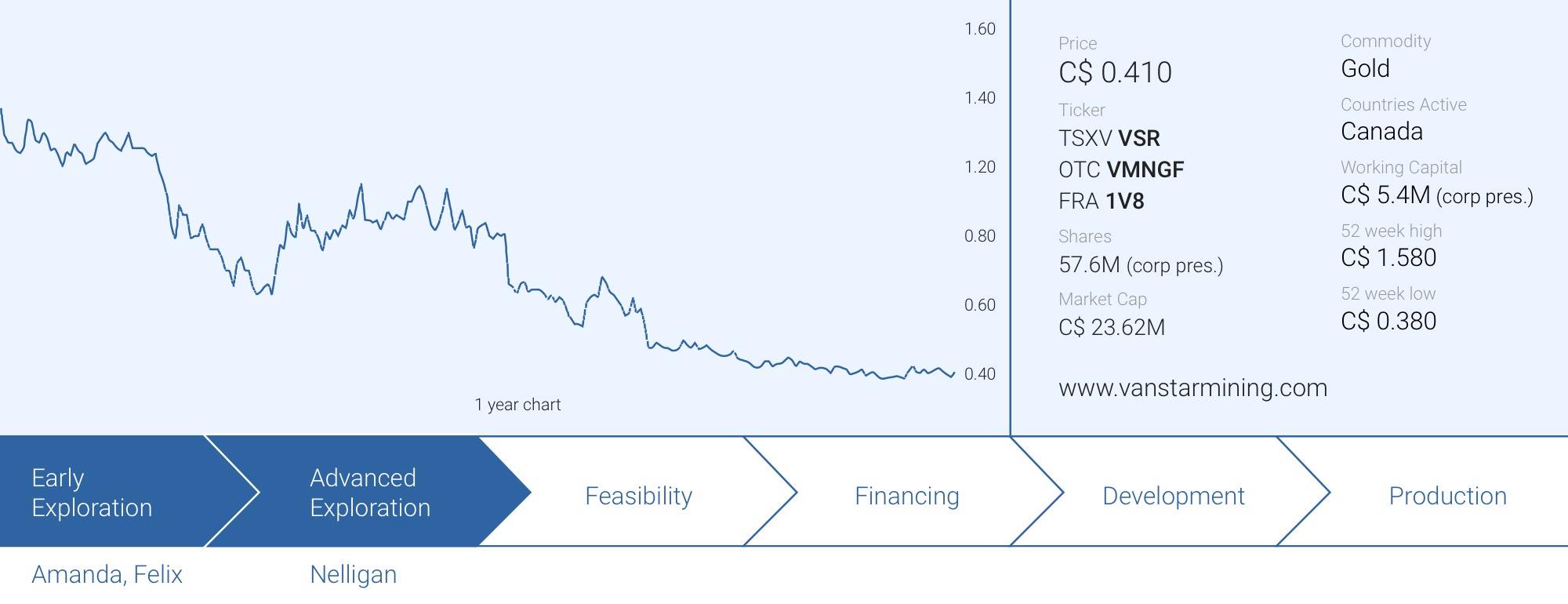

While most equities in the junior mining and exploration space have seen their share prices decline in the past year, Vanstar Mining Resources (VSR.V) has one of the ugliest charts of them all. And that’s surprising, as it actually is a company with exposure to the very promising Nelligan gold asset in Québec. Although investors generally apply a discount to minority stakes in projects, Vanstar is in a luxury position as joint venture partner IAMgold (IAG, IMG.TO) is doing all the heavy lifting and Vanstar won’t have to spend a dollar on exploration in the foreseeable future. In fact, the joint venture agreement with IAMgold also stipulates the senior producer is also covering Vanstar’s portion of the initial capex which will only have to be repaid using the incoming cash flows upon reaching the commercial production phase.

With a market capitalization of less than US$20M, the downside risk seems to be rather low as a 20-25% stake in a 3.2 million ounces (and growing) gold deposit in Québec surely has some value.

