Main Zone package with Colibri Resources (CBI.V) holding the remaining 49%. But the remaining 22 square kilometers are completely under Tocvan ownership.

As the ‘major regional producer’ has indicated it is only interested in assets with the potential to host gold deposits with an excess of 2 million ounces, it is clear they would be interested in the regional exploration potential.

Drilling continues to confirm the presence of widespread gold-silver mineralization at Gran Pilar

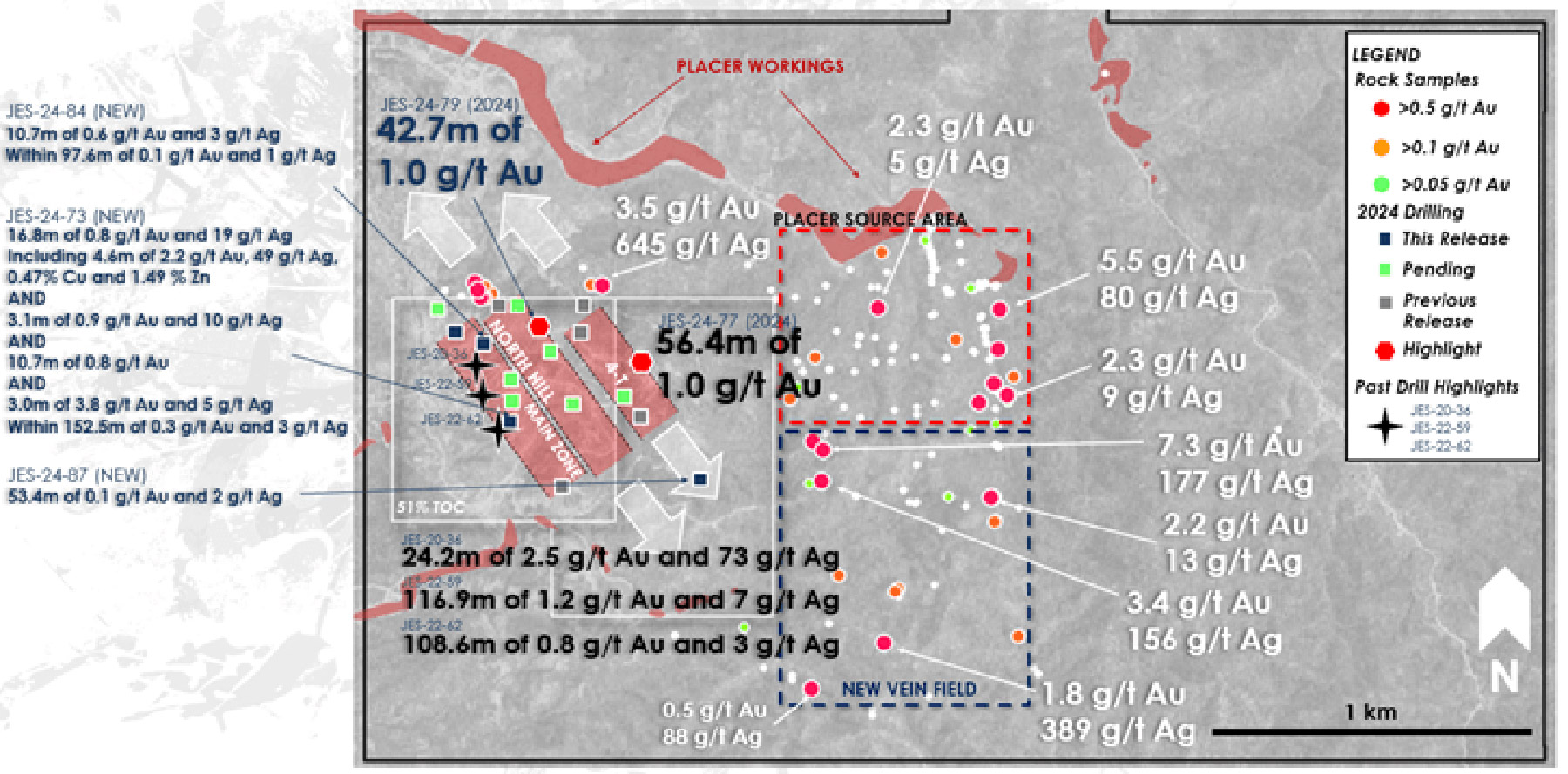

Tocvan has completed almost 3,300 meters of drilling across 26 holes as part of its 2024 exploration program. The company still plans to get back in the field now the rain season has ended, as Tocvan planned to drill in excess of 3,700 meters as part of a resource definition drill program. Meanwhile, the surface exploration program generated additional areas of interest on the property.

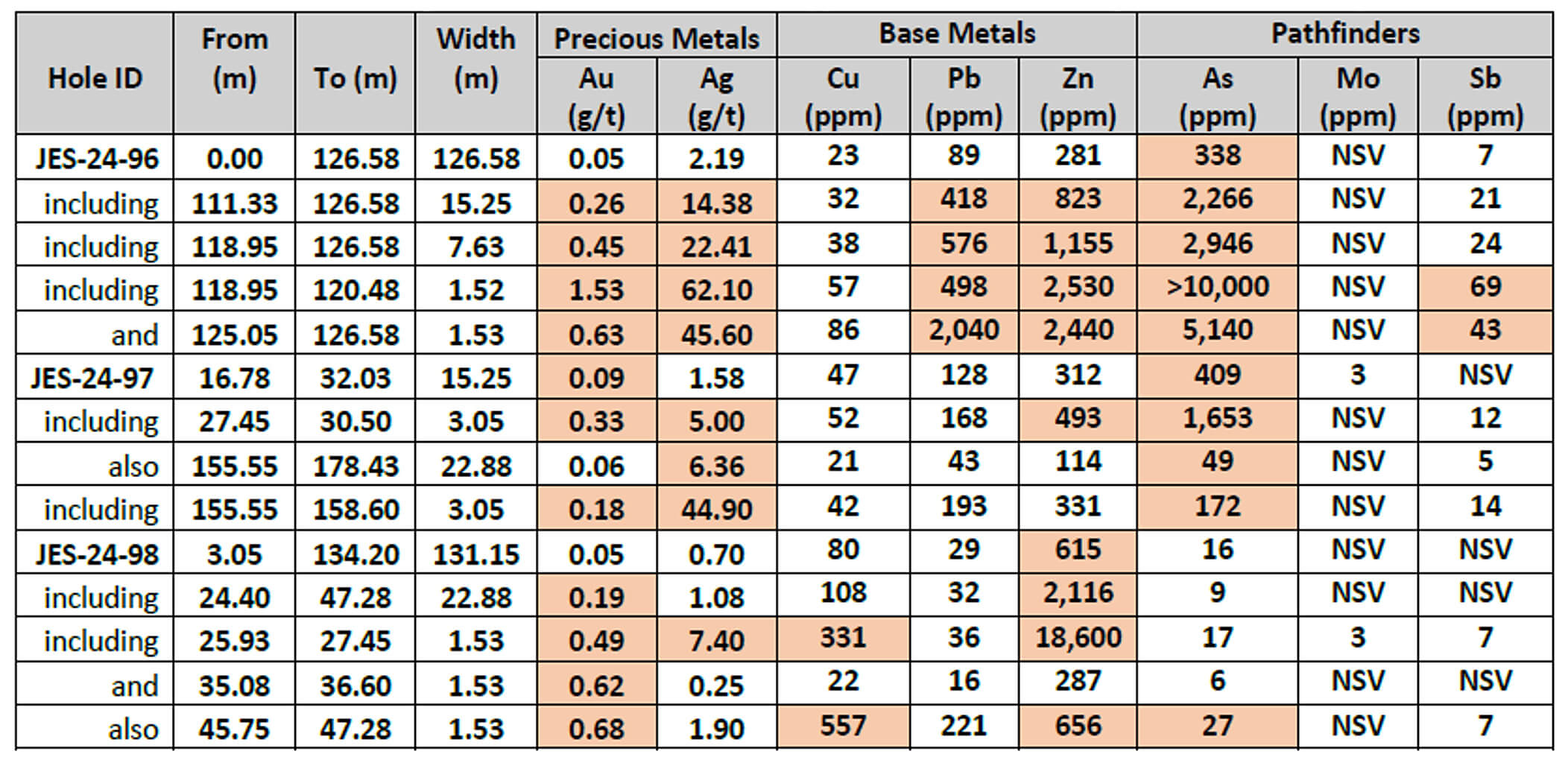

The drill results have been a mixed bag this summer. While Tocvan encountered gold (and silver) mineralization in all holes the grades that were encountered were pretty light in most instances. Of course, it is an oxide-hosted gold project so grades are expected to be low and using a cutoff grade of 0.17-0.2 g/t gold (which is quite typical for oxide gold deposits), most of the encountered mineralisation would likely meet the cutoff threshold. The tables below show the highlights of the most recent three holes.

So yes, there is widespread gold and silver mineralization all over the property, but in order to work towards a preliminary economic assessment the project will definitely need a higher grade. Barely meeting the anticipated cutoff grade won’t cut it.

Fortunately the well-defined Main Zone is providing that grade. The company also completed a few infill drill holes on the Main Zone and with 16.8 meters containing 0.8 g/t gold and 19 g/t silver and another hole encountering 10.7 meters with 0.6 g/t gold and 3 g/t silver. And although these two holes were classified as infill drill holes, they were actually drilled along the edge of the Main Zone and encountering the mineralization in those locations bodes well for a future resource calculation. Additionally, the presence of copper and zinc in hole JES-24-73 is pretty interesting as well, as the drill bit also encountered an interval of 4.6 meters with 2.2 g/t gold, 49 g/t silver 0.46% copper and 1.48% zinc. The company’s technical team thinks this base metal rich zone is related to the silicified magnetite rich breccia which was encountered in the area about two years ago.