A recap of the flagship Nelligan project

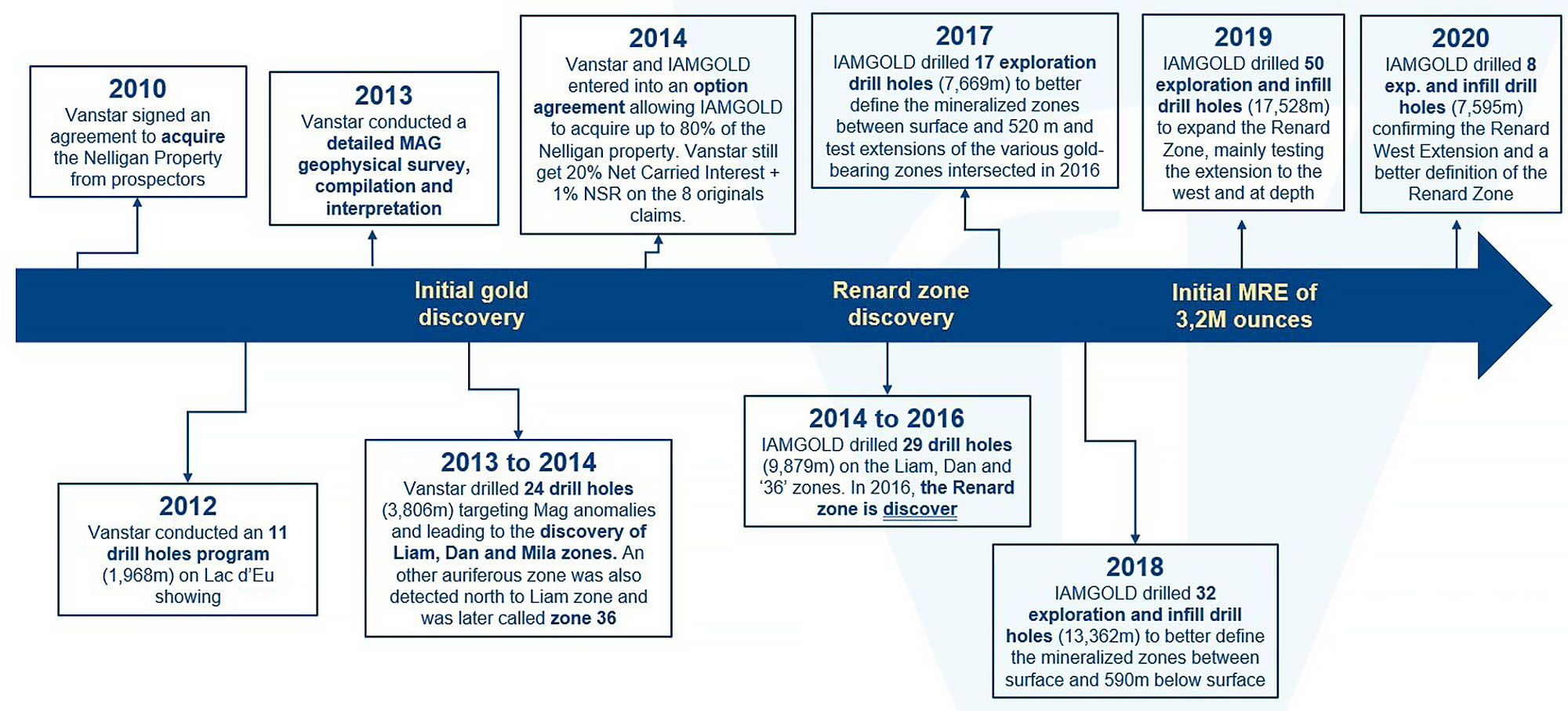

The Nelligan project is actually a textbook example of how sometimes, in really rare cases actually, an ultra-cheap acquisition could turn out to be a company maker. Vanstar initially acquired a 100% interest in Nelligan in 2010 for less than C$50,000 in cash and stock. Additionally, the 2% NSR that was originally granted to the vendors was repurchased in 2017 for a total of 1.2 million shares and convertible debentures totaling just C$37,500 which was subsequently converted into almost 341,000 shares of Vanstar. The total consideration paid for the property was just around C$150,000 in a combination of cash and stock (and using the share price at the time of making the stock payments).

Just a few years after acquiring Nelligan, Vanstar was able to sign up IAMgold as its main partner on the project as the latter could earn an 80% stake in Nelligan (IAMgold has already reached the 75% threshold about two years ago).