Of course Tocvan Ventures is barely scratching the proverbial surface here as the company continued to drill the Main Zone and 4-T Trend, but the blue sky potential seems to be on the North Alteration Zone and the Placer Source Target. The image below indicates the main unique selling points for those targets as the company sees a combined exploration potential of 1-3 million ounces of gold on each zones.

And yes, talk is cheap. So it will be up to CEO Brodie Sutherland and his technical team to figure out the high-priority drill targets and try to build tonnage (and grade!) on those two additional zones. That’s where the exploration focus will shift to.

It’s also important to note the company’s plan to build a pilot plant in Q1 2025 (subject to completing the permitting phase for a small-scale pilot plant in the current quarter). The pilot plant facility will be used to treat approximately 50,000 tonnes of near-surface rock with an anticipated grade of 1.3 g/t. We would expect the company to be able to recover around 1,300-1,500 ounces of gold and the proceeds of the gold sales will be helpful to cover the costs associated with the detailed metallurgical test work. But the additional data and insight into the met work and potential flow sheet will obviously be the most important takeaway. As a reminder, the 2023 metallurgical test program processed just 700 tonnes of material at a recovery rate of 62% for the gold while the gravity and agitated leach process achieved a gold recovery rate of approximately 95%. The outcome of the pilot plant test program will be important to decide how to further advance the project towards a maiden resource calculation and a maiden economic study.