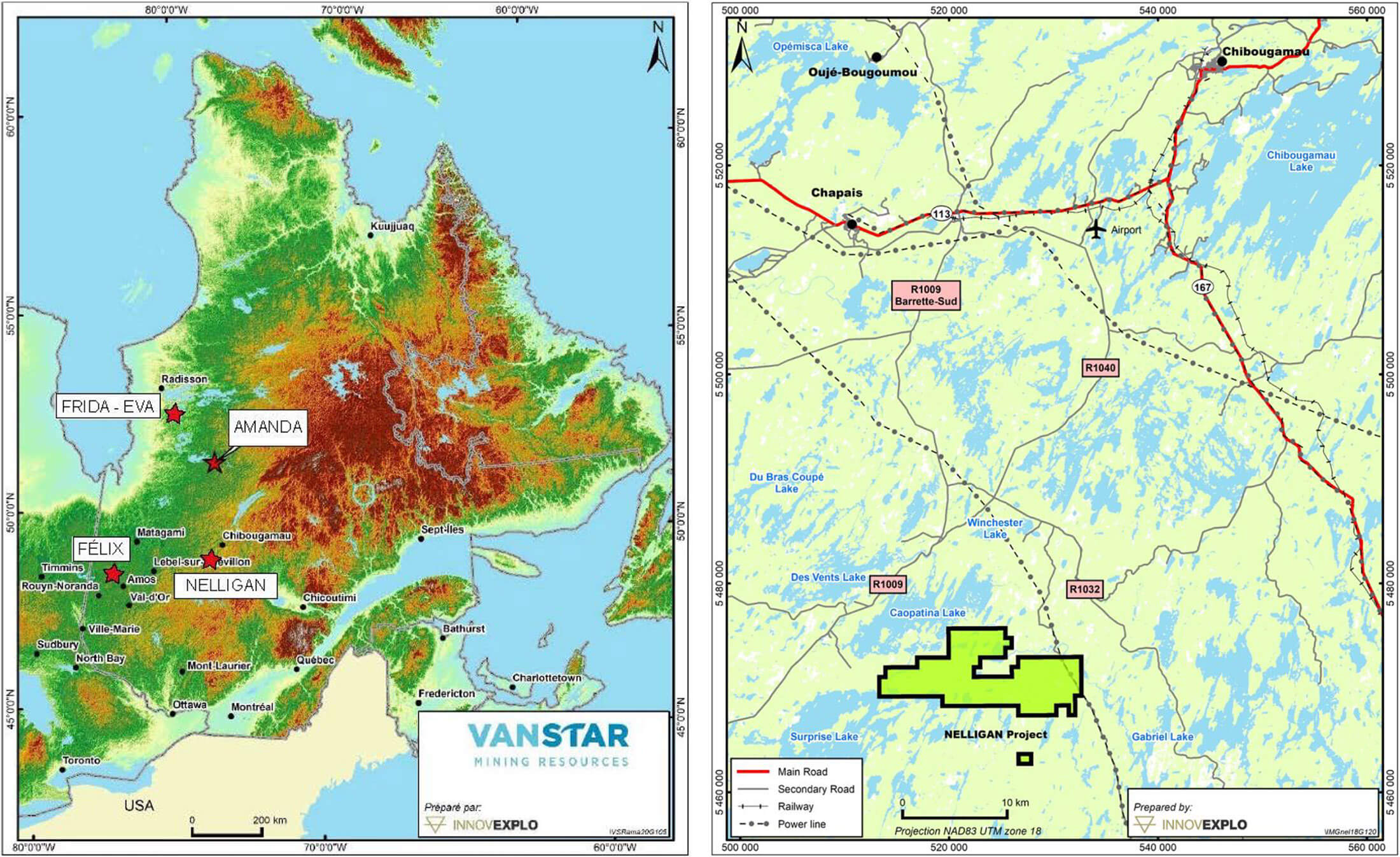

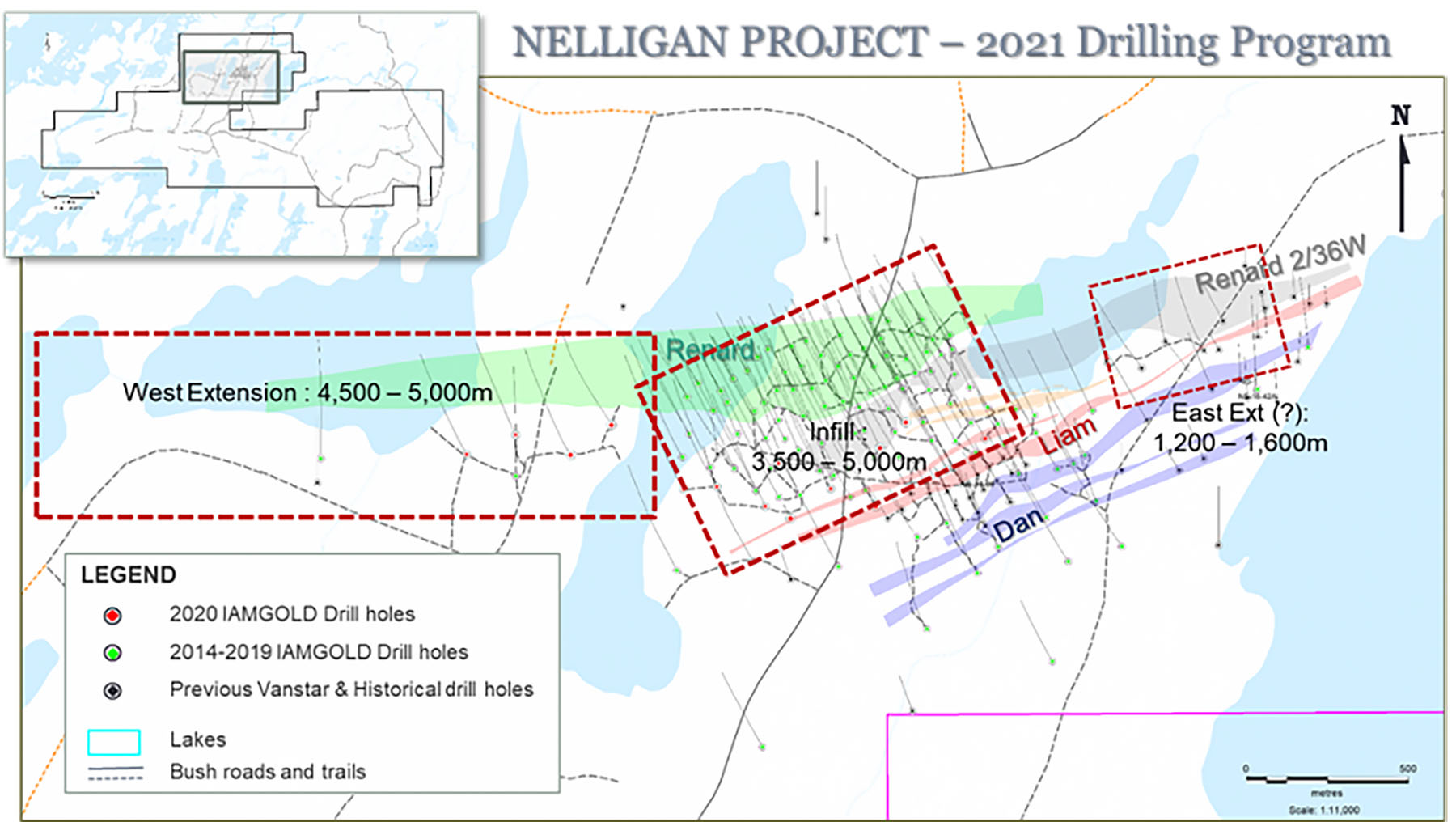

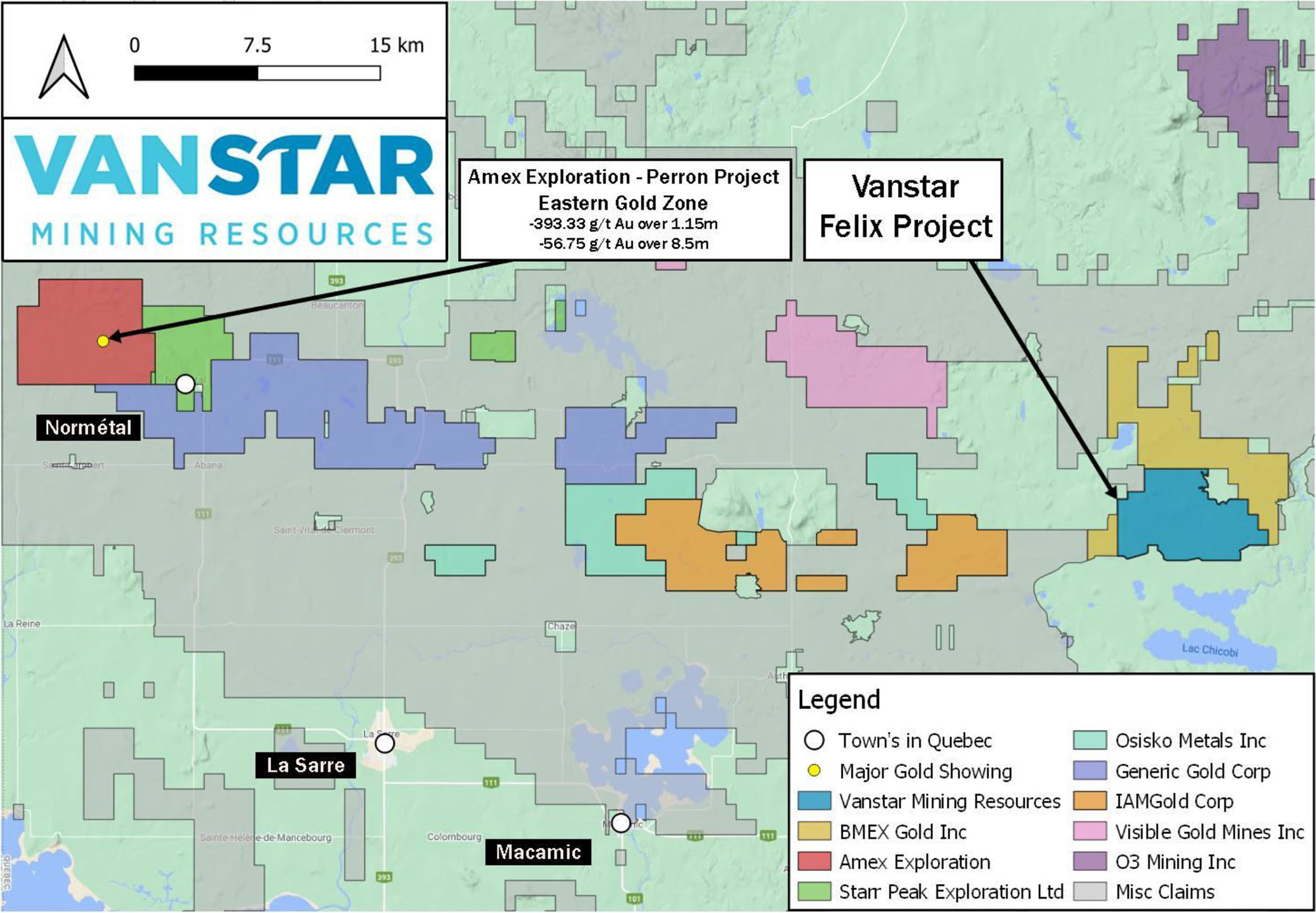

The flagship Nelligan project is located about 300 kilometers northeast of Val D’Or and about 60 kilometers southwest of Chibougamau in Québec, one of Canada’s Tier 1 mining jurisdictions. The total size of the project is almost 10,000 hectares (100 square kilometers) and after a 5-year long exploration agreement between Vanstar and IAMgold (which is earning an 80% interest in Nelligan), the initial resource estimate in Q4 2019 came in at a very enticing 3.2 million ounces of gold.