Recent surface exploration results are very encouraging

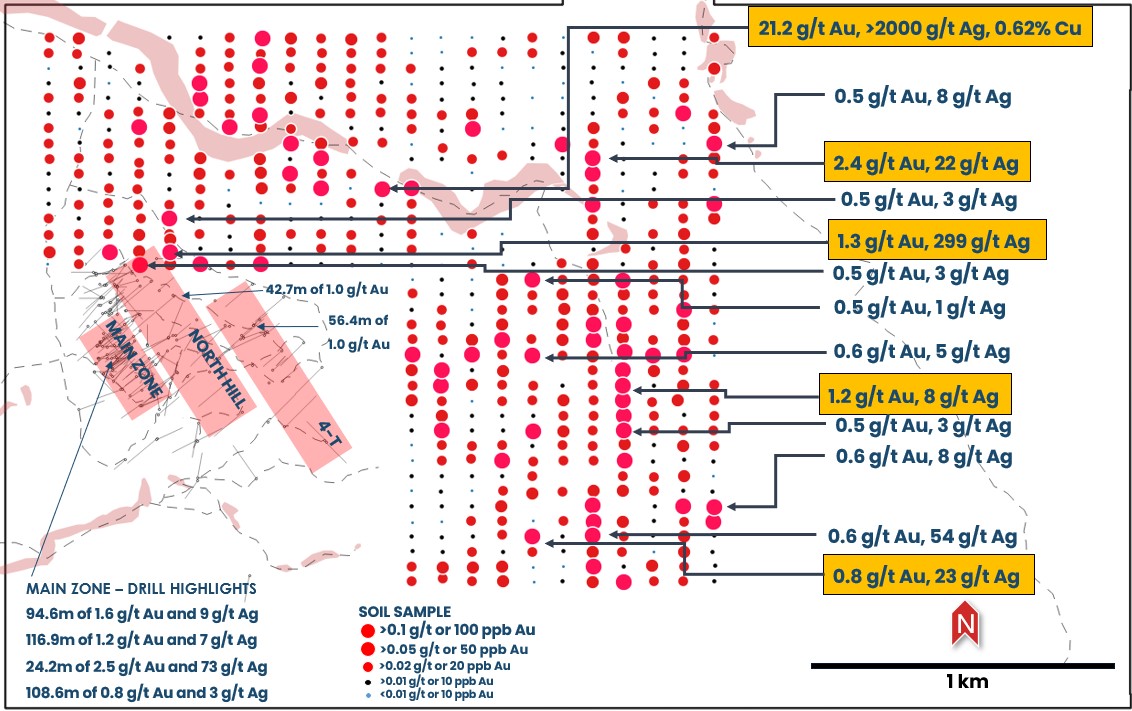

Throughout the summer (and during the rain season in Sonora State), Tocvan continued to work at Gran Pilar as it has completed a substantial surface sampling program, which focused on the northern and eastern extensions of the Main Zone, 4-T Trends and the North Hill. A few hundred samples were collected by Tocvan’s field team and the results – which were recently released – outlined several high grade expansion targets.

A total of 541 soil samples (and 184 rock chip samples) were sent to the lab for analysis, and about two thirds of the samples came back as anomalous (with a grade higher than 0.02 g/t gold) of which 62 samples (approximately 12%)) yielded in excess of 0.1 g/t gold (and warrant immediate follow-up by the company). The highest grade sample (which of course is not representative) yielded 21.2 g/t gold, in excess of 2 kilograms of silver per tonne of rock as well as 12.7% Pb, 2.3% Zn and 0.62% copper. Interestingly, as the map below shows, that sample is next to but up the bank of the stream that has been used by artisanal miners for their placer operations. An old underground mine working was discovered 15 meters away from the sample. It is likely that zones of mineralization like this are the source of the placer gold.

All 541 samples were taken in a block of just two square kilometers in an area that’s 100% owned by Tocvan and the interesting results in the areas where several samples yielded north of 0.1 g/t and in some cases consistently around 0.5 g/t highlight the potential of the Greater Pilar area. The higher grade zones also appear to be directly tied to historical workings, and validate the use of soil sampling as a way to define and refine future drill targets. It’s also worth mentioning the Greater Pilar area has never been drilled before and has not really seen any decent-sized systematic exploration program.

The stronger share price will be helpful under the Sorbie-Bornholm agreement

We already explained the company’s deal with Sorbie-Bornholm in a previous report, and the bottom line obviously hasn’t changed: the higher the Tocvan share price is, the more advantageous the financing agreement is for the company.

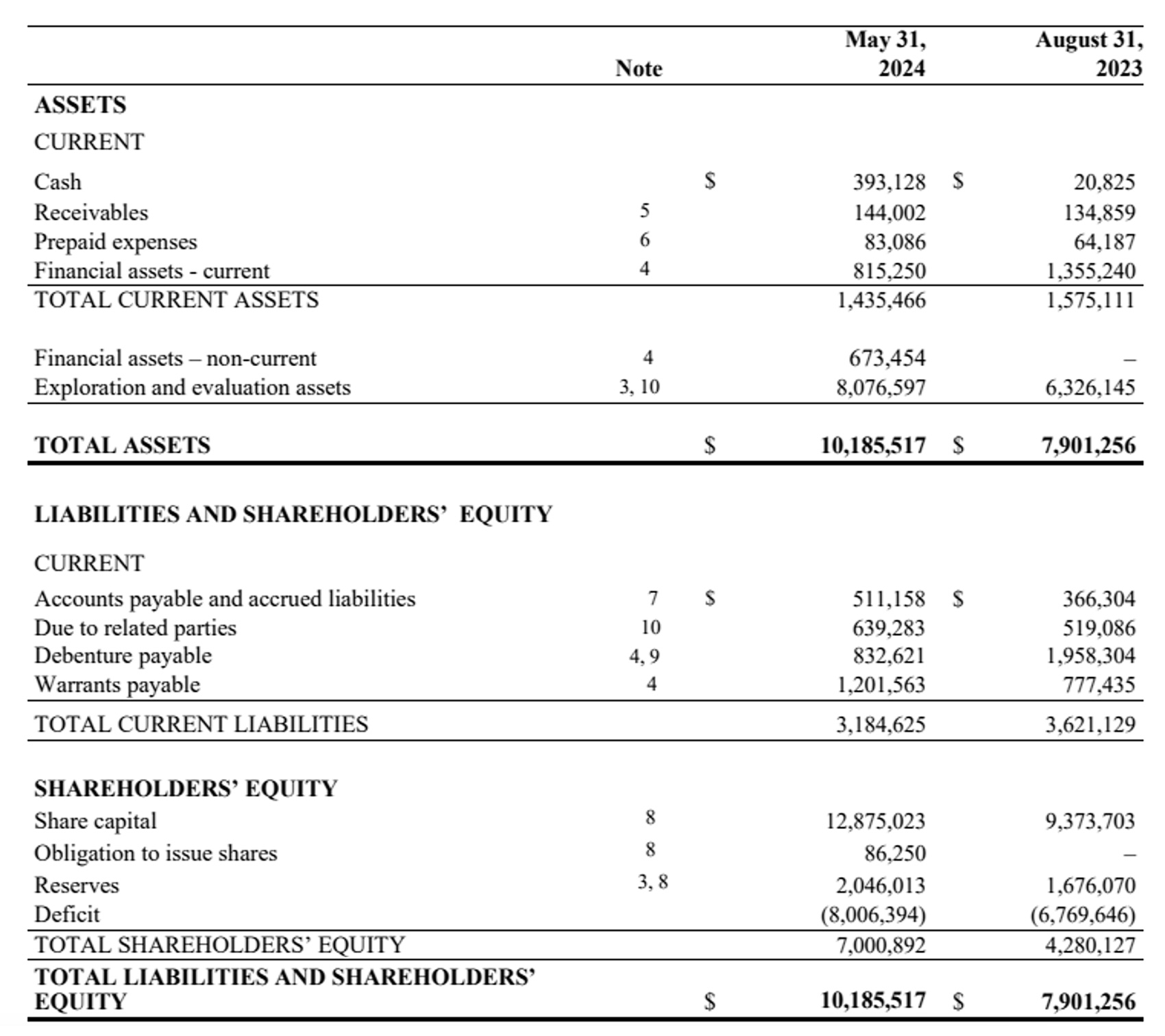

However, the way the deal has been structured, there is a continuous pressure on the company’s balance sheet. As you can see below, Tocvan had a net working capital deficit of approximately C$1.7M as of the end of May (the most recent financial results available). But if you look more closely, you’ll see about C$2M of the current liabilities is actually related to the debenture and warrants payable.