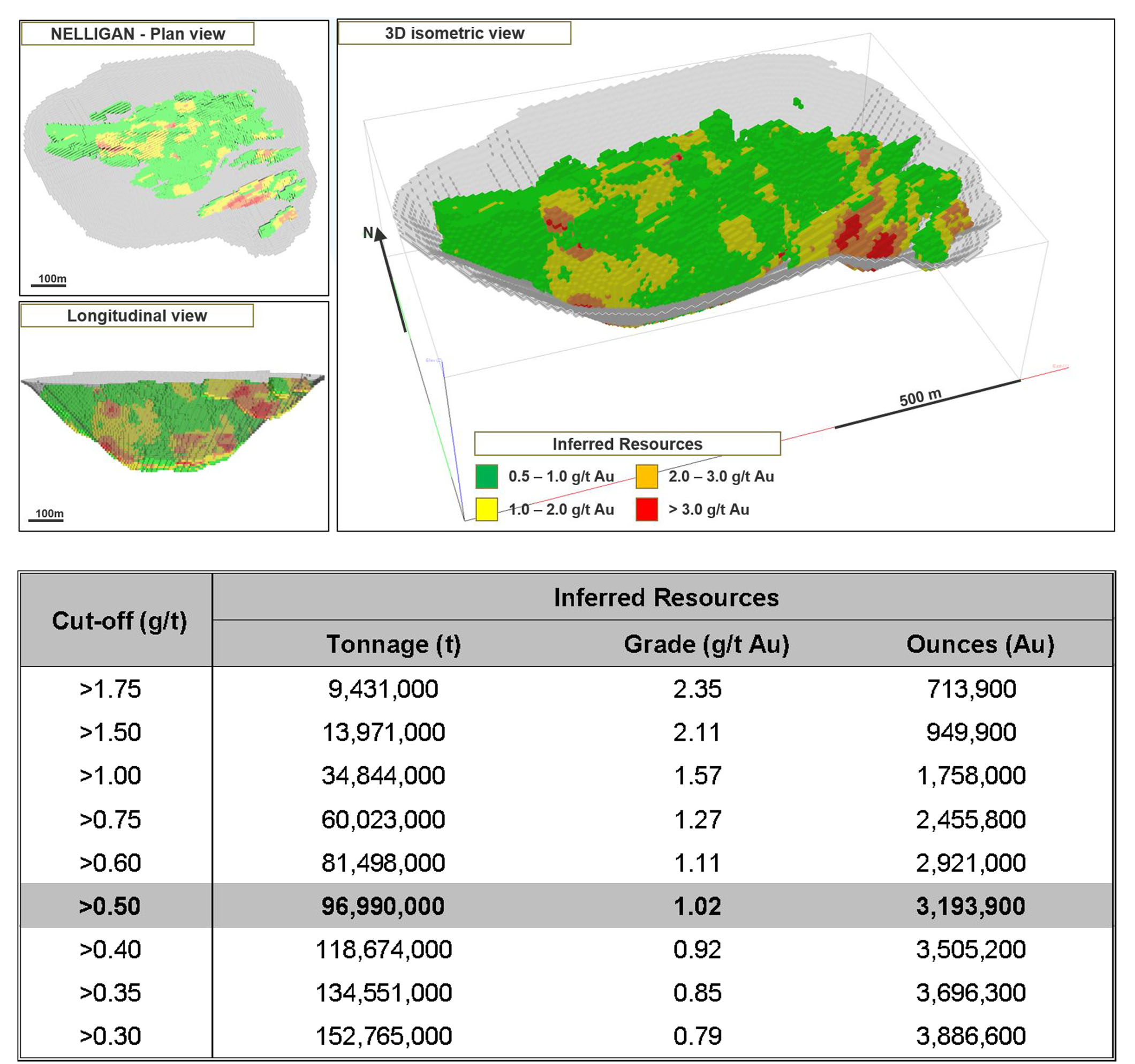

This resource is based on drilling off a 3.5 kilometer long and 1.5-kilometer wide zone with a drill spacing that’s sufficiently narrow to allow for an inferred resource calculation.

As you can see in the image above, there is a decent correlation between the cutoff grade and the average grade of the resource. The pit shell was based on a gold price of C$1,650 per ounce and with gold trading roughly 40% higher, IAMgold may be considering lowering the cutoff grade in the next resource update. Reducing the cutoff grade from 0.5 g/t to 0.4 g/t would increase the gold resource by approximately 10% to 3.5 million ounces, but would also reduce the average grade by around the same percentage while the strip ratio may decrease so future cutoff grades will be based on trade-off studies taking both important elements (average grade and strip ratio) into account.

No economic studies have been prepared for the Nelligan project and the maiden (inferred resource estimate will very likely serve as a stepping stone to further unlock the value of the project. Fortunately for Vanstar Mining, the company isn’t required to spend a single dollar on exploration. It can let joint venture partner IAMgold do the heavy lifting.

IAMgold: a wildcard?

Being in a partnership with IAMgold is both a blessing and a curse. It’s a curse because the market will likely continue to apply a discount to Vanstar Mining as it owns just a minority stake in the project which means it’s at the mercy of IAMgold.