This is related to the Sorbie-Bornholm financing agreement in 2022 when Tocvan agreed to issue Sorbie 3.2 million units and C$2.8M in convertible notes in return for 24 cash payments (on a monthly basis) with an initial benchmark price of C$1.10. The company followed up on that transaction with additional equity swap agreements with Sorbie and as the company is basically exchanging stock for cash on a monthly basis, accounting rules dictate the liabilities side of the equity swap arrangement has to be booked as a financial liability. So although Tocvan’s balance sheet contains a working capital deficit of approximately C$1.7M, about C$2M will be automatically extinguished as the equity swap program continues and wraps up. That being said, as Tocvan has now entered into three equity swap agreements with Sorbie – with the most recent one in April of this year – we wouldn’t be surprised to see the company extending the relationship – and this has now indeed happened given yesterday’s announcement Tocvan is looking to raise C$3M to fund a new drill program at Gran Pilar.

The most recent completed swap deal consisted of C$1.5M to be paid out in 24 monthly tranches of C$62,500 per month against a benchmark price of C$0.48 per share. And the modus operandi remains unchanged. If the share price trades below the benchmark price, Tocvan will receive less cash (for instance, if the VWAP is C$0.40, Tocvan won’t receive C$62,500 but C$0.40 * 130,209 = C$52,083 per month). With the current share price trading around and even slightly above the benchmark price, Tocvan is now achieving at least its eyed monthly payments related to the most recent Sorbie agreement and will perhaps receive even more than that if the share price remains this strong. For example, cash received for the last months settlement was C$73,632 based on a C$0.5655 VWAP.

And just yesterday, after-hours, Tocvan announced a new C$3M financing, of which C$1.8M will be placed with Sorbie-Bornholm using the same modus operandi as the previous raises. The remaining C$1.2M financing will be a ‘normal’ private placement with units priced at C$0.48. Each unit consists of one common share and one full warrant with each warrant having an exercise price of C$0.75, valid for a period of three years. A portion of the proceeds will be used to immediately start drilling again as the company would like to complete 1,250 meters of core drilling before the end of this year.

Conclusion

While the assay results of the summer drill program weren’t very exciting aside from two holes that yielded 1.0 g/t Au over 42.7m and 56.4m, it is clear there is widespread gold and silver mineralization at Gran Pilar and it is now up to Tocvan’s technical team to prioritize additional drill targets and hopefully encounter higher grade material before it moves the project towards an initial resource calculation.

A recent research report published by Atrium outlined a back of the envelope calculation using a 3,750-4,500 tonnes per day heap leach operation. This would yield approximately 50,000 ounces of gold per year and assuming a recovery of 90% for the gold and 75% for the silver, the research firm ended up with an after-tax NPV8% of C$196M using $2200 gold and $28 silver.

It’s still very early days at Gran Pilar, but the back-of-the-envelope calculation makes sense, although readers are warned Atrium used an average gold grade of 1 g/t, which once again confirms the assay results of this summer’s drill program were a bit ‘light’.

The regional exploration targets could potentially be interesting and there must be some substance to Tocvan’s projected exploration potential of 1-3 million ounces on both zones. We don’t consider CEO Sutherland to be a serial BS’er, so we assume some serious thought has been put into those targets.

Disclosure: The author has a long position in Tocvan Ventures. Tocvan Ventures is a sponsor of the website. Please read our full disclosure.