However, the original earn-in agreement by the previous Vanstar management in 2014 is a textbook example of how important joint venture negotiations can be. In most of the agreements these days, both parties are required to make pro rata contributions once a certain threshold has been reached. That’s not the case in the Vanstar-IAMgold agreement.

IAMgold currently owns 75% of the project, but is still on the hook for 100% of the expenditures as it is still working towards earning an 80% stake in the project which will be established once IAMgold completes a feasibility study on the project. Considering Nelligan currently just hosts an inferred resource estimate, we’d say a full feasibility study is at least five years away. And IAMgold will have to bankroll all the expenses to get to the feasibility stage. Theoretically, IAMgold could establish a 75/25 joint venture at any time foregoing its option to earn 80% but as the producer has already completed two additional self-funded drill programs since obtaining the 75% stake, we can reasonably assume it’s their intention to move ahead towards a feasibility study.

And even when IAMgold reaches the 80% milestone, Vanstar still wouldn’t have to contribute a dime: as per the original agreement, Vanstar will obtain a 20% carried interest once the feasibility study has been published. This means IAMgold will fund 100% of the capex and development expenses all the way until commercial production. Vanstar will be able to repay IAMgold using 80% of the distributions from the joint venture. Additionally, Vanstar is entitled to a 1% NSR on some of the claims that make up the Nelligan project.

IAMgold does have the option to acquire the remaining 20% of Nelligan by paying the ‘fair value’ which will be determined by an independent valuator. Should this happen, Vanstar will retain an additional 1.5% NSR on the entire Nelligan project.

Although it is entirely possible for IAMgold to first move to an 80% ownership and subsequently acquire the remaining 20% stake, it’s not something we are worrying about. The current market capitalization of Vanstar Mining is currently less than US$20M and we would dare to bet the remaining 1.5% NSR (+ the original 1% NSR on some of the claims) would already be worth more than the current market capitalization of the company.

The downside risk appears to be limited here and the main risk would be to see IAMgold dropping the joint venture altogether. But we can’t really see that happen as IAMgold has already invested tens of millions of dollars in exploration and making cash payments to Vanstar. And as IAMgold is completing the construction of its multi-million ounce Coté Lake project in Ontario, it could make sense for them to offset potential profits from Cote Lake by spending more cash elsewhere in Canada and then the Nelligan project could be high on the shortlist.

Vanstar has plenty of cash

Although it doesn’t have to contribute to the Nelligan joint venture, Vanstar makes sure it has a healthy cash position to avoid running into any problems.

As of the end of June, Vanstar had a positive working capital position of in excess of C$5M which means the company is in good shape. In fact, the cash position represents almost C$0.10 per share and although this is somewhat irrelevant as the dollars will be spent anyway, it’s reassuring to see the company won’t be pushed with its back against the wall by the market betting on the next capital raise.

A portion of the cash will also be used by Vanstar on the other projects in its asset portfolio as about C$1.8M has specifically been earmarked to be spent on exploration activities by the end of next year. Vanstar started a 2,000 meter drill program on its Felix project in September and we hope to see assay results soon. We expect the spending requirement to be just around C$1.5M by the end of this year and that will put Vanstar in a comfortable position to continue to work on its own projects in 2022.

While these secondary projects could perhaps be interesting further down the road, an investment in Vanstar is basically a call option on the Nelligan project and the other projects are really just secondary assets.

Conclusion

Investing or speculating in the mining industry is generally based on an interpreted risk/reward ratio. Investors should always offset the potential downside risks against the potential upside. In Vanstar’s case, this boils down to the question ‘what would be the minimum value of a 20% stake in a 3.2 million ounce (and growing) gold project in Québec where exploration activities are currently fully funded by a senior producer?’.

There’s no clear answer to that question. The price is obviously what a fool wants to pay for it. But it seems more likely than not that the fair value of Vanstar exceeds the current market capitalization. Investors will have to be patient as IAMgold is diligently working towards de-risking the project. The assay results from this summer’s ~10,000-meter drill program should be out soon and the drill results from the East and West Extension will be interesting as any exploration success there could once again change the scope of the project.

Vanstar Mining will be active on several fronts this winter, and throughout 2022. And we will obviously keep an eye on the exploration results and their significance as they roll in.

Disclosure: The author has a long position in Vanstar Mining. Vanstar Mining will become a sponsor of the website.